Australian Tax Law

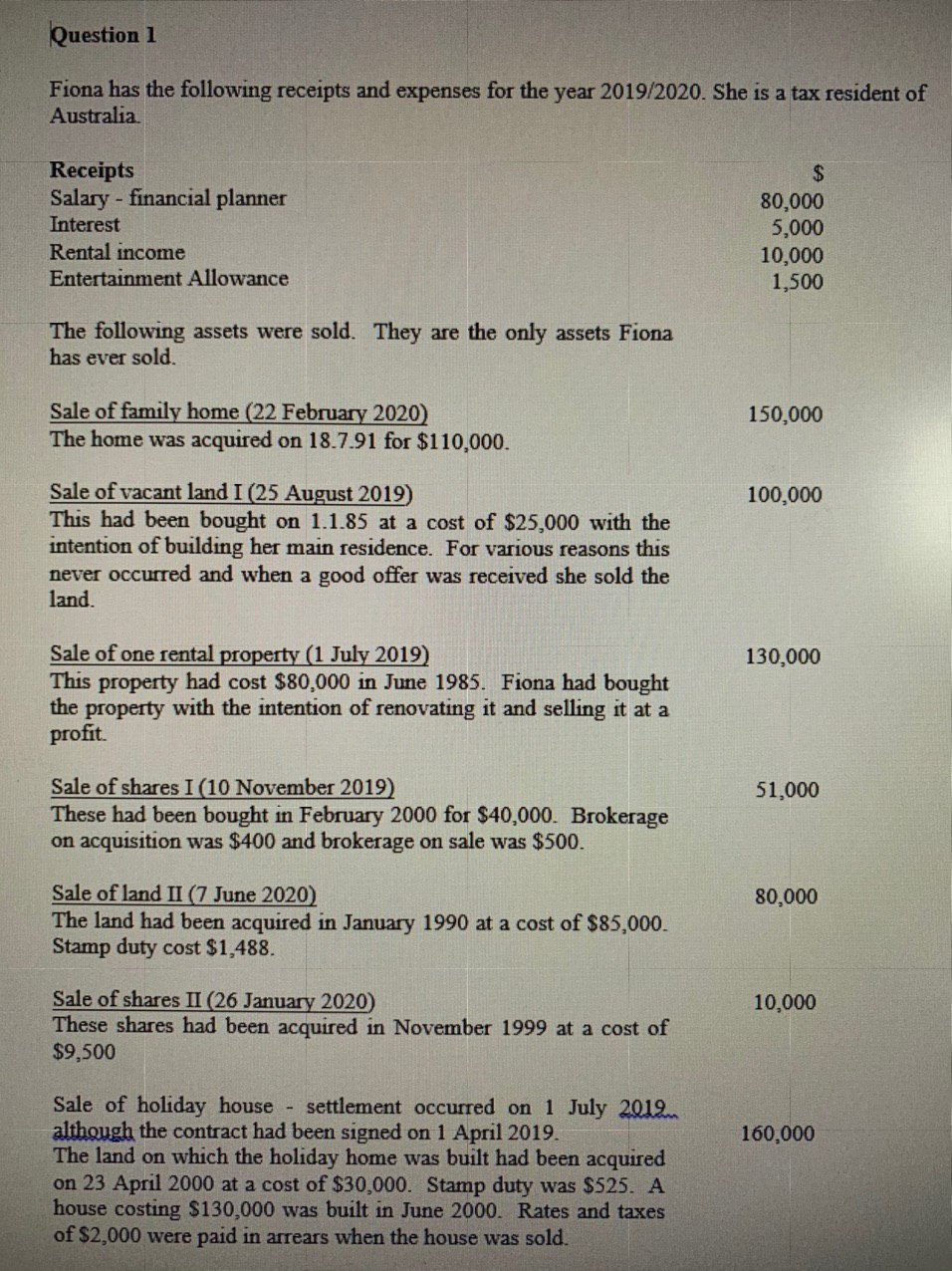

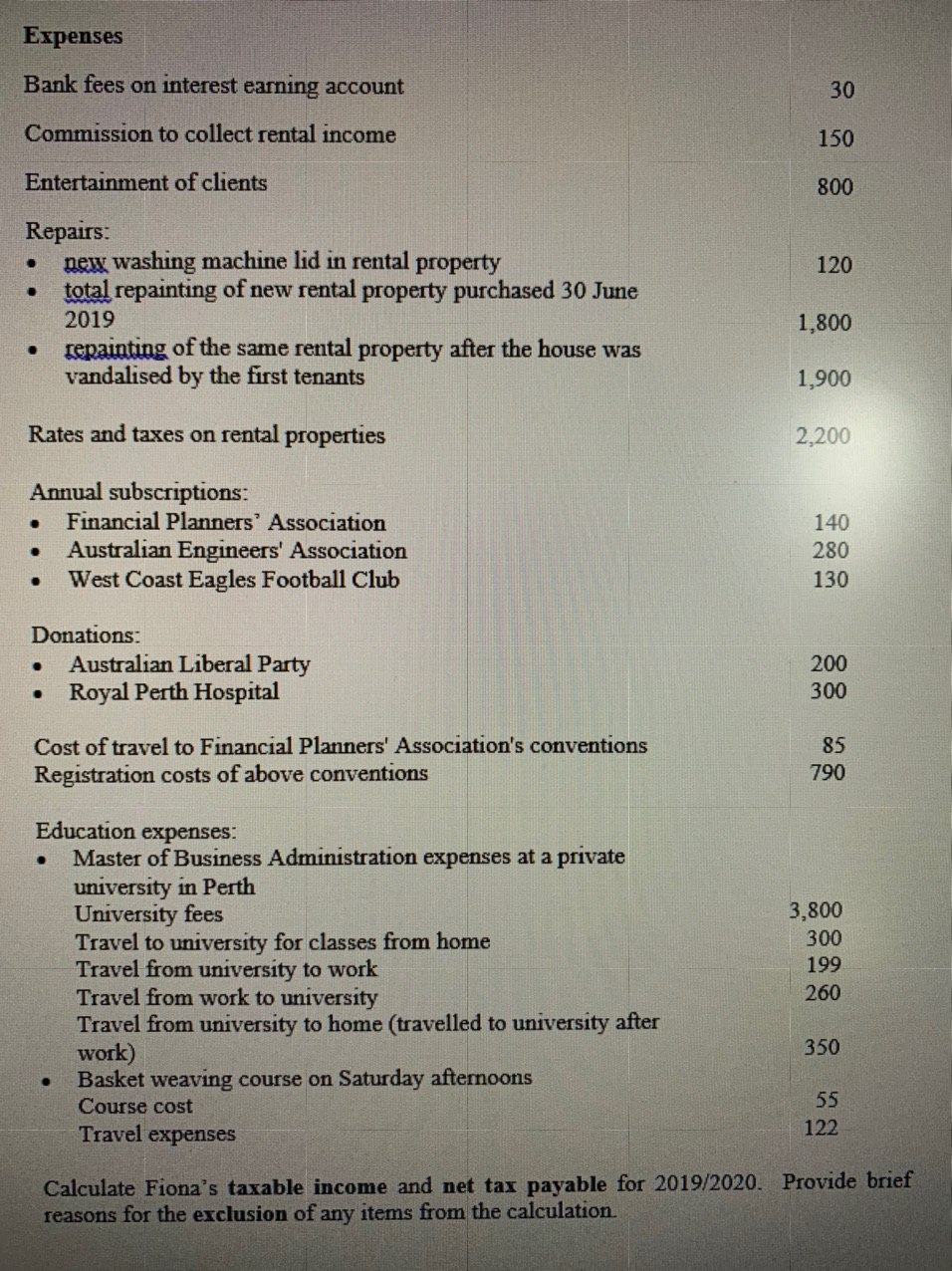

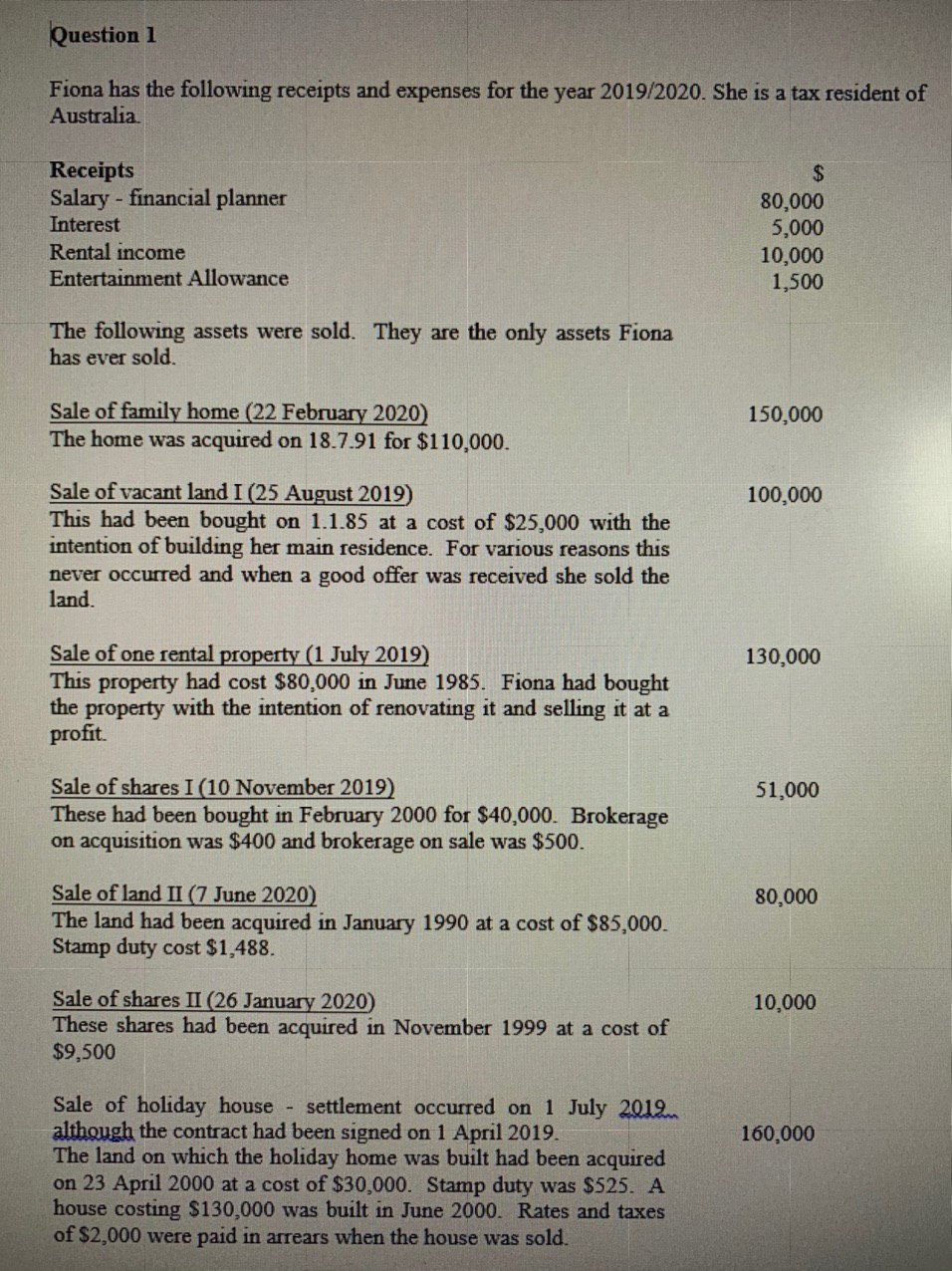

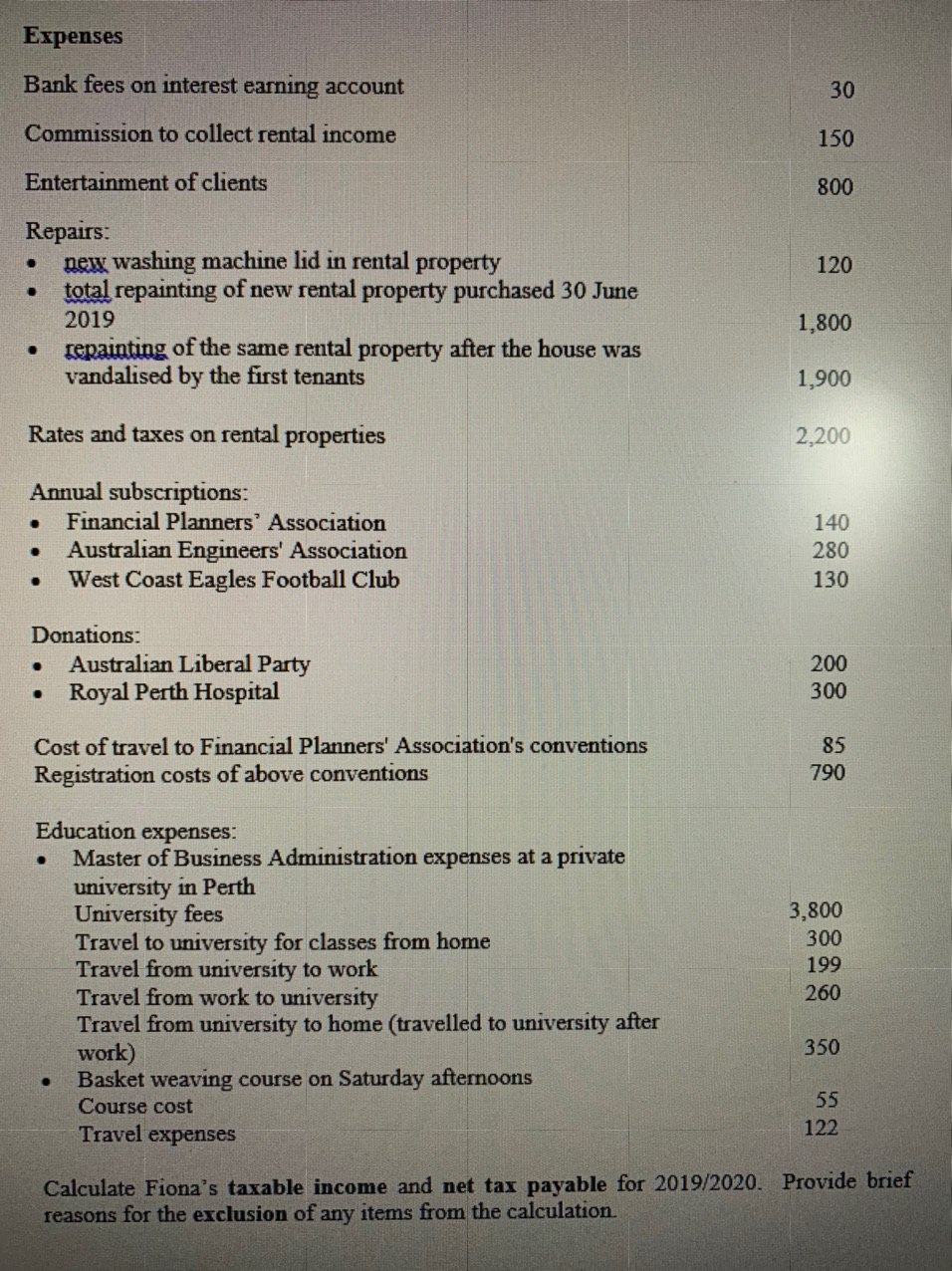

Question 1 Fiona has the following receipts and expenses for the year 2019/2020. She is a tax resident of Australia Receipts Salary - financial planner Interest Rental income Entertainment Allowance $ 80,000 5,000 10,000 1,500 The following assets were sold. They are the only assets Fiona has ever sold. Sale of family home (22 February 2020) The home was acquired on 18.7.91 for $110,000. 150,000 100,000 Sale of vacant land I (25 August 2019) This had been bought on 1.1.85 at a cost of $25,000 with the intention of building her main residence. For various reasons this never occurred and when a good offer was received she sold the land 130,000 Sale of one rental property (1 July 2019) This property had cost $80,000 in June 1985. Fiona had bought the property with the intention of renovating it and selling it at a profit. 51,000 Sale of shares I (10 November 2019) These had been bought in February 2000 for $40,000. Brokerage on acquisition was $400 and brokerage on sale was $500. 