Augusta has a municipal water and gas utility district (MUD). The trial balance on January 1, 20X1, follows:

| | | Debit | | Credit |

| Cash | | $ | 92,600 | | | | | |

| Accounts Receivable | | | 27,000 | | | | | |

| Inventory of Supplies | | | 9,800 | | | | | |

| Land | | | 121,600 | | | | | |

| Plant and Equipment | | | 489,000 | | | | | |

| Accumulated Depreciation | | | | | | $ | 80,600 | |

| Vouchers Payable | | | | | | | 16,900 | |

| Bonds Payable, 6% | | | | | | | 514,000 | |

| Net Position: | | | | | | | | |

| Invested in Capital Assets, Net of Related Debt | | | | | | | 16,000 | |

| Unrestricted | | | | | | | 112,500 | |

| Total | | $ | 740,000 | | | $ | 740,000 | |

| |

Additional Information for 20X1:

- Charges to customers for water and gas were $420,900; collections were $432,800.

- A loan of $30,840 for two years was received from the general fund.

- The water and gas lines were extended to a new development at a cost of $76,400. The contractor was paid.

- Supplies were acquired from central stores (internal service fund) for $13,700. Operating expenses were $328,900, and interest expense was $30,840. Payment was made for the interest and the payable to central stores, and $326,900 of the vouchers were paid.

- Adjusting entries were as follows: estimated uncollectible accounts receivable, $8,400; depreciation expense, $32,500; and supplies expense, $15,800.

