Answered step by step

Verified Expert Solution

Question

1 Approved Answer

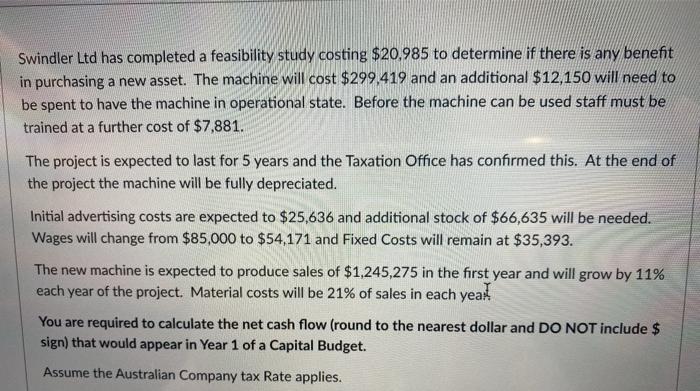

aus tax is 30% Swindler Ltd has completed a feasibility study costing $20,985 to determine if there is any benefit in purchasing a new asset.

aus tax is 30%

Swindler Ltd has completed a feasibility study costing $20,985 to determine if there is any benefit in purchasing a new asset. The machine will cost $299,419 and an additional $12,150 will need to be spent to have the machine in operational state. Before the machine can be used staff must be trained at a further cost of $7,881. The project is expected to last for 5 years and the Taxation Office has confirmed this. At the end of the project the machine will be fully depreciated. Initial advertising costs are expected to $25,636 and additional stock of $66,635 will be needed. Wages will change from $85,000 to $54,171 and Fixed Costs will remain at $35,393. The new machine is expected to produce sales of $1,245,275 in the first year and will grow by 11% each year of the project. Material costs will be 21% of sales in each yeah You are required to calculate the net cash flow (round to the nearest dollar and DO NOT include $ sign) that would appear in Year 1 of a Capital Budget. Assume the Australian Company tax Rate applies Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started