Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Automobile manufacturers and dealers use a variety of marketing devices to sell cars. Among these are rebates and low-cost dealer-arranged financing packages. To determine

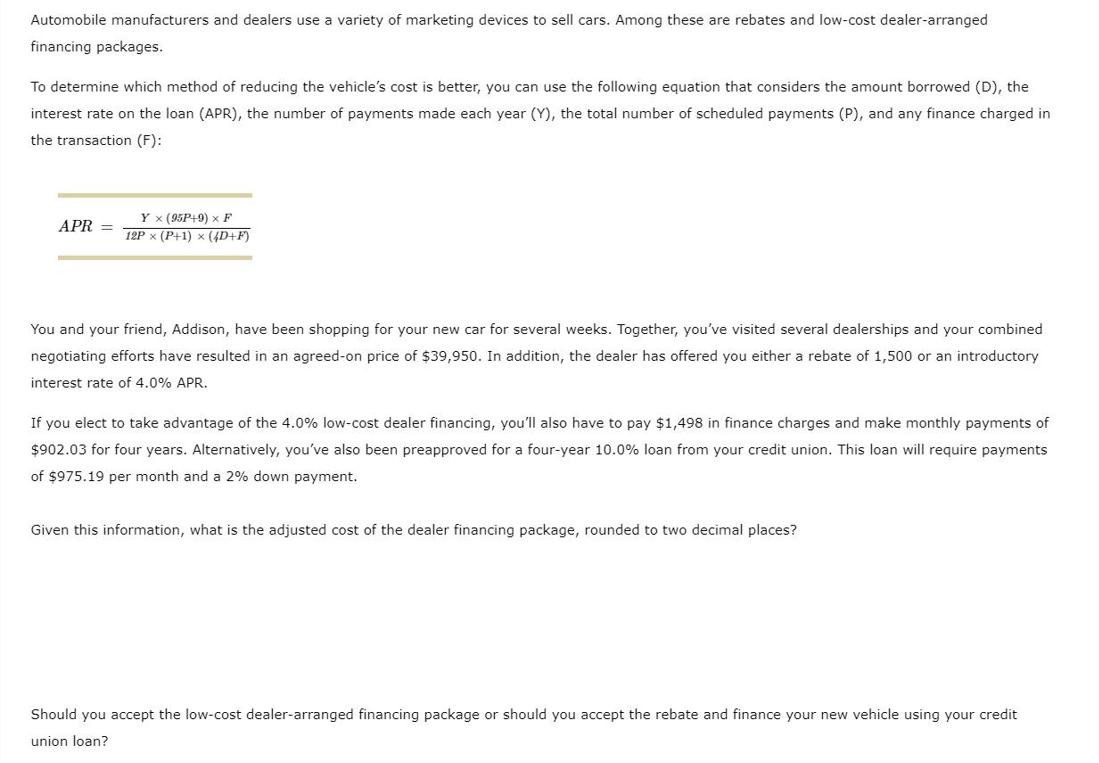

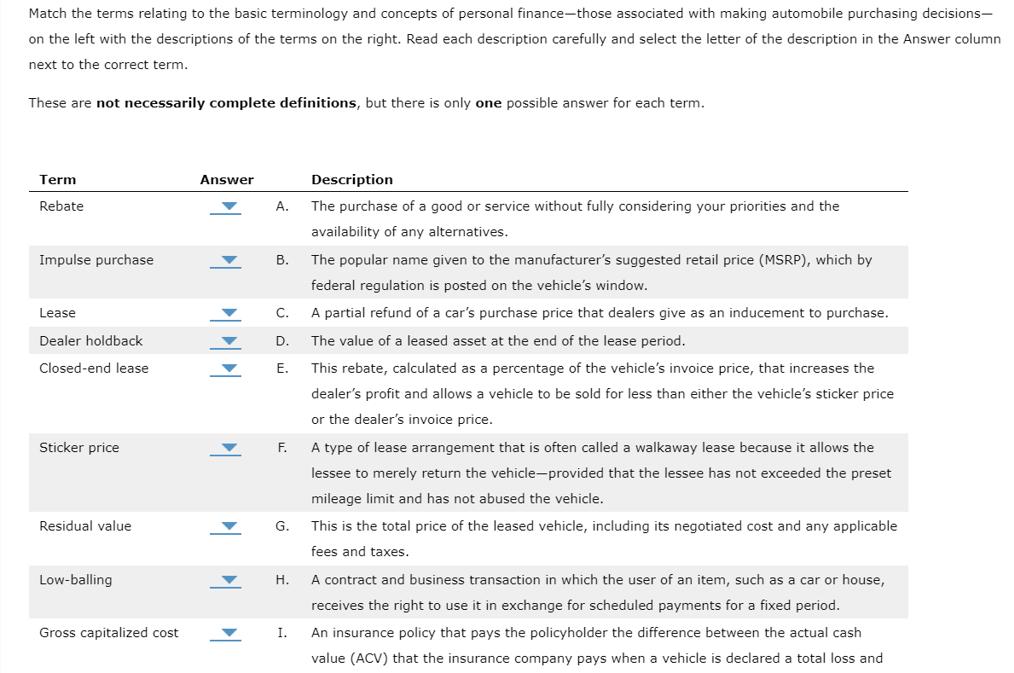

Automobile manufacturers and dealers use a variety of marketing devices to sell cars. Among these are rebates and low-cost dealer-arranged financing packages. To determine which method of reducing the vehicle's cost is better, you can use the following equation that considers the amount borrowed (D), the interest rate on the loan (APR), the number of payments made each year (Y), the total number of scheduled payments (P), and any finance charged in the transaction (F): Yx (95P+9) x F APR = 12P (P+1) (4D+F) You and your friend, Addison, have been shopping for your new car for several weeks. Together, you've visited several dealerships and your combined negotiating efforts have resulted in an agreed-on price of $39,950. In addition, the dealer has offered you either a rebate of 1,500 or an introductory interest rate of 4.0% APR. If you elect to take advantage of the 4.0% low-cost dealer financing, you'll also have to pay $1,498 in finance charges and make monthly payments of $902.03 for four years. Alternatively, you've also been preapproved for a four-year 10.0% loan from your credit union. This loan will require payments of $975.19 per month and a 2% down payment. Given this information, what is the adjusted cost of the dealer financing package, rounded to two decimal places? Should you accept the low-cost dealer-arranged financing package or should you accept the rebate and finance your new vehicle using your credit union loan? Match the terms relating to the basic terminology and concepts of personal finance-those associated with making automobile purchasing decisions- on the left with the descriptions of the terms on the right. Read each description carefully