80,000 Sale of land II (7 June 2020) The land had been acquired in January 1990 at a cost of $85,000. Stamp duty cost $1,488. 10,000 Sale of shares II (26 January 2020 These shares had been acquired in November 1999 at a cost of $9,500 160,000 Sale of holiday house - settlement occurred on 1 July 2012 although the contract had been signed on 1 April 2019. The land on which the holiday home was built had been acquired on 23 April 2000 at a cost of $30,000. Stamp duty was $525. A house costing $130,000 was built in June 2000. Rates and taxes of $2,000 were paid in arrears when the house was sold. Expenses Bank fees on interest earning account 30 Commission to collect rental income 150 Entertainment of clients 800 120 . Repairs: new washing machine lid in rental property total repainting of new rental property purchased 30 June 2019 sepainting of the same rental property after the house was vandalised by the first tenants 1,800 . 1,900 Rates and taxes on rental properties 2,200 . Annual subscriptions: Financial Planners' Association Australian Engineers' Association West Coast Eagles Football Club 140 280 130 Donations: Australian Liberal Party Royal Perth Hospital 200 300 . Cost of travel to Financial Planners' Association's conventions Registration costs of above conventions 85 790 Education expenses: Master of Business Administration expenses at a private university in Perth University fees Travel to university for classes from home Travel from university to work Travel from work to university Travel from university to home (travelled to university after work) Basket weaving course on Saturday afternoons Course cost Travel expenses 3,800 300 199 260 350 55 122 Calculate Fiona's taxable income and net tax payable for 2019/2020. Provide brief reasons for the exclusion of any items from the calculation Question 1 Fiona has the following receipts and expenses for the year 2019/2020. She is a tax resident of Australia Receipts Salary - financial planner Interest Rental income Entertainment Allowance $ 80,000 5,000 10,000 1,500 The following assets were sold. They are the only assets Fiona has ever sold. Sale of family home (22 February 2020) The home was acquired on 18.7.91 for $110,000. 