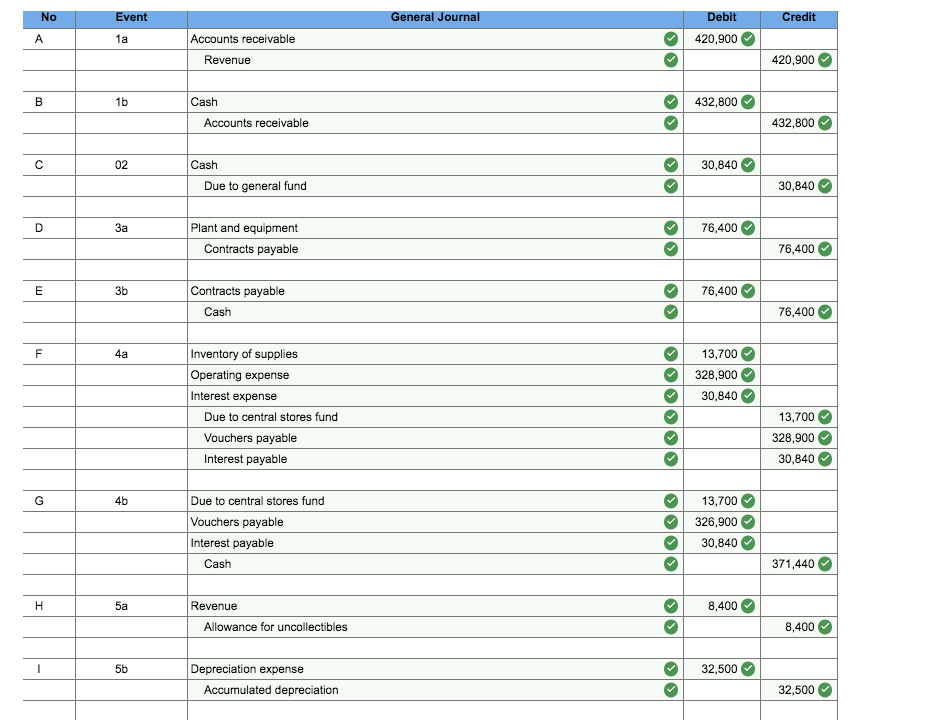

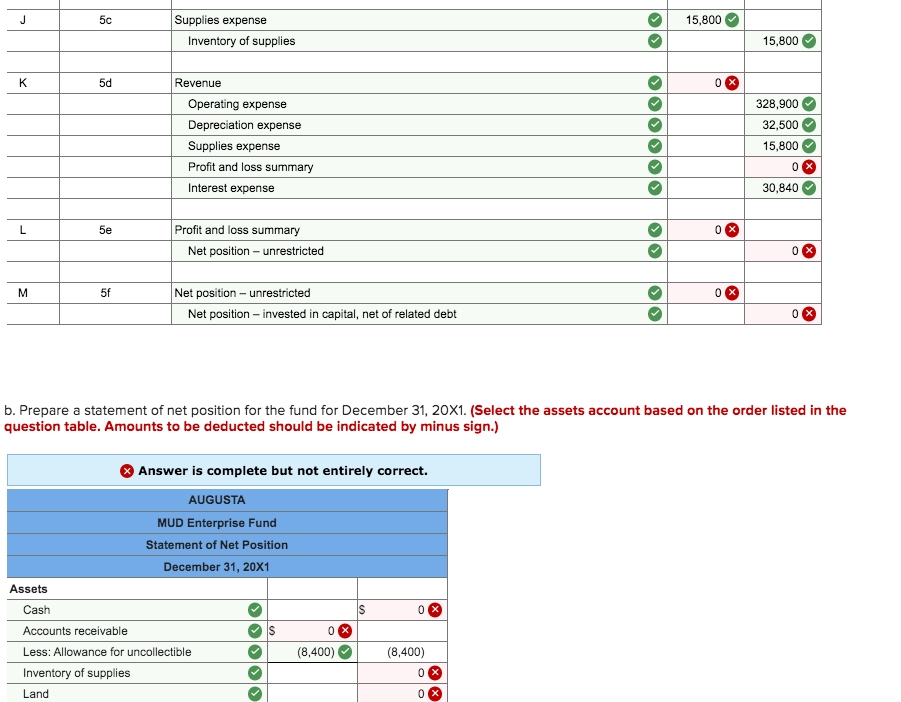

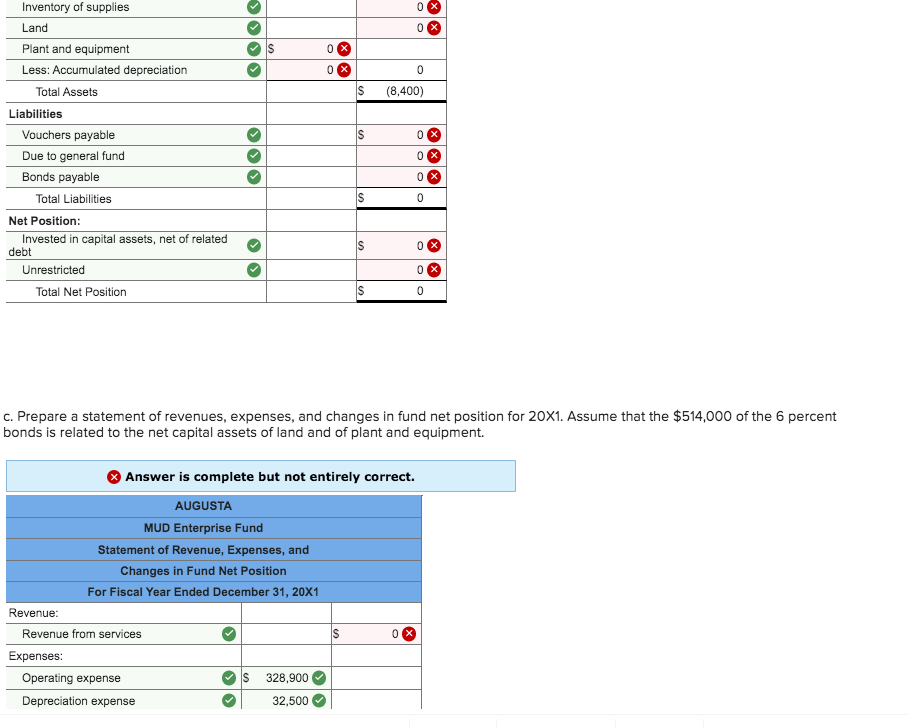

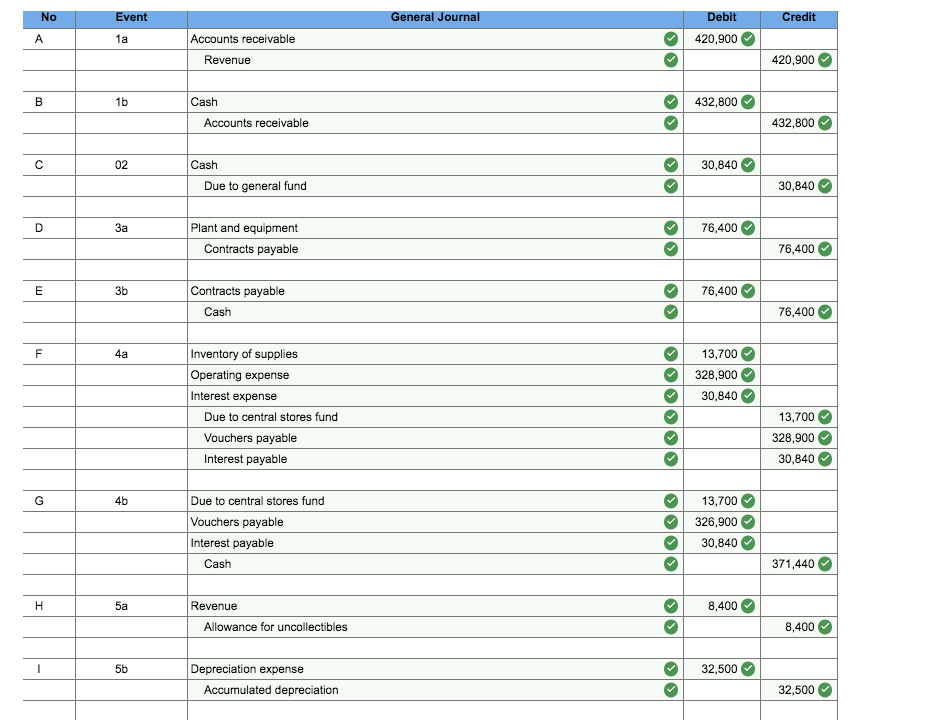

Required: a. Prepare entries for the MUD enterprise fund for 20X1 and closing entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

