Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Audit Procedures for Manufacturing Companies: Audit procedures for manufacturing companies involve a series of steps and processes aimed at evaluating the accuracy, reliability, and integrity

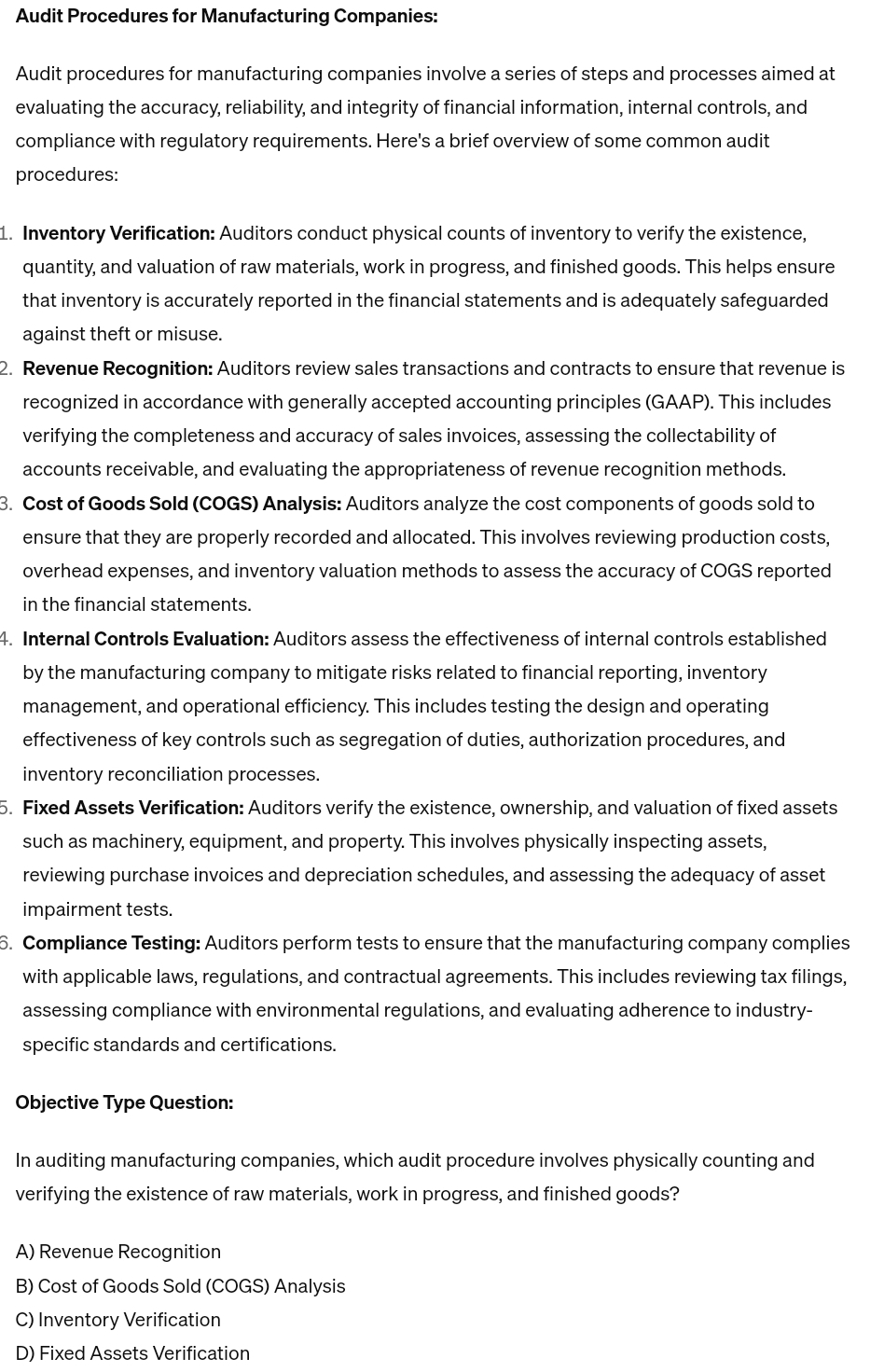

Audit Procedures for Manufacturing Companies:

Audit procedures for manufacturing companies involve a series of steps and processes aimed at evaluating the accuracy, reliability, and integrity of financial information, internal controls, and compliance with regulatory requirements. Here's a brief overview of some common audit procedures:

Inventory Verification: Auditors conduct physical counts of inventory to verify the existence, quantity, and valuation of raw materials, work in progress, and finished goods. This helps ensure that inventory is accurately reported in the financial statements and is adequately safeguarded against theft or misuse.

Revenue Recognition: Auditors review sales transactions and contracts to ensure that revenue is recognized in accordance with generally accepted accounting principles GAAP This includes verifying the completeness and accuracy of sales invoices, assessing the collectability of accounts receivable, and evaluating the appropriateness of revenue recognition methods.

Cost of Goods Sold COGS Analysis: Auditors analyze the cost components of goods sold to ensure that they are properly recorded and allocated. This involves reviewing production costs, overhead expenses, and inventory valuation methods to assess the accuracy of COGS reported in the financial statements.

Internal Controls Evaluation: Auditors assess the effectiveness of internal controls established by the manufacturing company to mitigate risks related to financial reporting, inventory management, and operational efficiency. This includes testing the design and operating effectiveness of key controls such as segregation of duties, authorization procedures, and inventory reconciliation processes.

Fixed Assets Verification: Auditors verify the existence, ownership, and valuation of fixed assets such as machinery, equipment, and property. This involves physically inspecting assets, reviewing purchase invoices and depreciation schedules, and assessing the adequacy of asset impairment tests.

Compliance Testing: Auditors perform tests to ensure that the manufacturing company complies with applicable laws, regulations, and contractual agreements. This includes reviewing tax filings, assessing compliance with environmental regulations, and evaluating adherence to industryspecific standards and certifications.

Objective Type Question:

In auditing manufacturing companies, which audit procedure involves physically counting and verifying the existence of raw materials, work in progress, and finished goods?

A Revenue Recognition

B Cost of Goods Sold COGS Analysis

C Inventory Verification

D Fixed Assets Verification

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started