Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Audit Procedures for Compliance with Accounting Standards Ensuring compliance with accounting standards is a fundamental aspect of the auditing process. Accounting standards provide guidelines and

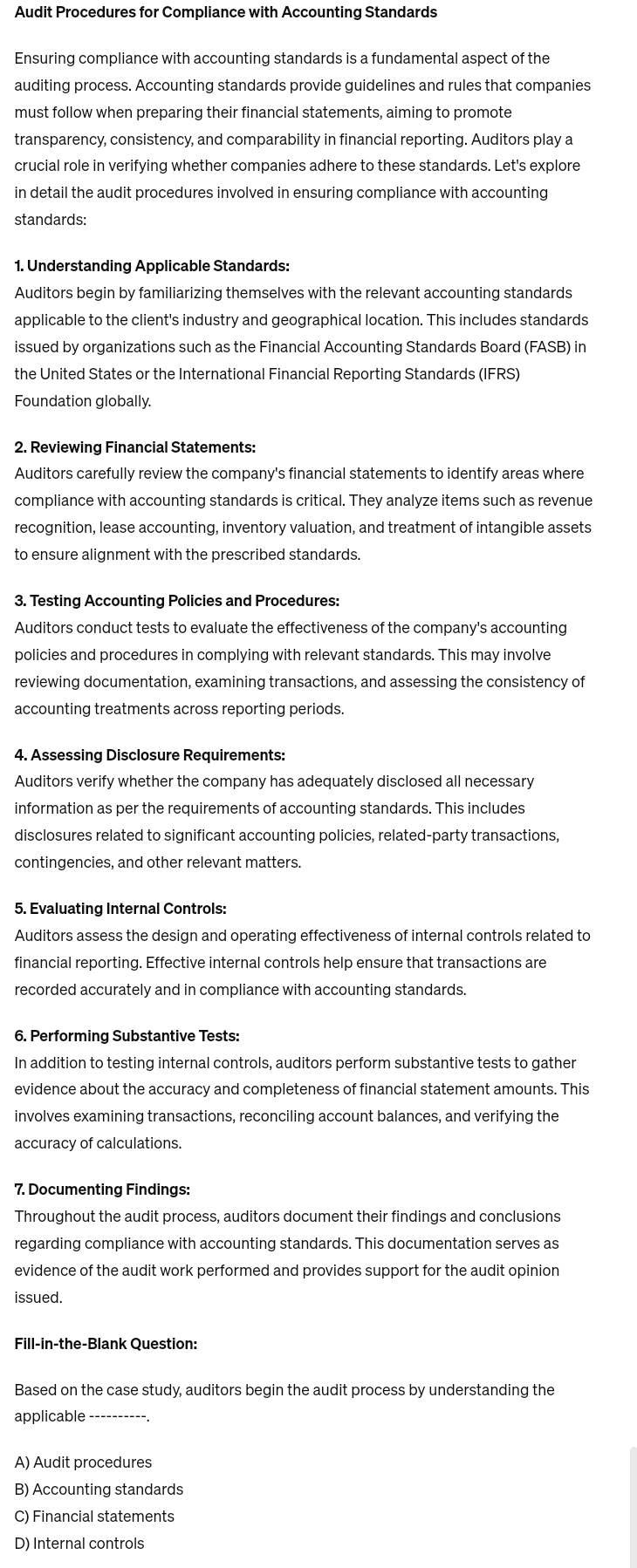

Audit Procedures for Compliance with Accounting Standards

Ensuring compliance with accounting standards is a fundamental aspect of the auditing process. Accounting standards provide guidelines and rules that companies must follow when preparing their financial statements, aiming to promote transparency, consistency, and comparability in financial reporting. Auditors play a crucial role in verifying whether companies adhere to these standards. Let's explore in detail the audit procedures involved in ensuring compliance with accounting standards:

Understanding Applicable Standards:

Auditors begin by familiarizing themselves with the relevant accounting standards applicable to the client's industry and geographical location. This includes standards issued by organizations such as the Financial Accounting Standards Board FASB in the United States or the International Financial Reporting Standards IFRS Foundation globally.

Reviewing Financial Statements:

Auditors carefully review the company's financial statements to identify areas where compliance with accounting standards is critical. They analyze items such as revenue recognition, lease accounting, inventory valuation, and treatment of intangible assets to ensure alignment with the prescribed standards.

Testing Accounting Policies and Procedures:

Auditors conduct tests to evaluate the effectiveness of the company's accounting policies and procedures in complying with relevant standards. This may involve reviewing documentation, examining transactions, and assessing the consistency of accounting treatments across reporting periods.

Assessing Disclosure Requirements:

Auditors verify whether the company has adequately disclosed all necessary information as per the requirements of accounting standards. This includes disclosures related to significant accounting policies, relatedparty transactions, contingencies, and other relevant matters.

Evaluating Internal Controls:

Auditors assess the design and operating effectiveness of internal controls related to financial reporting. Effective internal controls help ensure that transactions are recorded accurately and in compliance with accounting standards.

Performing Substantive Tests:

In addition to testing internal controls, auditors perform substantive tests to gather evidence about the accuracy and completeness of financial statement amounts. This involves examining transactions, reconciling account balances, and verifying the accuracy of calculations.

Documenting Findings:

Throughout the audit process, auditors document their findings and conclusions regarding compliance with accounting standards. This documentation serves as evidence of the audit work performed and provides support for the audit opinion issued.

FillintheBlank Question:

Based on the case study, auditors begin the audit process by understanding the applicabl

A Audit procedures

B Accounting standards

C Financial statements

D Internal controls

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started