Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are planning to retire in 40 years (t = 40). After retirement, you need annual withdrawals of $900 from your retirement account for

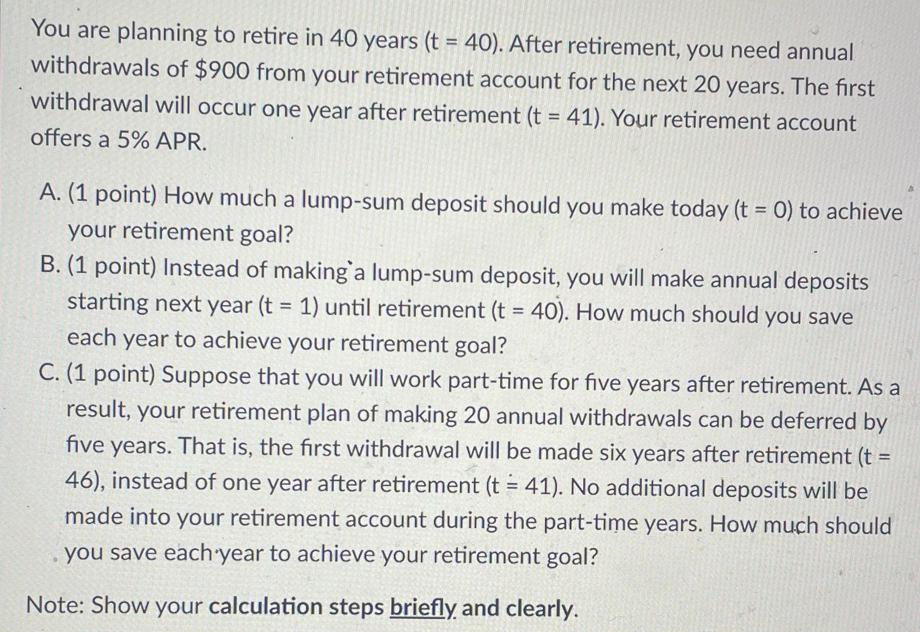

You are planning to retire in 40 years (t = 40). After retirement, you need annual withdrawals of $900 from your retirement account for the next 20 years. The first withdrawal will occur one year after retirement (t = 41). Your retirement account offers a 5% APR. A. (1 point) How much a lump-sum deposit should you make today (t = 0) to achieve your retirement goal? B. (1 point) Instead of making a lump-sum deposit, you will make annual deposits starting next year (t = 1) until retirement (t = 40). How much should you save each year to achieve your retirement goal? C. (1 point) Suppose that you will work part-time for five years after retirement. As a result, your retirement plan of making 20 annual withdrawals can be deferred by five years. That is, the first withdrawal will be made six years after retirement (t = 46), instead of one year after retirement (t = 41). No additional deposits will be made into your retirement account during the part-time years. How much should you save each year to achieve your retirement goal? Note: Show your calculation steps briefly and clearly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A To calculate the lumpsum deposit you should make today t 0 to achieve your retirement goal you can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663db9f680ea8_962963.pdf

180 KBs PDF File

663db9f680ea8_962963.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started