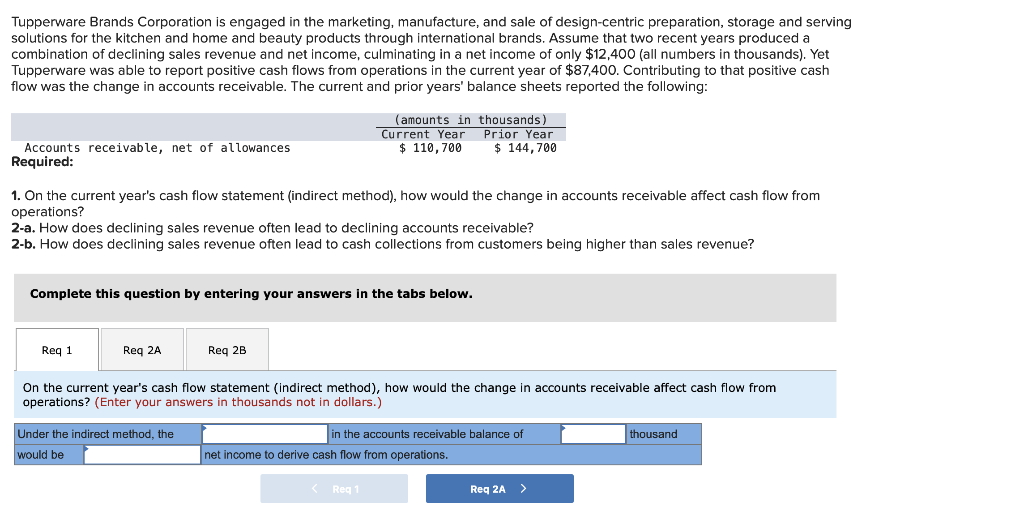

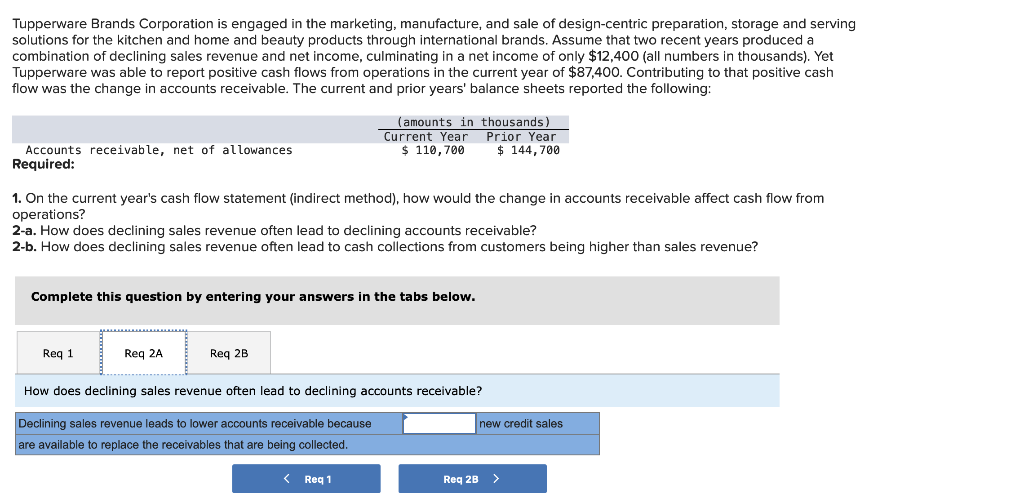

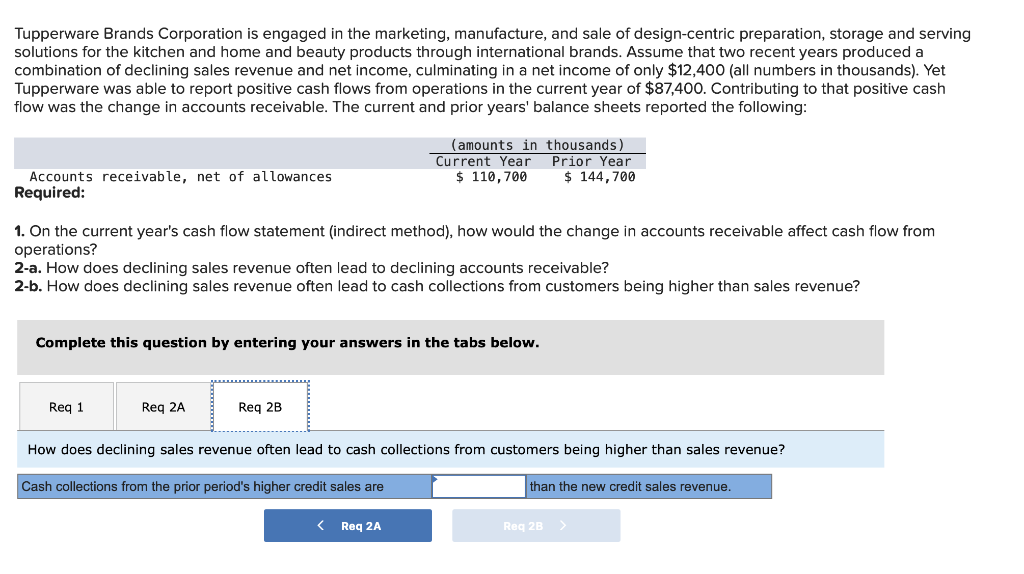

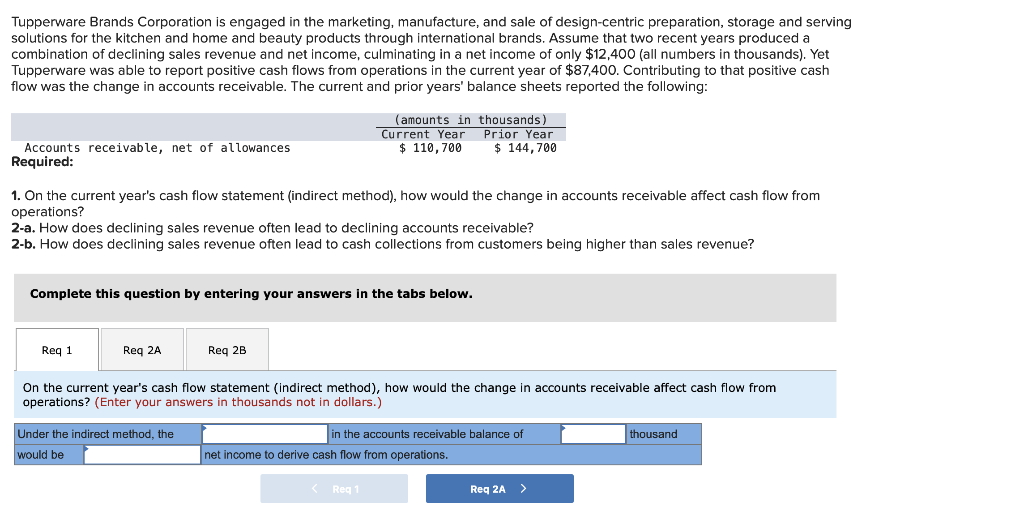

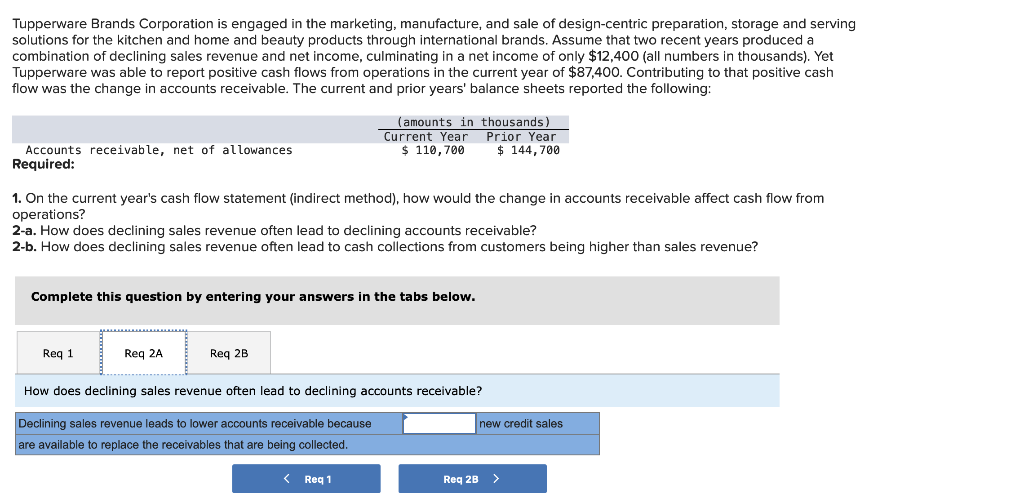

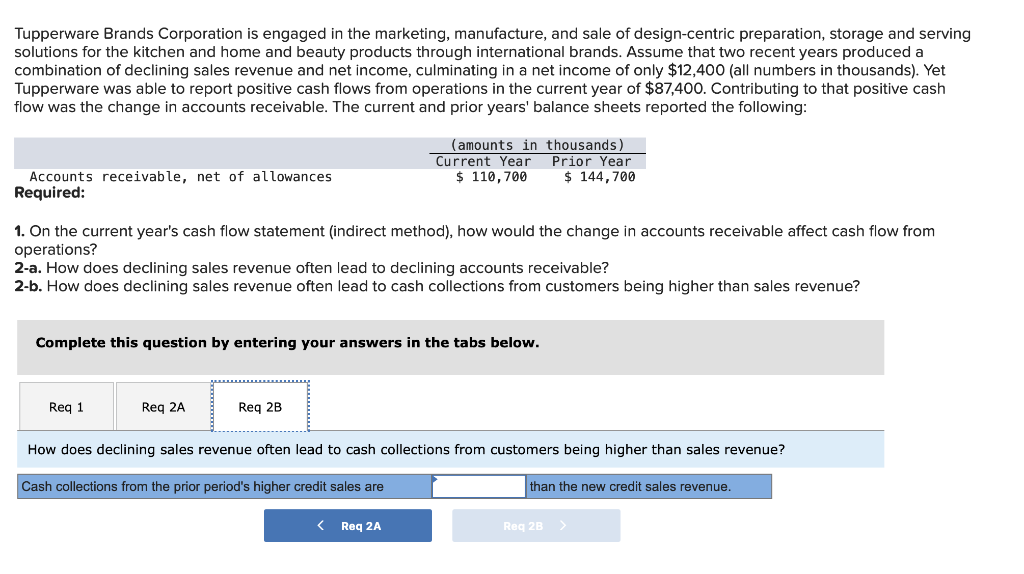

Tupperware Brands Corporation is engaged in the marketing, manufacture, and sale of design-centric preparation, storage and serving solutions for the kitchen and home and beauty products through international brands. Assume that two recent years produced a combination of declining sales revenue and net income, culminating in a net income of only $12,400 (all numbers in thousands). Yet Tupperware was able to report positive cash flows from operations in the current year of $87,400. Contributing to that positive cash flow was the change in accounts receivable. The current and prior years' balance sheets reported the following: 1. On the current year's cash flow statement (indirect method), how would the change in accounts receivable affect cash flow from operations? 2-a. How does declining sales revenue often lead to declining accounts receivable? 