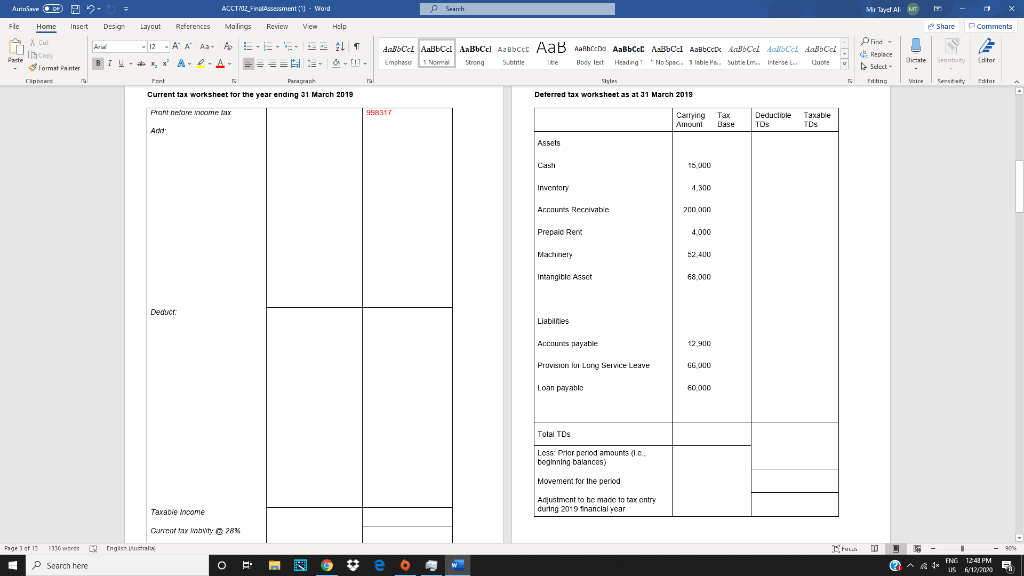

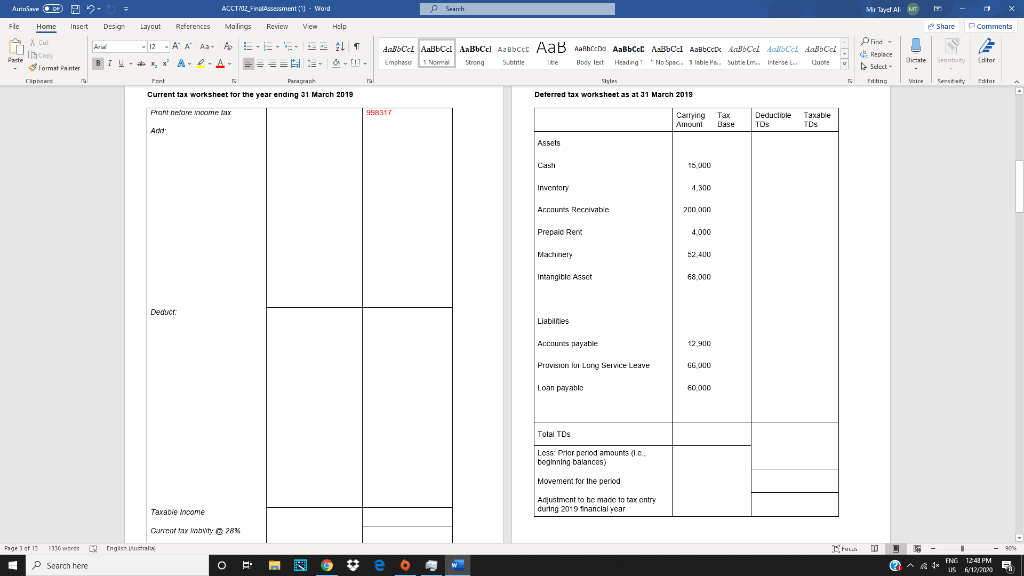

Aurinn ACCTROZ_FinalAssessment - Word p Search Mir Tarel Al M Fle Home Insert Design Layout References Malings Review Vic Help Share Comments X Cut COM 12A A A A AES 21 BI XA-2-A- doBC AaBbca ABCd AaBbccc AaB Aalboete AaBbccc ABC AaBbcc AaBbce dopce daca Emphasis 1 Normal Strong Subtitle Body lett Hending No Spac. 1lable Pa.. Subtle tm.. Interset.. Quote Find Replace Sect Diste Sent Editor 3 Format Painter Clipboard Para Editing Voir Editar Doc McStuffins, CEO of McStuffinsville Hospital has asked you for help with her deferred tax. For the year ending 31 March 2019, McStuffinsville Hospital made an accounting profit that is the 998317. The tax rate is 28%. The following information was also provided to you: As at the end of the 2019 financial year McStuffinsville Hospital has a 4 year-old portable X- ray machine. The machine cost $62,000 and is depreciated over a total useful life of 25 years with an expected residual or salvage value of $2,000. For tax purposes the machinery is fully depreciated using a 5% depreciation rate. At the start of the 2016 financial year $119,000 of R&D expenditure was capitalized and tumed into an intangible asset to be amortized over seven years. For tax purposes such expenditure is deductible in the year incurred (note there was no R&D tax credit in 2016- 2019). McStuffinsville Hospital rents iPads and iPhones for staff. At 31 March 2019. $4,000 was paid in advance for the next year. Tax deductions for this item are available for amounts Paru paid. At the start of the year there was a provision for annual long service leave of $56,000. $8,000 long service leave was taken during the year and the long service leave expense for the year was $18,000. Tax deductions for this item are available for amounts paid. There were entertainment expenses incurred and paid of $11,000. For