and select the letter of the description in the Answer column next to the correct term. These are not necessarily complete definitions, but there is only one possible answer for each term. Term Rebate Answer Description A. The purchase of a good or service without fully considering your priorities and the availability of any alternatives. Impulse purchase B. The popular name given to the manufacturer's suggested retail price (MSRP), which by federal regulation is posted on the vehicle's window. Lease C. Dealer holdback D. A partial refund of a car's purchase price that dealers give as an inducement to purchase. The value of a leased asset at the end of the lease period. Closed-end lease E. Sticker price F. Residual value Low-balling This rebate, calculated as a percentage of the vehicle's invoice price, that increases the dealer's profit and allows a vehicle to be sold for less than either the vehicle's sticker price or the dealer's invoice price. A type of lease arrangement that is often called a walkaway lease because it allows the lessee to merely return the vehicle-provided that the lessee has not exceeded the preset mileage limit and has not abused the vehicle. G. This is the total price of the leased vehicle, including its negotiated cost and any applicable fees and taxes. H. A contract and business transaction in which the user of an item, such as a car or house, receives the right to use it in exchange for scheduled payments for a fixed period. An insurance policy that pays the policyholder the difference between the actual cash value (ACV) that the insurance company pays when a vehicle is declared a total loss and Gross capitalized cost I.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the adjusted cost of the dealer financing package we need to calculate the total cost o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663db9ea15328_962964.pdf

180 KBs PDF File

663db9ea15328_962964.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started