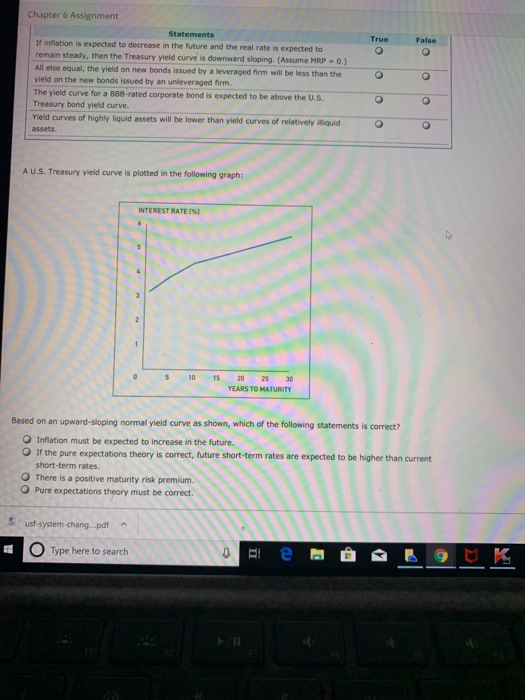

Attempts: Keep the Highest:/20 Attention: Due to a bug in Google Chrome, this page may not function correctly. Click here to learn more. 5. Factors that impact the yield curve Aa Aa are three factors that can affect the shape of the Treasury yield curve (rt, IP, and MRP) and five factors that can affect the shape of the corporate yield curve (rt, IPt, MRPt, DRP, and LP.). The yield curve reflects the aggregation of the impacts from these factors. Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. Consider all factors that affect the yield curve. Then identify which of the foll the U.S. Treasury yield curve can take. Check all that apply. owing shapes that Upward-sloping yield curve Downward-sloping yield curve Inverted yield curve Identify whether each of the following statements is true or false. Statements True False If inflation is expected to decrease in the future and the real rate is expected to remain steady, then the Treasury yield curve is downward sloping. (Assume MRP 0.) All else equal, the yield on new bonds issued by a leveraged firm will be less than the yield on the new bonds issued by an unleveraged firm The yield curve for a B88-rated corporate bond is expected to be above the U.S Treasury bond yield curve. Yield curves of highly liquid assets will be lower than yield curves of relatively illiquidO assets. A U.S. Treasury yield curve is plotted in the following graph: INTEREST RATE 1%) usf-system-chang..pdf 0 Type here to search Chapter 6 Assignment Statements True False If inflation is expected to decrease in the future and the real rate is expected to remain steady, then the Treasury yield curve is downward sloping. (Assume MRP All else equal, the yield on new bonds issued by a leveraged firm will be less than the yield on the new bonds issued by an unleveraged frm. The yield curve for a 888-rated Treasury bond yield curve. corporate bond is expected to be above the U.S Yield curves of highly liquid assets will be lower than yield curves of relatively liquid assets A U.S. Treasury yield curve is plotted in the following graph: INTEREST RATE%) 0 s 0 15 20 25 30 YEARS TO MATURITY Based on an upward-sloping normal yield curve as shown, which of the following statements is correct? O Inflation must be expected to increase in the future. O If the pure expectations theory is correct, future short-term rates are expected to be higher than current short-term rates. O There is a positive maturity risk premium. O Pure expectations theory must be correct ust-system chang.pf O Type here to search