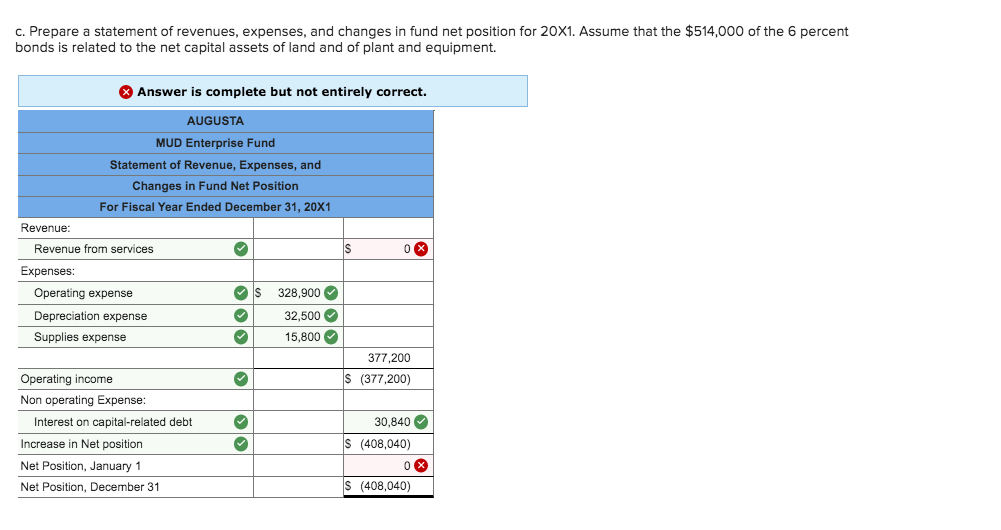

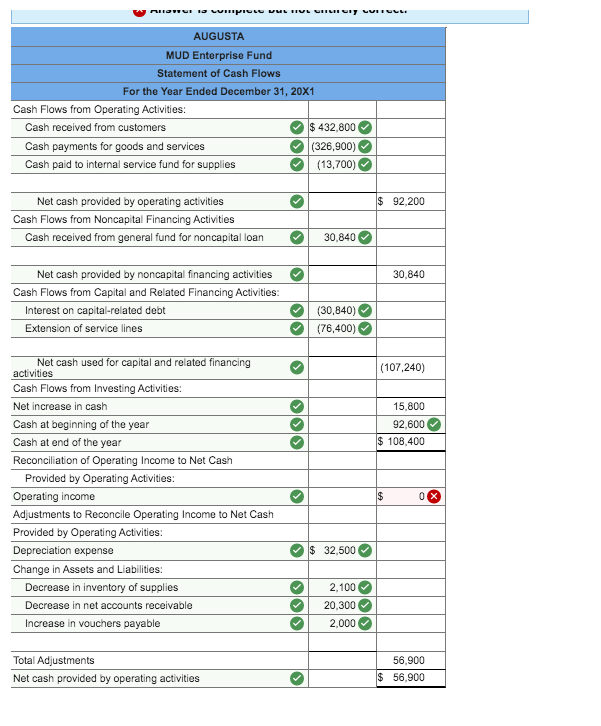

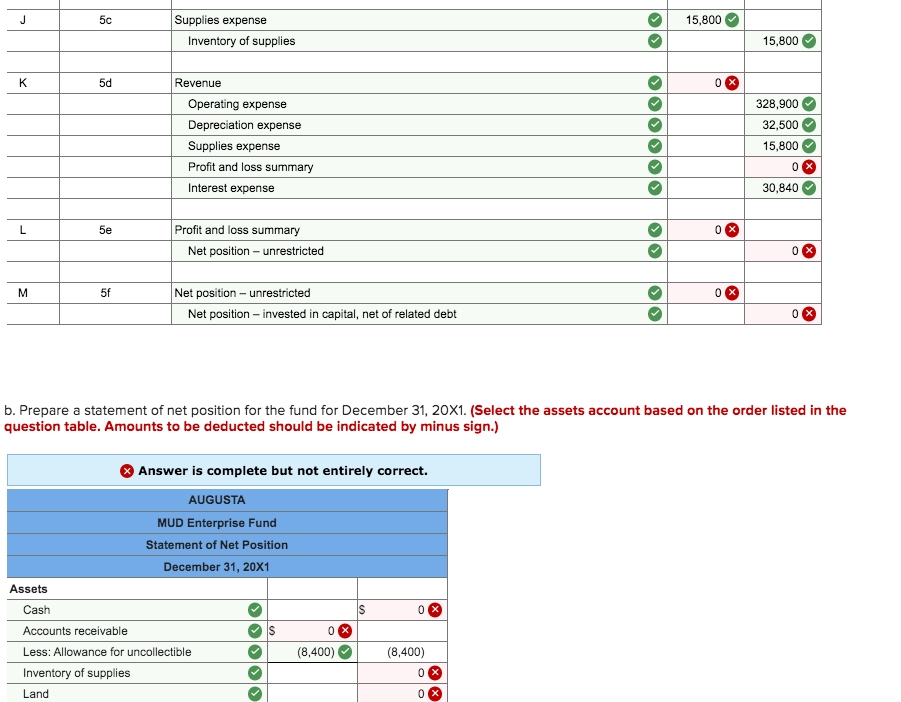

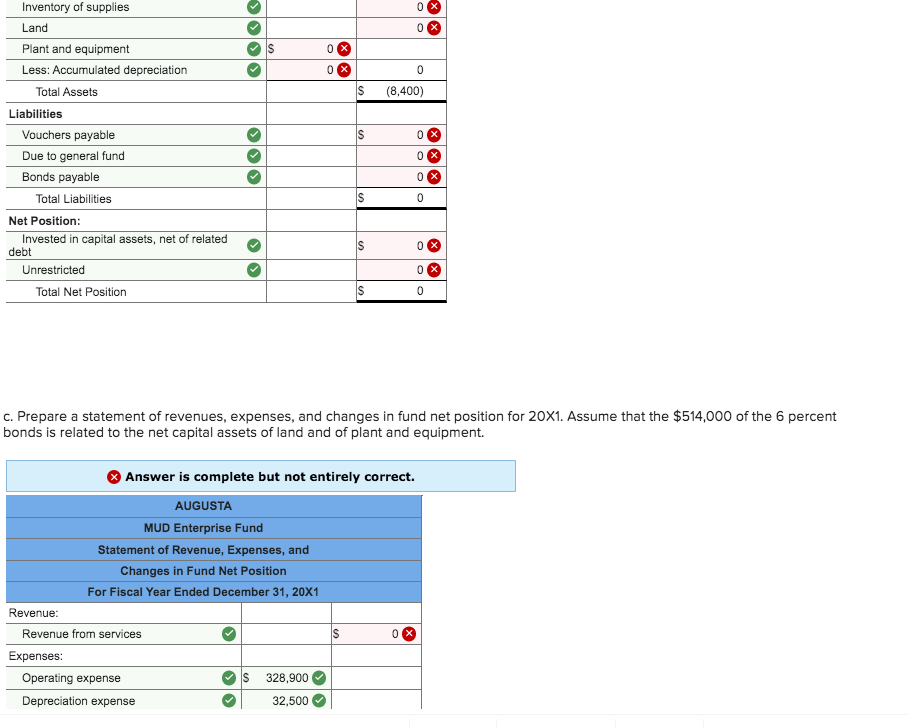

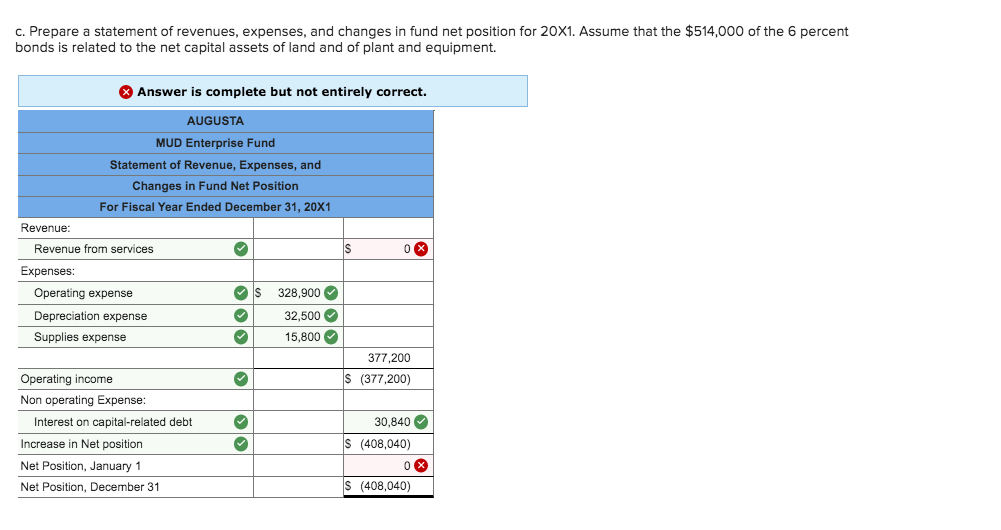

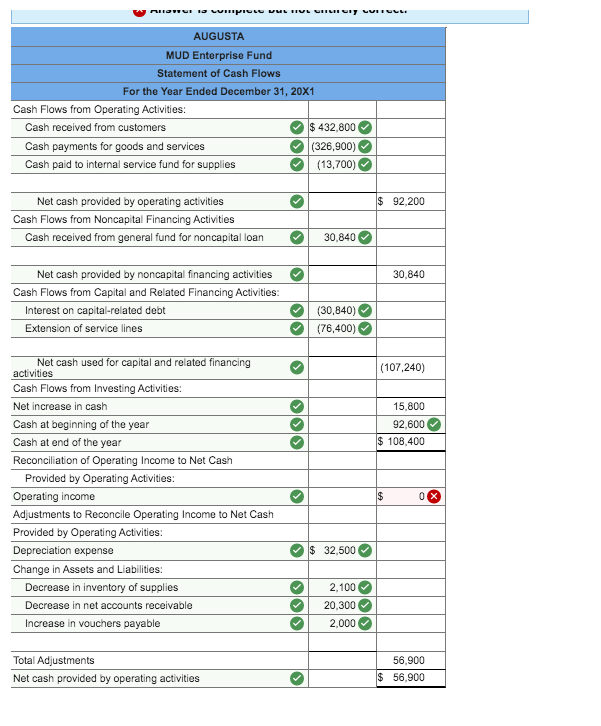

General Journal Credit No A Event 1a Debit 420,900 Accounts receivable Revenue 420,900 Cash 432,800 Accounts receivable 432,800 30,840 Cash Due to general fund 30,840 76,400 Plant and equipment Contracts payable 76,400 76,400 Contracts payable Cash 76,400 olololololo OO 13,700 328,900 30,840 Inventory of supplies Operating expense Interest expense Due to central stores fund Vouchers payable Interest payable 13,700 328,900 30,840 Due to central stores fund Vouchers payable Interest payable Cash 13,700 326,900 30,840 371,440 8,400 Revenue Allowance for uncollectibles 8,400 Depreciation expense 32,500 Accumulated depreciation 32,500 15,800 Supplies expense Inventory of supplies 0 0 15,800 K & Revenue Operating expense Depreciation expense Supplies expense Profit and loss summary Interest expense 0 0 0 0 328,900 32,500 15,800 30,840 Profit and loss summary Net position - unrestricted 0 0 5f Net position - unrestricted Net position - invested in capital, net of related debt 0 b. Prepare a statement of net position for the fund for December 31, 20X1. (Select the assets account based on the order listed in the question table. Amounts to be deducted should be indicated by minus sign.) > Answer is complete but not entirely correct. AUGUSTA MUD Enterprise Fund Statement of Net Position December 31, 20X1 Assets Cash 0 X 0X (8,400) Accounts receivable Less: Allowance for uncollectible Inventory of supplies Land 0 % Inventory of supplies Land Plant and equipment Less: Accumulated depreciation Total Assets S (8,400) Liabilities Vouchers payable Due to general fund Bonds payable Total Liabilities Net Position: Invested in capital assets, net of related debt Unrestricted Total Net Position $ 0 c. Prepare a statement of revenues, expenses, and changes in fund net position for 20X1. Assume that the $514,000 of the 6 percent bonds is related to the net capital assets of land and of plant and