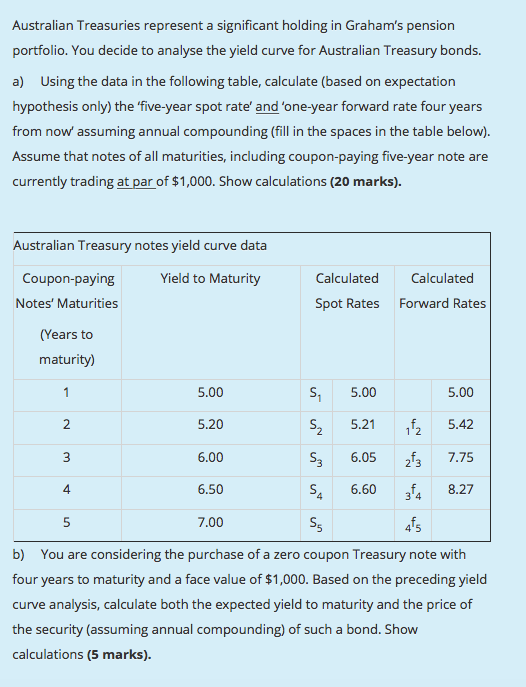

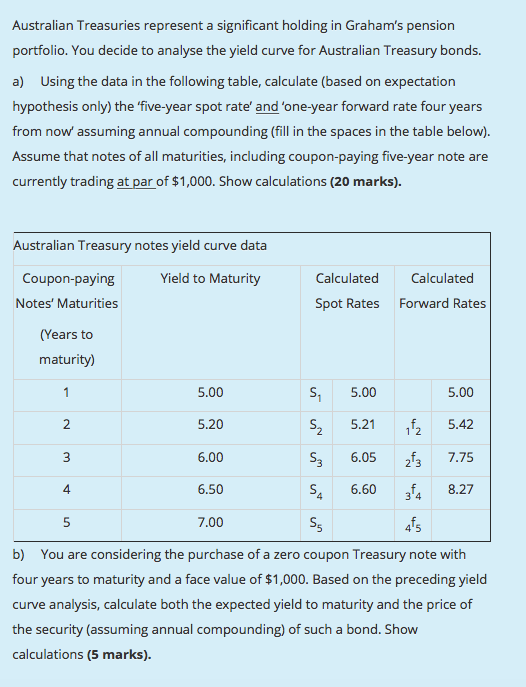

Australian Treasuries represent a significant holding in Graham's pension portfolio. You decide to analyse the yield curve for Australian Treasury bonds. a) Using the data in the following table, calculate (based on expectation hypothesis only) the "five-year spot rate' and 'one-year forward rate four years from now' assuming annual compounding (fill in the spaces in the table below). Assume that notes of all maturities, including coupon-paying five-year note are currently trading at par of $1,000. Show calculations (20 marks). Australian Treasury notes yield curve data Coupon-paying Yield to Maturity Notes' Maturities Calculated Calculated Spot Rates Forward Rates (Years to maturity) 1 5.00 5, 5.00 5.00 2 5.20 S 5.21 fa 5.42 3 4 6.00 S; 6.05 2f3 7.75 6.50 SA 6.60 34 8.27 5 7.00 S Afs b) You are considering the purchase of a zero coupon Treasury note with four years to maturity and a face value of $1,000. Based on the preceding yield curve analysis, calculate both the expected yield to maturity and the price of the security (assuming annual compounding) of such a bond. Show calculations (5 marks). Australian Treasuries represent a significant holding in Graham's pension portfolio. You decide to analyse the yield curve for Australian Treasury bonds. a) Using the data in the following table, calculate (based on expectation hypothesis only) the "five-year spot rate' and 'one-year forward rate four years from now' assuming annual compounding (fill in the spaces in the table below). Assume that notes of all maturities, including coupon-paying five-year note are currently trading at par of $1,000. Show calculations (20 marks). Australian Treasury notes yield curve data Coupon-paying Yield to Maturity Notes' Maturities Calculated Calculated Spot Rates Forward Rates (Years to maturity) 1 5.00 5, 5.00 5.00 2 5.20 S 5.21 fa 5.42 3 4 6.00 S; 6.05 2f3 7.75 6.50 SA 6.60 34 8.27 5 7.00 S Afs b) You are considering the purchase of a zero coupon Treasury note with four years to maturity and a face value of $1,000. Based on the preceding yield curve analysis, calculate both the expected yield to maturity and the price of the security (assuming annual compounding) of such a bond. Show calculations