Question

Auditing the Revenue Cycle: A Case for Accounting 405/5560 Create Fundamonium Data Analytics Memo As an auditor for a large public accounting firm, you have

Auditing the Revenue Cycle: A Case for Accounting 405/5560 Create Fundamonium Data Analytics Memo

As an auditor for a large public accounting firm, you have been assigned to an engagement with

Fundamonium Corporation (FC). FC designs, manufactures, and markets a variety of toys in the

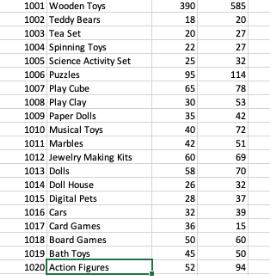

United States. They currently sell 20 products to customers across the nation (see the product list

tab in the excel file). Management has provided you with an excel file that includes Sales Data

for the years 2021, 2022, and 2023, and Accounts Receivable Data for the year 2023. You are

auditing the company for the year 2023. Please construct a memo to complete the tasks described

below. Add images to the memo's text as necessary.

Relevant information collected from management inquiry:

Fundamonium Corporation recognizes a sale based on the terms FOB shipping point, at which

time the title to the goods passes to the customer. When a sale is recognized, a unique Sales

Transaction ID is assigned to the Order ID in sequential order. The sales data provided by the

client displays the products included in each order with the corresponding Order ID, Customer

Name, Customer Number, Sales Person Name, and Sales Person Number, along with other

relevant sales information.

Management has a control in place that requires all invoices with products sales over $5,000 to

be approved by management. Additionally, prenumbered sales invoices (sales transaction IDs)

are used to ensure all valid sales transactions are recorded.

Part I: Perform Planning Analytical Procedures

Your goal as the auditor when performing planning analytical procedures is to identify areas of

risk in the revenue cycle of FC based on the data that you have been provided. In order to

establish the areas of risk associated with the revenue account, perform the following trend

analysis.

Using a visualization:

1. Display the trend in revenue for the years 2021, 2022 and 2023.

2. Display the trend in margin by product for the years 2021, 2022 and 2023.

3. Display the trend in revenue for the year 2023 by month.

4. Show the distribution of sales by product for the year 2023.

Answer the following questions after reviewing the trend in revenue:

1. Do these visualizations raise any concern(s) regarding revenues? Mention specifically

which assertion(s) you are most concerned about and why.

2. How do these results affect the subsequent testing of controls and substantive procedures?

3. What other types of trend analysis and/or ratio analysis could be performed for planning

analytical procedures using the information provided?

Part II: Perform Tests of Controls

To test the operating effectiveness of the internal controls, you will gather evidence to confirm or

refute management control policies outlined above. Perform the following tests:

1. Determine if all transactions over $5,000 have been approved by management.

2. Verify that all Sales Transaction IDs occur in sequential order.

Answer the following questions regarding the effectiveness of internal controls:

1. What other tests of controls could be performed using the data provided?

2. What assertion is being tested by verifying that the Sales Transaction IDs occur in

sequential order?

Part III: Perform Substantive Analytical Procedures

Perform the following procedures:

1. Verify that no Sales Transactions IDs have been duplicated. Because the raw data provided by

the client lists the Order IDs and Sales Transaction IDs by product sold in each order, you will

first need to aggregate the transactions by Sales Transaction IDs. Next, identify any duplicate

Sales Transaction IDs that correspond to more than one Order ID.

2. Perform a cutoff test to verify that only sales that shipped prior to December 31, 2023 were

recorded as sales.

3. Develop an accounts receivable aged trial balance for 2023 to determine if the allowance for

doubtful accounts is reasonable. The allowance for doubtful accounts as recorded is $200,000.

The materiality threshold is $25,000.

Answer the following questions related to substantive analytical procedures:

1. What assertion(s) are being tested by performing each of these procedures?

?

1001 Wooden Toys 390 585 1002 Teddy Bears 18 20 1003 Tea Set 20 27 1004 Spinning Toys 22 27 1005 Science Activity Set 25 32 1006 Puzzles 95 114 1007 Play Cube 65 78 1008 Play Clay 30 53 1009 Paper Dolls 35 42 1010 Musical Toys 40 72 1011 Marbles 42 51 1012 Jewelry Making Kits 60 69 1013 Dolls 58 70 1014 Doll House 26 32 1015 Digital Pets 28 37 1016 Cars 32 39 1017 Card Games 36 15 1018 Board Games 50 60 1019 Bath Toys 45 50 1020 Action Figures 52 94

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Your Company Logo Memorandum To Fundamonium Corporation Management From Your Name Auditor at Accounting Firm Date Date Subject Audit of Fundamonium Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started