equipment. Answer is complete but not entirely correct. AUGUSTA MUD Enterprise Fund Statement of Revenue, Expenses, and Changes in Fund Net Position For Fiscal Year Ended December 31, 20X1 Revenue: Revenue from services Expenses: Operating expense $ 328,900 Depreciation expense 32,500 c. Prepare a statement of revenues, expenses, and changes in fund net position for 20X1. Assume that the $514,000 of the 6 percent bonds is related to the net capital assets of land and of plant and equipment. Answer is complete but not entirely correct. AUGUSTA MUD Enterprise Fund Statement of Revenue, Expenses, and Changes in Fund Net Position For Fiscal Year Ended December 31, 20X1 Revenue: Revenue from services Expenses: Operating expense S 328.900 Depreciation expense 32,500 Supplies expense 15,800 377,200 S (377,200) Operating income Non operating Expense: Interest on capital-related debt Increase in Net position Net Position, January 1 Net Position, December 31 30,840 $ (408,040) 0 x $ (408,040) WAS. a pus WUE RIVE GRILY WELL AUGUSTA MUD Enterprise Fund Statement of Cash Flows For the Year Ended December 31, 20X1 Cash Flows from Operating Activities: Cash received from customers $ 432,800 Cash payments for goods and services (326,900) Cash paid to internal service fund for supplies (13,700) Net cash provided by operating activities Cash Flows from Noncapital Financing Activities Cash received from general fund for noncapital loan 30,840 30,840 Net cash provided by noncapital financing activities Cash Flows from Capital and Related Financing Activities: Interest on capital-related debt Extension of service lines (30,840) (76,400) (107,240) 15,800 92,600 $ 108,400 Net cash used for capital and related financing activities Cash Flows from Investing Activities: Net increase in cash Cash at beginning of the year Cash at end of the year Reconciliation of Operating Income to Net Cash Provided by Operating Activities: Operating income Adjustments to Reconcile Operating Income to Net Cash Provided by Operating Activities: Depreciation expense Change in Assets and Liabilities: Decrease in inventory of supplies Decrease in net accounts receivable Increase