tax purposes only 50% of the amount paid for entertainment expenses are tax deductible. The allowance for doubtful debts at the start of the year was $27,000, and at the end of the year it was $26,000. $5,000 of bad debts were written off during the year. Tax deductions for this item are available when debts are written off. The opening balances as at 1 April 2018 for Deductible Temporary Differences and Taxable Temporary Differences were 77,800 and 81,900, respectively. The tax rate is 28%. ** CONGRATULATIONSI ** Click Here And Claim Your 3 FREE Spins! 2Tadorian.com Fill in the current tax worksheet and deferred tax worksheet below. Record any journal entries relating to tax for the year. Close ro Page 2 of 19 1936 words English Search here O W QAA ENG 12:47 PM US f/12/20120 5 Aurinn ACCTROZ_FinalAssessment - Word Miraye Al MT Fle Home Insert Design Layout References Malines Review Vic Help Share Comments X Cut hoy Format Panter 12A A A A A.EL BIXA-2- A === - 0 - - doBC AaBbca ABCd AaBbccc AaB Aalboete AaBbccc ABC AaBbcc AaBbce dopce daca Emphasis 1 Norma Shong Subtitle Body Best Heading Hending No Spac. 1 Table P. Subtlem.. Intense L.. Quote Find Replace Sdect Paste Ite Sensit Editor Clipboard Editing Editor Current tax worksheet for the year ending 31 March 2019 Deterred tax worksheet as at 31 March 2013 Prant hetare vome tax 998317 Carrying Amount Tax Base Deductible TDS Taxable TDS Adet Assets Casti 15 000 Inventor 1,300 Arcounts Receivable 200.000 Prepaid Rent 4,000 Machinery 52 400 Intangible Asset 68.000 Deduct: Liabilities Accounts payable 12 900 Provision for Lung Service Leave 66000 Loan payable 60,000 Total TDS Less: Prior period amounts (10 beginning balancos) Movement for the period Adjustment to be made to tay entry during 2019 financial year Taxable income Current tay wary 28% Page 1 of 13 1736 wres LY English Pustralia C Fous 907 Search here e W (2 ENG 12:43 PM LIS 6/12/2016