Question

Auditing Scenario . You are about to read a brief auditing scenario. To the extent possible, place yourself in the CPAs shoes. Different aspects of

Auditing Scenario. You are about to read a brief auditing scenario. To the extent possible, place yourself in the CPA’s shoes.

Different aspects of the scenario would vary in significance to you were you to encounter them in reality. I am interested in finding out what would be important to you.

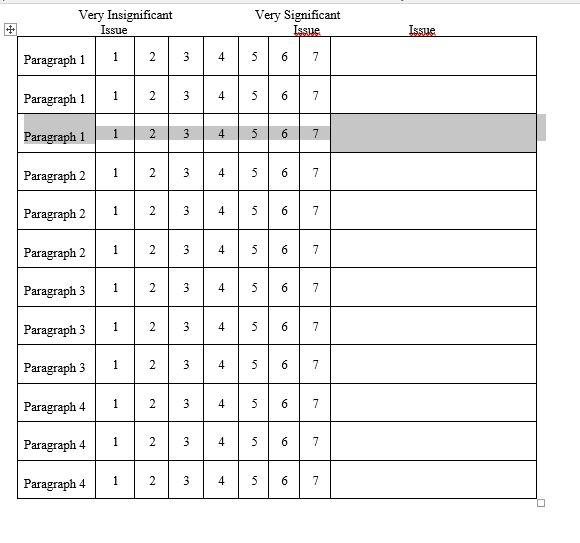

In your opinion, what are the issues in this scenario? Simply indicate, for those paragraphs which in your opinion contain an issue or issues:

The significance of the issue by marking a number between one and seven; and

The nature of the issue in the box beside the circled number (in ten words or less). You do not need to indicate how you would resolve any issues.

Frank Thomas is the senior responsible for the Sarken Industries audit. He is spending the last two hours of this morning preparing to meet with the partner and manager, prior to their meeting with the Sarken board, to discuss the preliminary audit findings. Year-end work has been pressured this year; several staff members were not available part of the time because they had to be reassigned temporarily to a client making a public offering. Also, additional work that was expected to be completed at interim had to be done at year-end because of the unexpected resignation of a second-year staff person. The work had gotten done within the budget, though Frank realizes that a few of the younger staff had likely failed to charge some of their wheel-spinning hours at year-end. In fact, hours charged were three percent below last year, his first year running the Sarken audit.

Frank retrieves the interim wallpaper bundles from the Central Services storage area in the office. Internal control weaknesses had been discovered during the review of internal controls at interim. These weaknesses were primarily the result of changes that had taken place in the prior quarter, changes that were documented as part of this year’s interim work by an experienced staff auditor. This documentation was used as a basis for determining the level of reliance to be placed on internal controls for year-end testing of the affected areas.

Frank’s thoughts run to the annual performance review he is about to receive from his advisor within the firm. His performance has been rated as very good each year until his first year as a senior when it was rated slightly above average. A friend who is a partner at another firm has made it clear that he would love for Frank to come to work for him, and he is considering that possibility. However, Frank enjoys working for his firm—it took him forty-five minutes yesterday just to draft a four-line note to his friend saying that he would consider his offer, and he might never have finished getting the words on paper had Sarken’s controller not stuck his head in the auditors’ room and asked to talk to him.

Frank has already briefed the manager on the disagreement he had with the client over his treatment of capitalized interest on some construction projects. The manager has sided with the client on the issue, stating that though Frank may technically be correct, the client’s position is reasonably supportable. Frank has changed the work papers accordingly, stating that the treatment is in accordance with GAAP, but he plans on discussing another issue, the client’s change in depreciation method, with both the partner and the manager simultaneously. As he finishes drafting a memo regarding the depreciation issue, several friends ask if Frank would like to go to lunch.

++ Very Insignificant Issue 1 Paragraph 1 Paragraph 1 Paragraph 1 Paragraph 2 Paragraph 2 Paragraph 2 Paragraph 3 Paragraph 3 Paragraph 3 Paragraph 4 Paragraph 4 Paragraph 4 1 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 3 2 2 2 2 2 3 4 2 3 3 3 3 3 3 3 3 3 4 4 4 a 4 4 4 4 4 4 4 Very Significant Issue 5 5 5 5 5 5 5 5 5. 5 5 in 4 5 6 6 7 6 6 6 7 6 6 6 7 6 7 6 6 7 6 7 7 7 7 7 7 7 Issue Increase

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started