in vouchers payable $ 32,500 2.100 20,300 2,000 Total Adjustments Net cash provided by operating activities 56.900 $ 56.900 General Journal Credit No A Event 1a Debit 420,900 Accounts receivable Revenue 420,900 Cash 432,800 Accounts receivable 432,800 30,840 Cash Due to general fund 30,840 76,400 Plant and equipment Contracts payable 76,400 76,400 Contracts payable Cash 76,400 olololololo OO 13,700 328,900 30,840 Inventory of supplies Operating expense Interest expense Due to central stores fund Vouchers payable Interest payable 13,700 328,900 30,840 Due to central stores fund Vouchers payable Interest payable Cash 13,700 326,900 30,840 371,440 8,400 Revenue Allowance for uncollectibles 8,400 Depreciation expense 32,500 Accumulated depreciation 32,500 15,800 Supplies expense Inventory of supplies 0 0 15,800 K & Revenue Operating expense Depreciation expense Supplies expense Profit and loss summary Interest expense 0 0 0 0 328,900 32,500 15,800 30,840 Profit and loss summary Net position - unrestricted 0 0 5f Net position - unrestricted Net position - invested in capital, net of related debt 0 b. Prepare a statement of net position for the fund for December 31, 20X1. (Select the assets account based on the order listed in the question table. Amounts to be deducted should be indicated by minus sign.) > Answer is complete but not entirely correct. AUGUSTA MUD Enterprise Fund Statement of Net Position December 31, 20X1 Assets Cash 0 X 0X (8,400) Accounts receivable Less: Allowance for uncollectible Inventory of supplies Land 0 % Inventory of supplies Land Plant and equipment Less: Accumulated depreciation Total Assets S (8,400) Liabilities Vouchers payable Due to general fund Bonds payable Total Liabilities Net Position: Invested in capital assets, net of related debt Unrestricted Total Net Position $ 0 c. Prepare a statement of revenues, expenses, and changes in fund net position for 20X1. Assume that the $514,000 of the 6 percent bonds is related to the net capital assets of land and of plant and equipment. Answer is complete but not entirely correct. AUGUSTA MUD Enterprise Fund Statement of Revenue, Expenses, and Changes in