Answered step by step

Verified Expert Solution

Question

1 Approved Answer

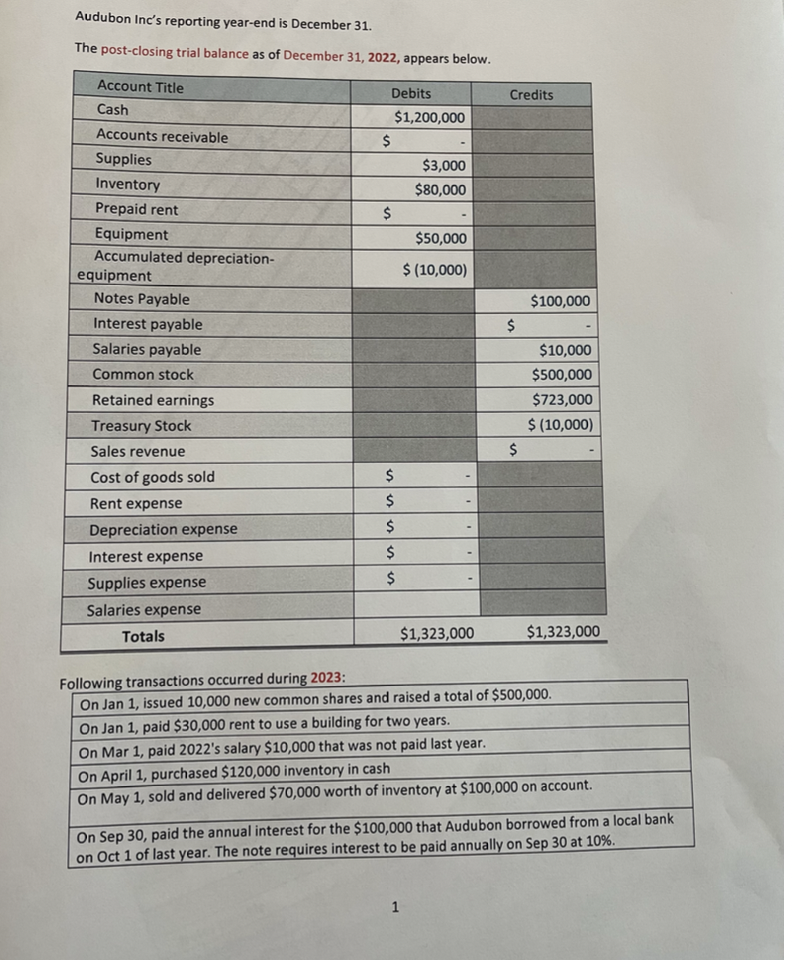

Audubon Inc's reporting year-end is December 31. The post-closing trial balance as of December 31, 2022, appears below. On Oct 1 , sold $20,000 worth

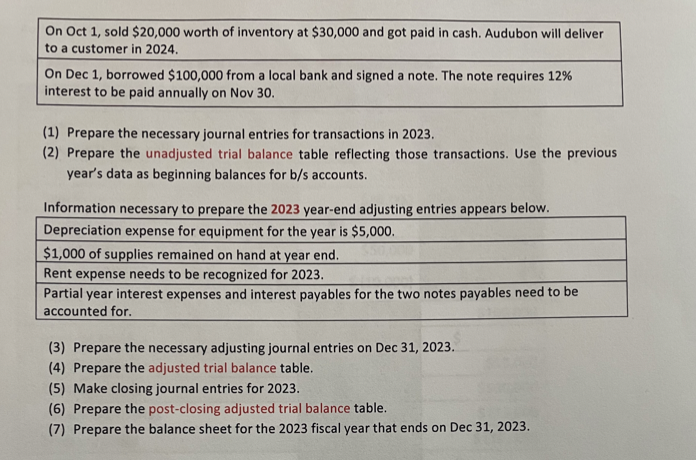

Audubon Inc's reporting year-end is December 31. The post-closing trial balance as of December 31, 2022, appears below. On Oct 1 , sold $20,000 worth of inventory at $30,000 and got paid in cash. Audubon will deliver to a customer in 2024. On Dec 1, borrowed $100,000 from a local bank and signed a note. The note requires 12% interest to be paid annually on Nov 30 . (1) Prepare the necessary journal entries for transactions in 2023. (2) Prepare the unadjusted trial balance table reflecting those transactions. Use the previous year's data as beginning balances for b/s accounts. Information necessaru to nrenare the 2023 vear-end adiusting entries annears below. (3) Prepare the necessary adjusting journal entries on Dec 31, 2023. (4) Prepare the adjusted trial balance table. (5) Make closing journal entries for 2023. (6) Prepare the post-closing adjusted trial balance table. (7) Prepare the balance sheet for the 2023 fiscal year that ends on Dec 31, 2023

Audubon Inc's reporting year-end is December 31. The post-closing trial balance as of December 31, 2022, appears below. On Oct 1 , sold $20,000 worth of inventory at $30,000 and got paid in cash. Audubon will deliver to a customer in 2024. On Dec 1, borrowed $100,000 from a local bank and signed a note. The note requires 12% interest to be paid annually on Nov 30 . (1) Prepare the necessary journal entries for transactions in 2023. (2) Prepare the unadjusted trial balance table reflecting those transactions. Use the previous year's data as beginning balances for b/s accounts. Information necessaru to nrenare the 2023 vear-end adiusting entries annears below. (3) Prepare the necessary adjusting journal entries on Dec 31, 2023. (4) Prepare the adjusted trial balance table. (5) Make closing journal entries for 2023. (6) Prepare the post-closing adjusted trial balance table. (7) Prepare the balance sheet for the 2023 fiscal year that ends on Dec 31, 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started