Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Audit Procedures for Foreign Currency Transactions: Foreign currency transactions are common in today's globalized business environment, where companies engage in international trade, investments, and financing

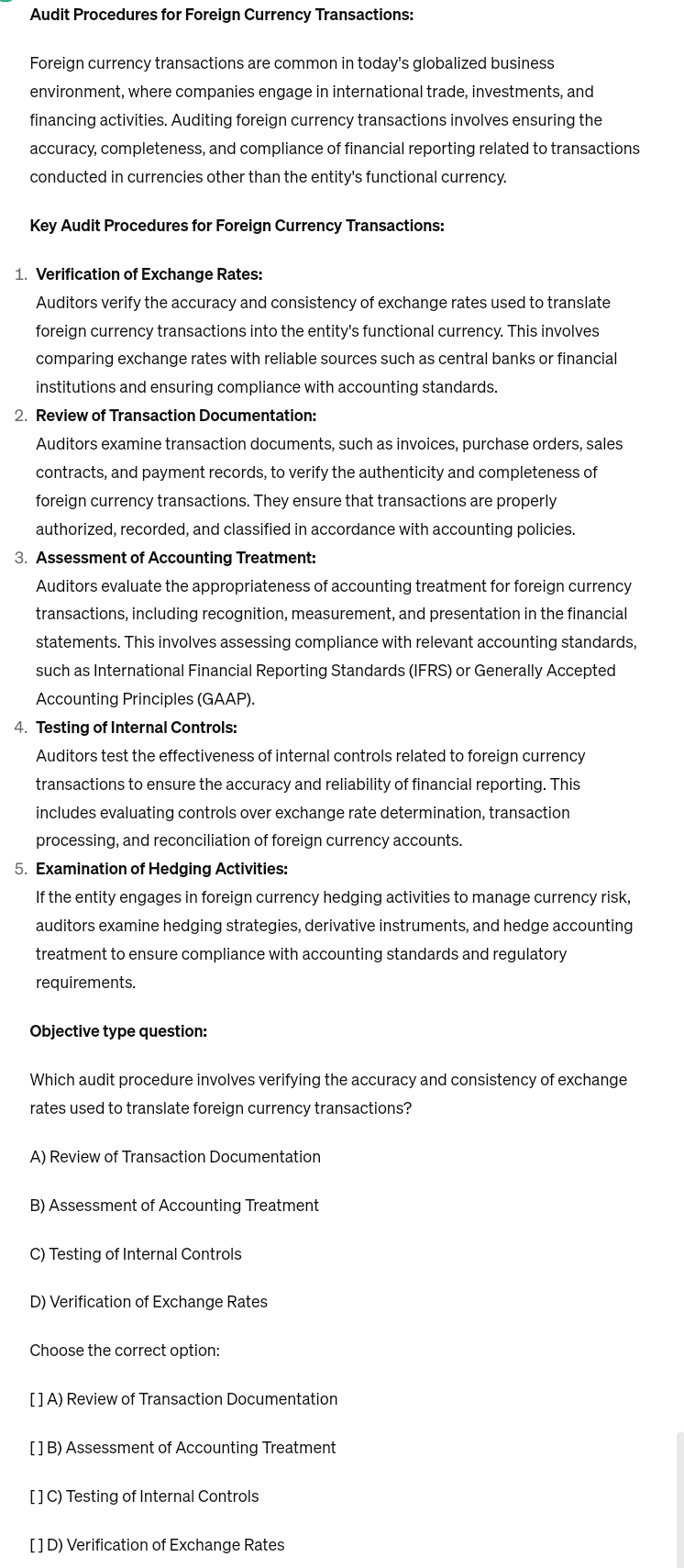

Audit Procedures for Foreign Currency Transactions:

Foreign currency transactions are common in today's globalized business environment, where companies engage in international trade, investments, and financing activities. Auditing foreign currency transactions involves ensuring the accuracy, completeness, and compliance of financial reporting related to transactions conducted in currencies other than the entity's functional currency.

Key Audit Procedures for Foreign Currency Transactions:

Verification of Exchange Rates:

Auditors verify the accuracy and consistency of exchange rates used to translate foreign currency transactions into the entity's functional currency. This involves comparing exchange rates with reliable sources such as central banks or financial institutions and ensuring compliance with accounting standards.

Review of Transaction Documentation:

Auditors examine transaction documents, such as invoices, purchase orders, sales contracts, and payment records, to verify the authenticity and completeness of foreign currency transactions. They ensure that transactions are properly authorized, recorded, and classified in accordance with accounting policies.

Assessment of Accounting Treatment:

Auditors evaluate the appropriateness of accounting treatment for foreign currency transactions, including recognition, measurement, and presentation in the financial statements. This involves assessing compliance with relevant accounting standards, such as International Financial Reporting Standards IFRS or Generally Accepted Accounting Principles GAAP

Testing of Internal Controls:

Auditors test the effectiveness of internal controls related to foreign currency transactions to ensure the accuracy and reliability of financial reporting. This includes evaluating controls over exchange rate determination, transaction processing, and reconciliation of foreign currency accounts.

Examination of Hedging Activities:

If the entity engages in foreign currency hedging activities to manage currency risk, auditors examine hedging strategies, derivative instruments, and hedge accounting treatment to ensure compliance with accounting standards and regulatory requirements.

Objective type question:

Which audit procedure involves verifying the accuracy and consistency of exchange rates used to translate foreign currency transactions?

A Review of Transaction Documentation

B Assessment of Accounting Treatment

C Testing of Internal Controls

D Verification of Exchange Rates

Choose the correct option:

A Review of Transaction Documentation

B Assessment of Accounting Treatment

C Testing of Internal Controls

D Verification of Exchange Rates

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started