Auditing questions help needed. as soon as possible.

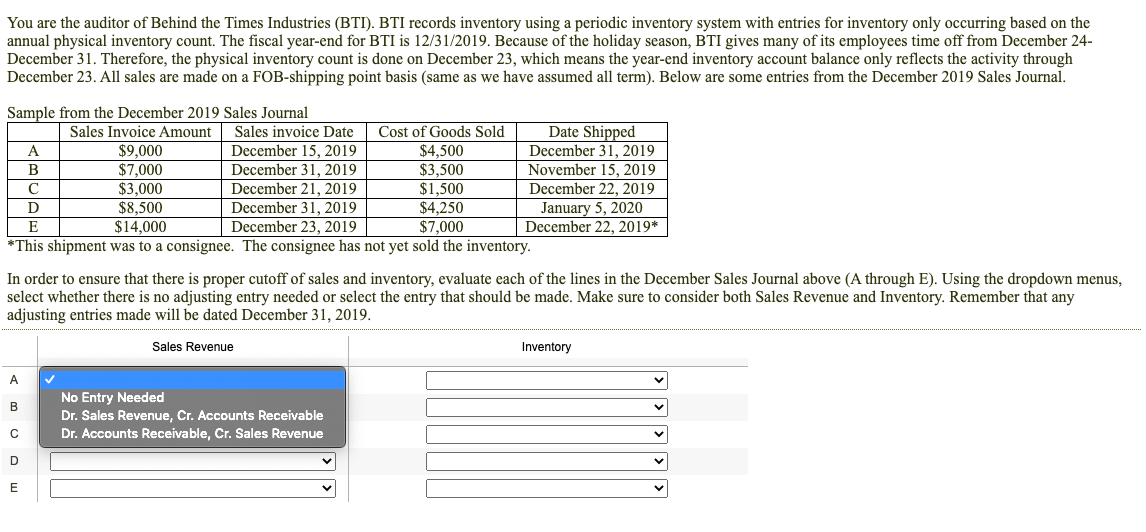

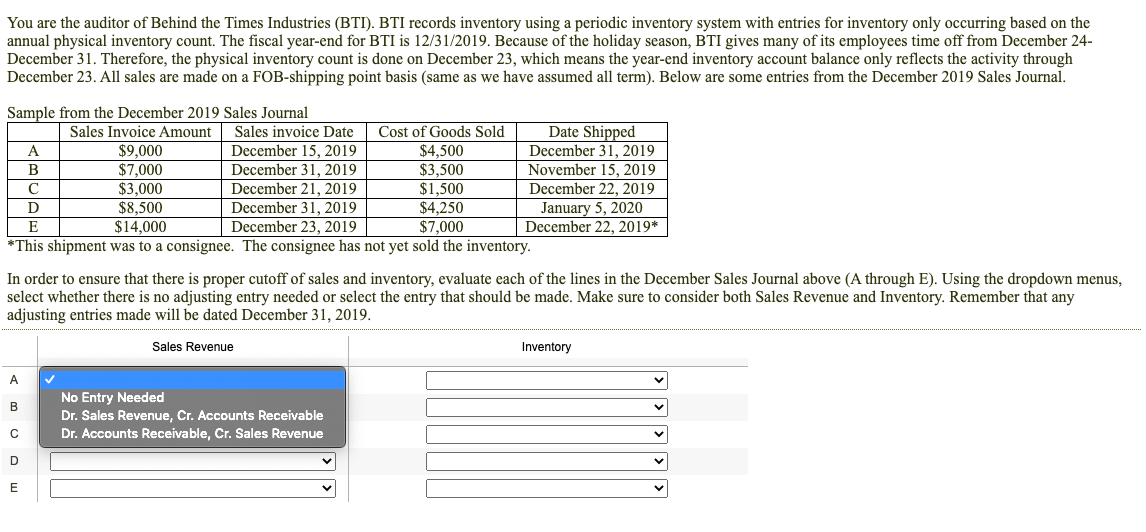

You are the auditor of Behind the Times Industries (BTI). BTI records inventory using a periodic inventory system with entries for inventory only occurring based on the annual physical inventory count. The fiscal year-end for BTI is 12/31/2019. Because of the holiday season, BTI gives many of its employees time off from December 24- December 31. Therefore, the physical inventory count is done on December 23, which means the year-end inventory account balance only reflects the activity through December 23. All sales are made on a FOB-shipping point basis (same as we have assumed all term). Below are some entries from the December 2019 Sales Journal. Sample from the December 2019 Sales Journal Sales Invoice Amount Sales invoice Date Cost of Goods Sold Date Shipped A $9,000 December 15, 2019 $4,500 December 31, 2019 B $7,000 December 31, 2019 $3,500 November 15, 2019 C $3,000 December 21, 2019 $1,500 December 22, 2019 D $8.500 December 31, 2019 $4,250 January 5, 2020 E $14,000 December 23, 2019 $7,000 December 22, 2019* *This shipment was to a consignee. The consignee has not yet sold the inventory. In order to ensure that there is proper cutoff of sales and inventory, evaluate each of the lines in the December Sales Journal above (A through E). Using the dropdown menus, select whether there is no adjusting entry needed or select the entry that should be made. Make sure to consider both Sales Revenue and Inventory. Remember that any adjusting entries made will be dated December 31, 2019. Sales Revenue Inventory A B No Entry Needed Dr. Sales Revenue, Cr. Accounts Receivable Dr. Accounts Receivable, Cr. Sales Revenue D E You are the auditor of Behind the Times Industries (BTI). BTI records inventory using a periodic inventory system with entries for inventory only occurring based on the annual physical inventory count. The fiscal year-end for BTI is 12/31/2019. Because of the holiday season, BTI gives many of its employees time off from December 24- December 31. Therefore, the physical inventory count is done on December 23, which means the year-end inventory account balance only reflects the activity through December 23. All sales are made on a FOB-shipping point basis (same as we have assumed all term). Below are some entries from the December 2019 Sales Journal. Sample from the December 2019 Sales Journal Sales Invoice Amount Sales invoice Date Cost of Goods Sold Date Shipped A $9,000 December 15, 2019 $4,500 December 31, 2019 B $7,000 December 31, 2019 $3,500 November 15, 2019 C $3,000 December 21, 2019 $1,500 December 22, 2019 D $8.500 December 31, 2019 $4,250 January 5, 2020 E $14,000 December 23, 2019 $7,000 December 22, 2019* *This shipment was to a consignee. The consignee has not yet sold the inventory. In order to ensure that there is proper cutoff of sales and inventory, evaluate each of the lines in the December Sales Journal above (A through E). Using the dropdown menus, select whether there is no adjusting entry needed or select the entry that should be made. Make sure to consider both Sales Revenue and Inventory. Remember that any adjusting entries made will be dated December 31, 2019. Sales Revenue Inventory A B No Entry Needed Dr. Sales Revenue, Cr. Accounts Receivable Dr. Accounts Receivable, Cr. Sales Revenue D E