Answered step by step

Verified Expert Solution

Question

1 Approved Answer

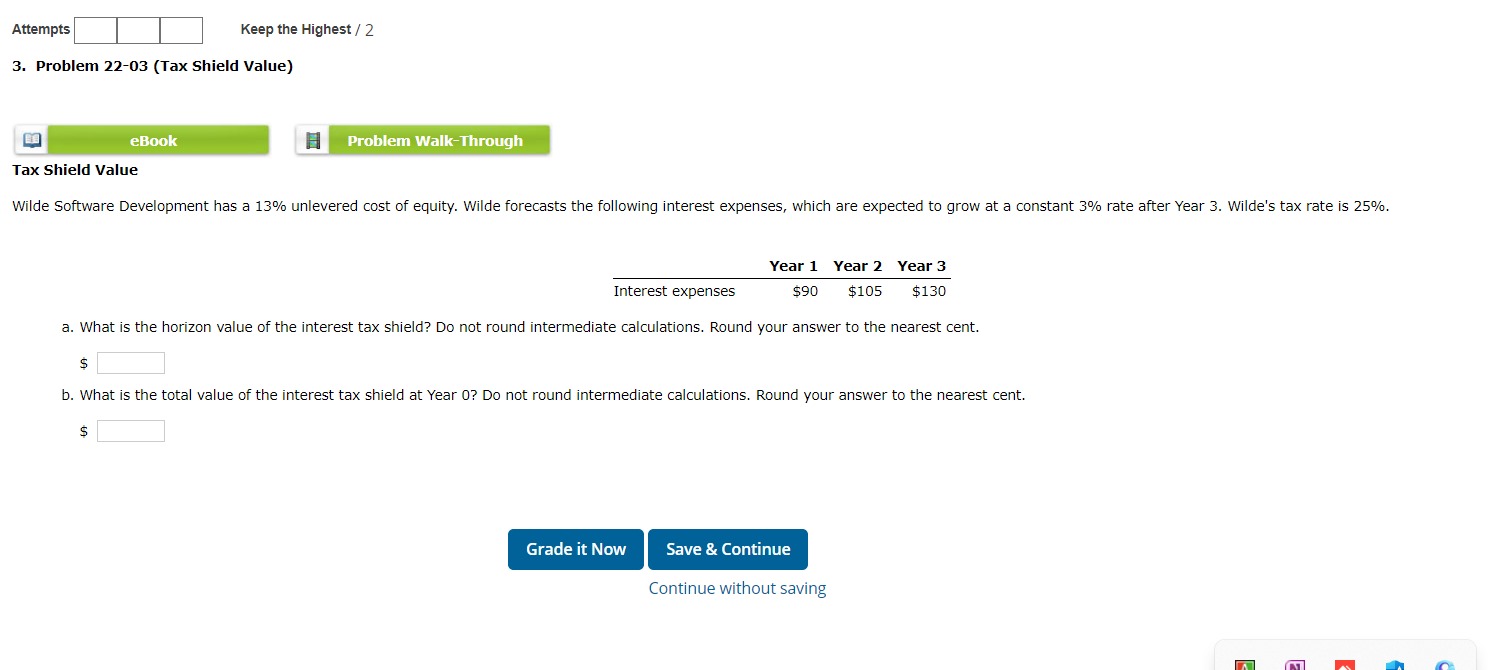

Attempts Keep the Highest / 2 3. Problem 22-03 (Tax Shield Value) eBook Tax Shield Value Problem Walk-Through Wilde Software Development has a 13%

