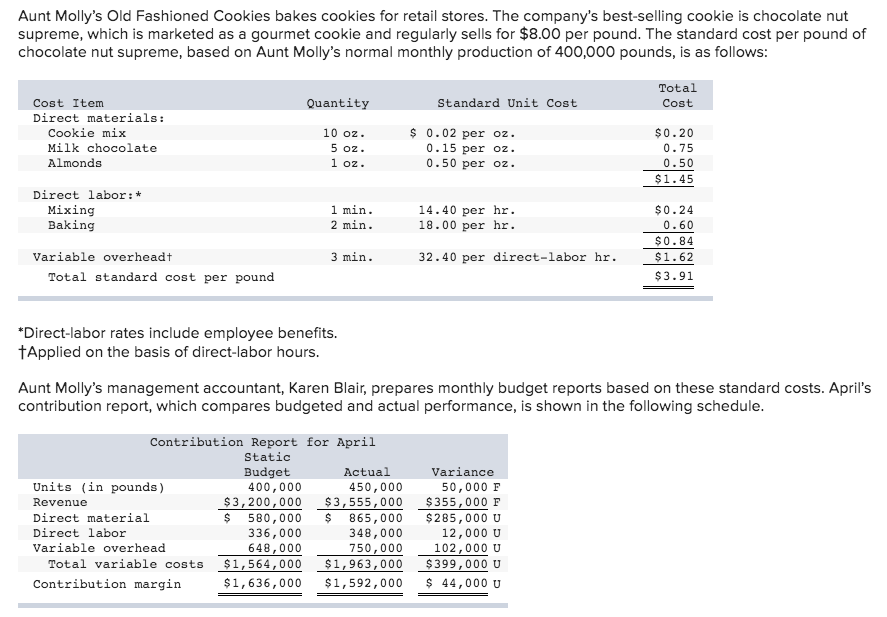

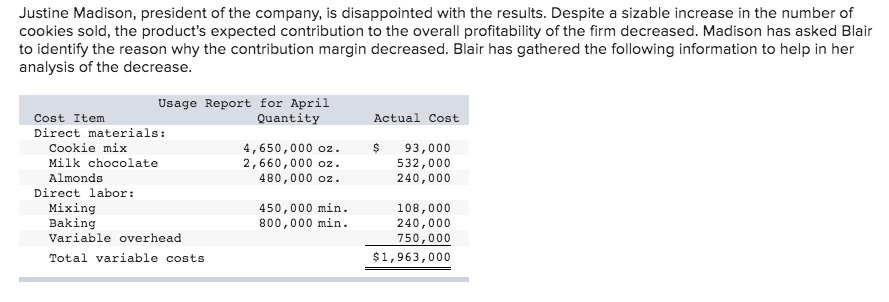

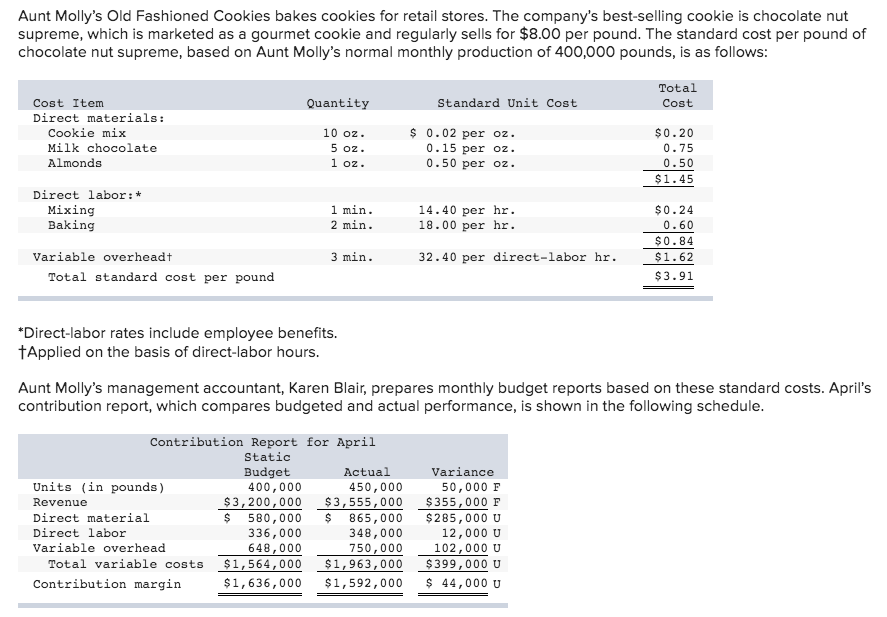

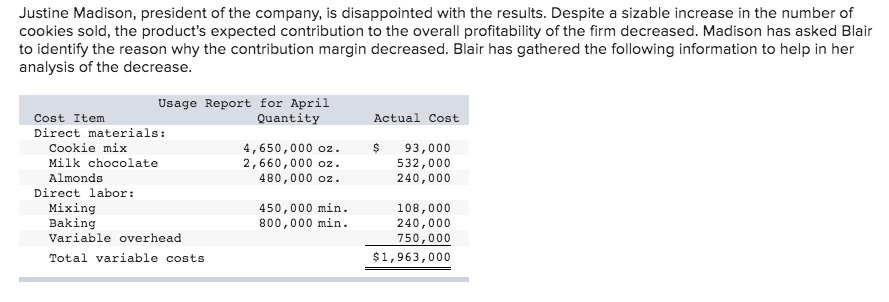

Aunt Molly's Old Fashioned Cookies bakes cookies for retail stores. The company's best-selling cookie is chocolate nut supreme, which is marketed as a gourmet cookie and regularly sells for $8.00 per pound. The standard cost per pound of chocolate nut supreme, based on Aunt Molly's normal monthly production of 400,000 pounds, is as follows Total Cost Quantity Standard Unit Cost Cost Item Direct materials: Cookie mix Milk chocolate Almonds 10 oz 5 oz l oz $0.02 per oz. 0.15 per oz. 0.50 per oz. $0.20 0.75 0.50 $1.45 Direct labor:* 14.40 per hr. 18.00 per hr $0.24 0.60 $0.84 $1.62 $3.91 Mixing Baking l min 2 min Variable overheadt 3 min 32.40 per direct-labor hr Total standard cost per pound *Direct-labor rates include employee benefits. tApplied on the basis of direct-labor hours. Aunt Molly's management accountant, Karen Blair, prepares monthly budget reports based on these standard costs. April's contribution report, which compares budgeted and actual performance, is shown in the following schedule Contribution Report for April Static Budget 400,000 Actual Variance Units (in pounds) Revenue Direct material Direct labor Variable overhead 50,000 F $3,200,000 $3,555,000 $355,000 F $ 580,000 865,000 $285,000 U 12,000 U 102,000 U Total variable costs $1,564,000 $1,963,000 $399,000 U $1,636,000 $1,592,000 44,000 U 450,000 336,000 648,000 348,000 750,000 Contribution margin Justine Madison, president of the company, is disappointed with the results. Despite a sizable increase in the number of cookies sold, the product's expected contribution to the overall profitability of the firm decreased. Madison has asked Blair to identify the reason why the contribution margin decreased. Blair has gathered the following information to help in her analysis of the decrease Usage Report for Apri1 Actual Cost Cost Item Direct materials: Quantity Cookie mix Milk chocolate Almonds 4,650,000 oz. 93,000 532,000 240,000 2,660,000 oz. 480,000 oz. Direct labor: Mixing Baking Variable overhead Total variable costs 450,000 min. 800,000 min. 108,000 240,000 750,000 $1,963,000 2. What is the total contribution margin in the flexible budget column of the new report prepared for part (1)? (Do not round your intermediate calculations.) Total contribution margin