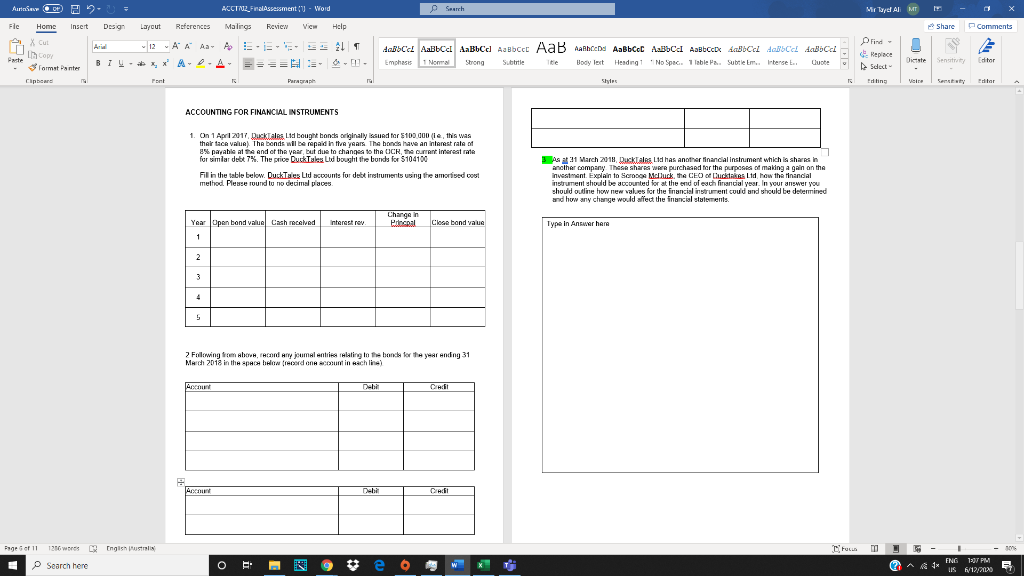

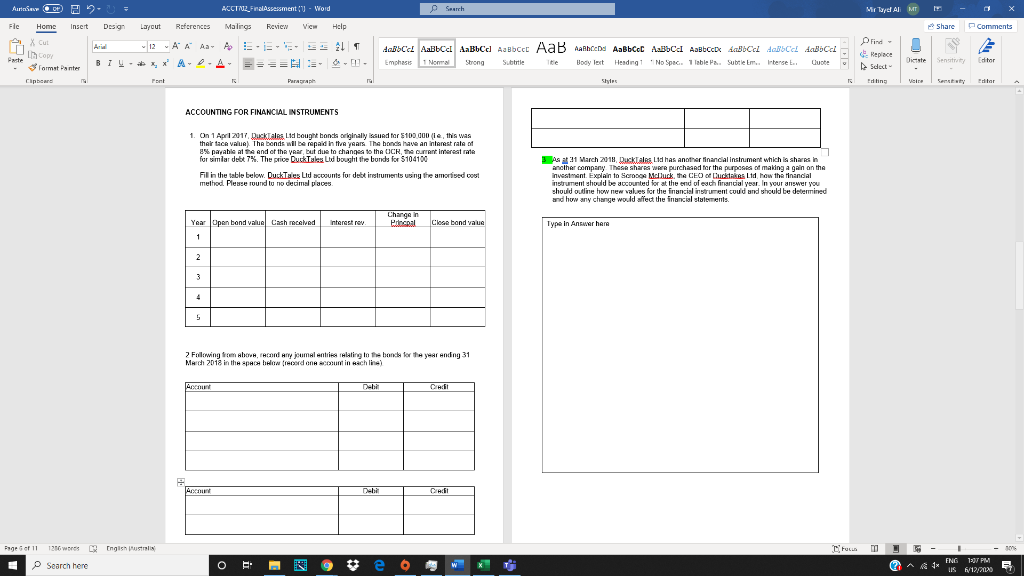

Aurinn ACCTROZ_FinalAssessment - Word Mir Tarel Al MT Fle Home Insert Design Layout References Malines Review Vic Help Share Comments X Cut h Copy Format Panter 12 AA AAA AES 211 BIU XX A. 2-4. ES == 0 - - doBC AaBbcc AaBbCd AaBbcc AaB Aalboete AaBbccc ABC AaBbcc AaBbce doc ABC Emphasis 1 Normal Strong Subtitle Body lent Hending No Spac. 1 Table P. Subtlem.. Intense L.. Paste te prind Replace det Editing Diste Sensit Editor Clipboard Font Paragraph Shes Editor ACCOUNTING FOR FINANCIAL INSTRUMENTS 1. On 1 April 2017 Ducktales Lid bought bonds originally issued for $100.000 (ie, this was their face value) The bonds will be repaid in the years. The band have an interest rate 8parable at the end of the year, but due to changes to the OCR, the current interest rate for similar debt 7%. The price Duck Tales Ltd bought the bonds for $104100 Fill in the table below. DuckTales Lid accounts for debt instruments using the amortised cost method. Please round to no decimal places 3 A21 March 2018 Ducktales Lid has another financial instrument which is shares in another company. These shares were purchased for the purposes of making again on the Investment. Explain to Scrooge Mdluck the CEO of Ducks Ltd how the tinandal instrument should be accounted for at the end of each financial year. In your answer you should outline how new values for the financial instrument could and should be determined and how any change would affect the financial statements. Year Open bond value Cashmcelved Interest rev Change in Prical Close band value Type In Answer her 1 2 3 4 5 2 Failowing from above record any jumal entries relating to the bands for the year ending 31 March 2018 in the space balon rencount in Rachline) ni Cad AD De CAS Page 5 of 11 1216 wres LV English USIN Thua T | 30 Search here O (2 ENG 1:37 PM LIS 6/12/2013 Aurinn ACCTROZ_FinalAssessment - Word Mir Tarel Al MT Fle Home Insert Design Layout References Malines Review Vic Help Share Comments X Cut h Copy Format Panter 12 AA AAA AES 211 BIU XX A. 2-4. ES == 0 - - doBC AaBbcc AaBbCd AaBbcc AaB Aalboete AaBbccc ABC AaBbcc AaBbce doc ABC Emphasis 1 Normal Strong Subtitle Body lent Hending No Spac. 1 Table P. Subtlem.. Intense L.. Paste te prind Replace det Editing Diste Sensit Editor Clipboard Font Paragraph Shes Editor ACCOUNTING FOR FINANCIAL INSTRUMENTS 1. On 1 April 2017 Ducktales Lid bought bonds originally issued for $100.000 (ie, this was their face value) The bonds will be repaid in the years. The band have an interest rate 8parable at the end of the year, but due to changes to the OCR, the current interest rate for similar debt 7%. The price Duck Tales Ltd bought the bonds for $104100 Fill in the table below. DuckTales Lid accounts for debt instruments using the amortised cost method. Please round to no decimal places 3 A21 March 2018 Ducktales Lid has another financial instrument which is shares in another company. These shares were purchased for the purposes of making again on the Investment. Explain to Scrooge Mdluck the CEO of Ducks Ltd how the tinandal instrument should be accounted for at the end of each financial year. In your answer you should outline how new values for the financial instrument could and should be determined and how any change would affect the financial statements. Year Open bond value Cashmcelved Interest rev Change in Prical Close band value Type In Answer her 1 2 3 4 5 2 Failowing from above record any jumal entries relating to the bands for the year ending 31 March 2018 in the space balon rencount in Rachline) ni Cad AD De CAS Page 5 of 11 1216 wres LV English USIN Thua T | 30 Search here O (2 ENG 1:37 PM LIS 6/12/2013