2-b. How does declining sales revenue often lead to cash collections from customers being higher than sales revenue? Complete this question by entering your answers in the tabs below. On the current year's cash flow statement (indirect method), how would the change in accounts receivable affect cash flow from operations? (Enter your answers in thousands not in dollars.) Tupperware Brands Corporation is engaged in the marketing, manufacture, and sale of design-centric preparation, storage and serving solutions for the kitchen and home and beauty products through international brands. Assume that two recent years produced a combination of declining sales revenue and net income, culminating in a net income of only $12,400 (all numbers in thousands). Yet Tupperware was able to report positive cash flows from operations in the current year of $87,400. Contributing to that positive cash flow was the change in accounts receivable. The current and prior years' balance sheets reported the following: 1. On the current year's cash flow statement (indirect method), how would the change in accounts receivable affect cash flow from operations? 2-a. How does declining sales revenue often lead to declining accounts receivable? 2-b. How does declining sales revenue often lead to cash collections from customers being higher than sales revenue? Complete this question by entering your answers in the tabs below. How does declining sales revenue often lead to declining accounts receivable? Tupperware Brands Corporation is engaged in the marketing, manufacture, and sale of design-centric preparation, storage and serving solutions for the kitchen and home and beauty products through international brands. Assume that two recent years produced a combination of declining sales revenue and net income, culminating in a net income of only $12,400 (all numbers in thousands). Yet Tupperware was able to report positive cash flows from operations in the current year of $87,400. Contributing to that positive cash flow was the change in accounts receivable. The current and prior years' balance sheets reported the following: 1. On the current year's cash flow statement (indirect method), how would the change in accounts receivable affect cash flow from operations? 2-a. How does declining sales revenue often lead to declining accounts receivable? 2-b. How does declining sales revenue often lead to cash collections from customers being higher than sales revenue? Complete this question by entering your answers in the tabs below. How does declining sales revenue often lead to cash collections from customers being higher than sales revenue? Cash collections from the prior period's higher credit sales are than the new credit sales revenue