150,000 100,000 Sale of vacant land I (25 August 2019) This had been bought on 1.1.85 at a cost of $25,000 with the intention of building her main residence. For various reasons this never occurred and when a good offer was received she sold the land 130,000 Sale of one rental property (1 July 2019) This property had cost $80,000 in June 1985. Fiona had bought the property with the intention of renovating it and selling it at a profit. 51,000 Sale of shares I (10 November 2019) These had been bought in February 2000 for $40,000. Brokerage on acquisition was $400 and brokerage on sale was $500. 80,000 Sale of land II (7 June 2020) The land had been acquired in January 1990 at a cost of $85,000. Stamp duty cost $1,488. 10,000 Sale of shares II (26 January 2020 These shares had been acquired in November 1999 at a cost of $9,500 160,000 Sale of holiday house - settlement occurred on 1 July 2012 although the contract had been signed on 1 April 2019. The land on which the holiday home was built had been acquired on 23 April 2000 at a cost of $30,000. Stamp duty was $525. A house costing $130,000 was built in June 2000. Rates and taxes of $2,000 were paid in arrears when the house was sold. Expenses Bank fees on interest earning account 30 Commission to collect rental income 150 Entertainment of clients 800 120 . Repairs: new washing machine lid in rental property total repainting of new rental property purchased 30 June 2019 sepainting of the same rental property after the house was vandalised by the first tenants 1,800 . 1,900 Rates and taxes on rental properties 2,200 . Annual subscriptions: Financial Planners' Association Australian Engineers' Association West Coast Eagles Football Club 140 280 130 Donations: Australian Liberal Party Royal Perth Hospital 200 300 . Cost of travel to Financial Planners' Association's conventions Registration costs of above conventions 85 790 Education expenses: Master of Business Administration expenses at a private university in Perth University fees Travel to university for classes from home Travel from university to work Travel from work to university Travel from university to home (travelled to university after work) Basket weaving course on Saturday afternoons Course cost Travel expenses 3,800 300 199 260 350 55 122 Calculate Fiona's taxable income and net tax payable for 2019/2020. Provide brief reasons for the exclusion of any items from the calculation