Fund Net Position For Fiscal Year Ended December 31, 20X1 Revenue: Revenue from services Expenses: Operating expense $ 328,900 Depreciation expense 32,500 c. Prepare a statement of revenues, expenses, and changes in fund net position for 20X1. Assume that the $514,000 of the 6 percent bonds is related to the net capital assets of land and of plant and equipment. Answer is complete but not entirely correct. AUGUSTA MUD Enterprise Fund Statement of Revenue, Expenses, and Changes in Fund Net Position For Fiscal Year Ended December 31, 20X1 Revenue: Revenue from services Expenses: Operating expense S 328.900 Depreciation expense 32,500 Supplies expense 15,800 377,200 S (377,200) Operating income Non operating Expense: Interest on capital-related debt Increase in Net position Net Position, January 1 Net Position, December 31 30,840 $ (408,040) 0 x $ (408,040) WAS. a pus WUE RIVE GRILY WELL AUGUSTA MUD Enterprise Fund Statement of Cash Flows For the Year Ended December 31, 20X1 Cash Flows from Operating Activities: Cash received from customers $ 432,800 Cash payments for goods and services (326,900) Cash paid to internal service fund for supplies (13,700) Net cash provided by operating activities Cash Flows from Noncapital Financing Activities Cash received from general fund for noncapital loan 30,840 30,840 Net cash provided by noncapital financing activities Cash Flows from Capital and Related Financing Activities: Interest on capital-related debt Extension of service lines (30,840) (76,400) (107,240) 15,800 92,600 $ 108,400 Net cash used for capital and related financing activities Cash Flows from Investing Activities: Net increase in cash Cash at beginning of the year Cash at end of the year Reconciliation of Operating Income to Net Cash Provided by Operating Activities: Operating income Adjustments to Reconcile Operating Income to Net Cash Provided by Operating Activities: Depreciation expense Change in Assets and Liabilities: Decrease in inventory of supplies Decrease in net accounts receivable Increase in vouchers payable $ 32,500 2.100 20,300 2,000 Total Adjustments Net cash provided by operating activities 56.900 $ 56.900