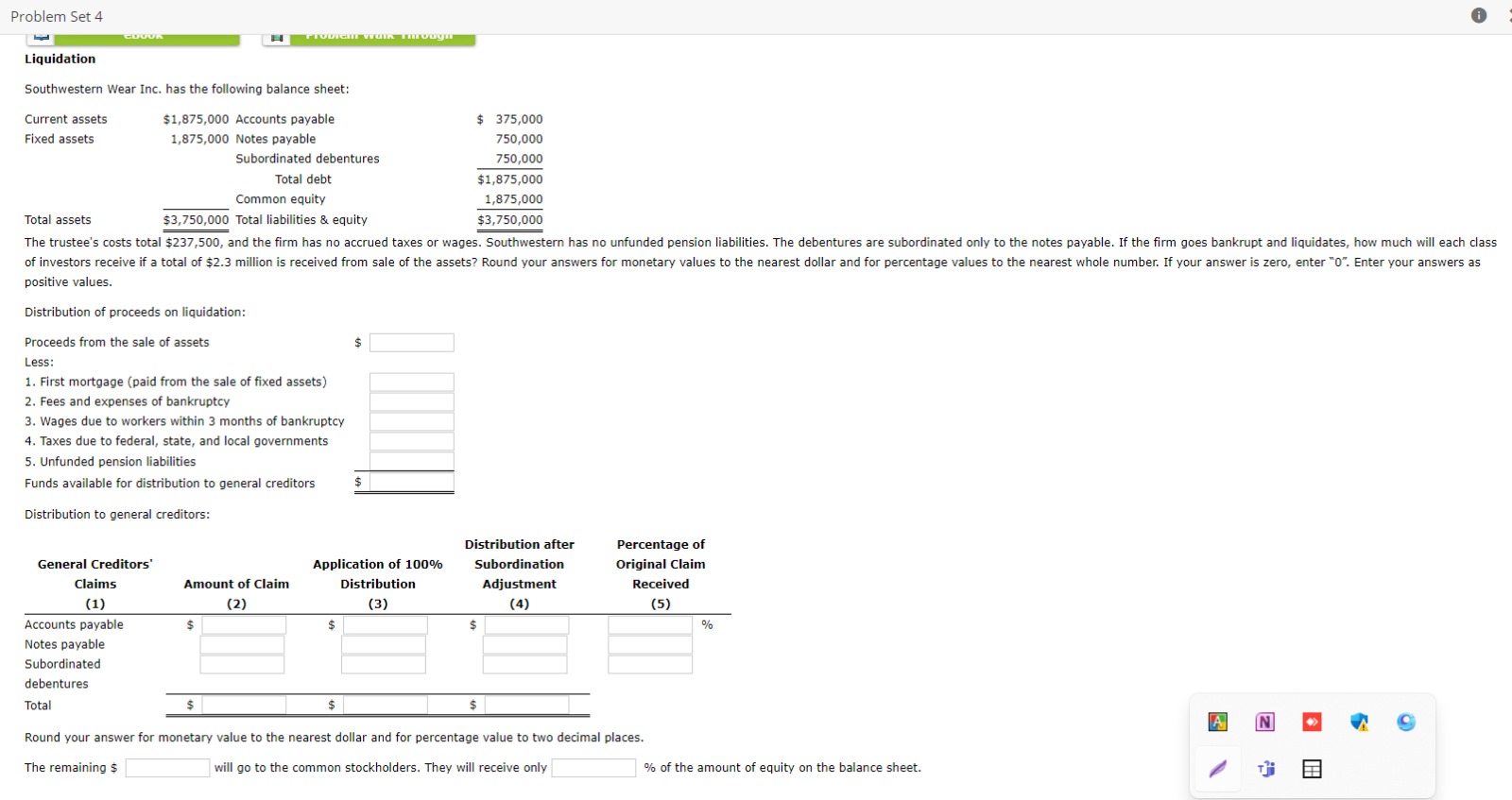

Attempts Keep the Highest / 2 3. Problem 22-03 (Tax Shield Value) eBook Tax Shield Value Problem Walk-Through Wilde Software Development has a 13% unlevered cost of equity. Wilde forecasts the following interest expenses, which are expected to grow at a constant 3% rate after Year 3. Wilde's tax rate is 25%. Interest expenses Year 1 Year 2 Year 3 $90 $105 $130 a. What is the horizon value of the interest tax shield? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. What is the total value of the interest tax shield at Year 0? Do not round intermediate calculations. Round your answer to the nearest cent. $ Grade it Now Save & Continue Continue without saving Problem Set 4 COUVR FIUDICH WUIR Fmvagn Liquidation Southwestern Wear Inc. has the following balance sheet: Current assets Fixed assets $1,875,000 Accounts payable 1,875,000 Notes payable Subordinated debentures $ 375,000 750,000 750,000 Total assets Total debt Common equity $3,750,000 Total liabilities & equity $1,875,000 1,875,000 $3,750,000 The trustee's costs total $237,500, and the firm has no accrued taxes or wages. Southwestern has no unfunded pension liabilities. The debentures are subordinated only to the notes payable. If the firm goes bankrupt and liquidates, how much will each class of investors receive if a total of $2.3 million is received from sale of the assets? Round your answers for monetary values to the nearest dollar and for percentage values to the nearest whole number. If your answer is zero, enter "0". Enter your answers as positive values. Distribution of proceeds on liquidation: Proceeds from the sale of assets Less: 1. First mortgage (paid from the sale of fixed assets) 2. Fees and expenses of bankruptcy 3. Wages due to workers within 3 months of bankruptcy 4. Taxes due to federal, state, and local governments 5. Unfunded pension liabilities Funds available for distribution to general creditors Distribution to general creditors: $ General Creditors' Claims (1) Accounts payable Notes payable Subordinated debentures Total Distribution after Percentage of Application of 100% Subordination Original Claim Amount of Claim (2) Distribution (3) Adjustment (4) Received (5) % $ $ $ Round your answer for monetary value to the nearest dollar and for percentage value to two decimal places. The remaining $ will go to the common stockholders. They will receive only % of the amount of equity on the balance sheet. N < 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started