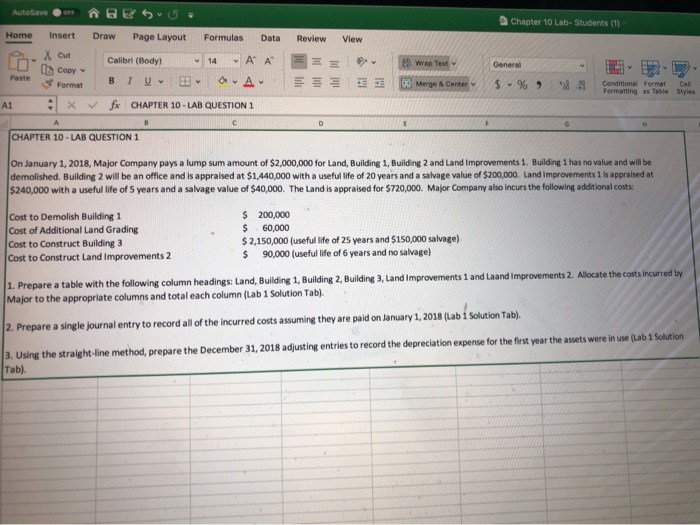

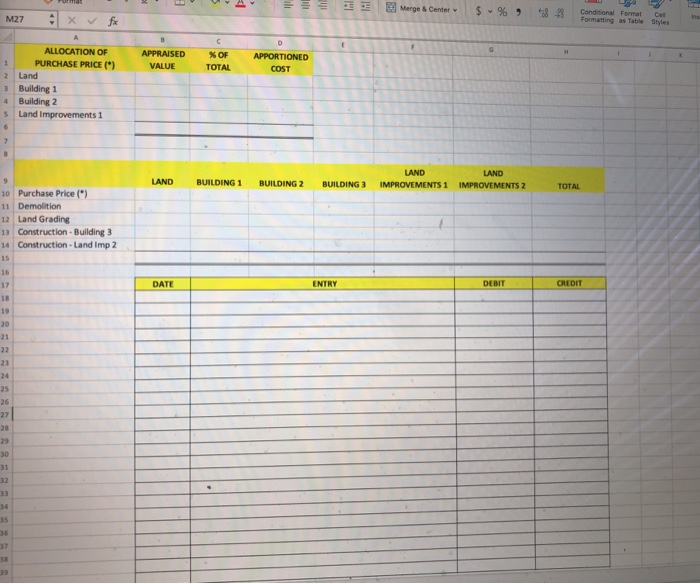

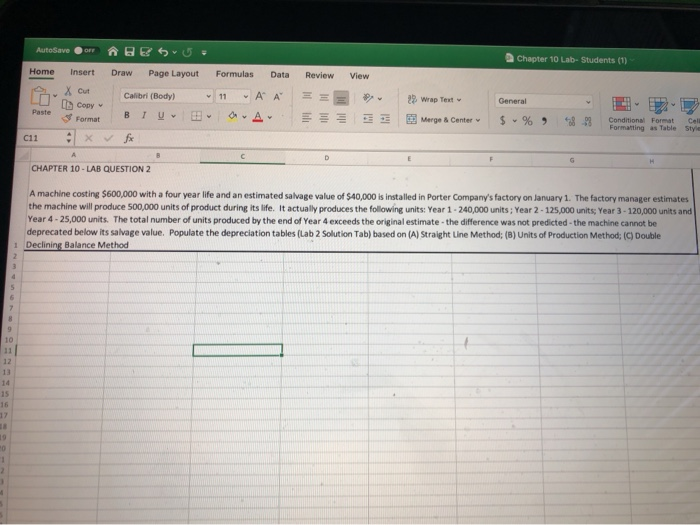

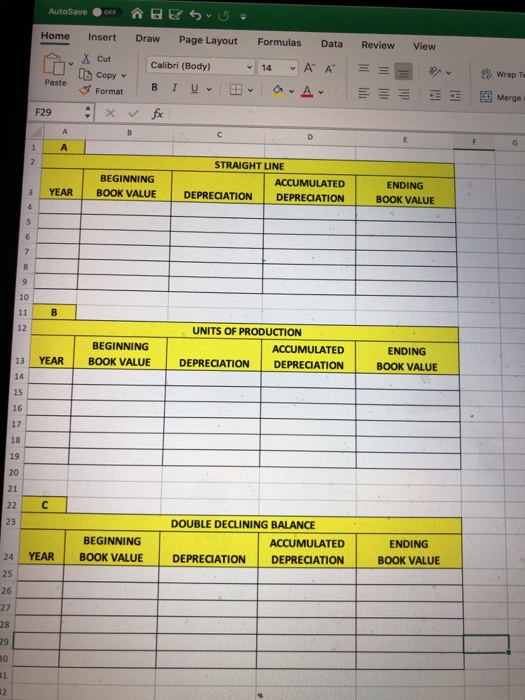

Autosave a n H 2 5 v 0 = Page Layout Chapter 10 Lab-Students (1) Home Draw Formulas Data Review View Insert X Cut Calibri (Body) 14 A A = = = U 29 Wrap Text Copy Paste General $ v % 9 % , B T U EE E 3 00 Merge & Center Center 823 99 Format x Conditional Format Formatting as Table Cell Styles A1 fx CHAPTER 10 - LAB QUESTION 1 CHAPTER 10 - LAB QUESTION 1 On January 1, 2018, Major Company pays a lump sum amount of $2,000,000 for Land, Building 1, Building 2 and Land improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $1,440,000 with a useful life of 20 years and a salvage value of $200,000. Land improvements 1 is appraisedat $240,000 with a useful life of 5 years and a salvage value of $40,000. The Land is appraised for $720,000. Major Company also incurs the following additional costs Cost to Demolish Building 1 Cost of Additional Land Grading Cost to Construct Building 3 Cost to Construct Land Improvements 2 $ 200,000 $ 60,000 $ 2,150,000 (useful life of 25 years and $150,000 salvage) $ 90,000 (useful life of 6 years and no salvage) 1. Prepare a table with the following column headings: Land, Building 1, Building 2, Building 3, Land improvements 1 and Laand improvements 2. Allocate the costs incurred by Major to the appropriate columns and total each column (Lab 1 Solution Tab). 12. Prepare a single journal entry to record all of the incurred costs assuming they are paid on January 1, 2018 (Lab 1 Solution Tab). 13. Using the straight-line method, prepare the December 31, 2018 adjusting entries to record the depreciation expense for the first year the assets were in use Lab 1 Solution ). M27 x 3 fx M erge Center $ % 9 Conditional Format ALLOCATION OF PURCHASE PRICE") APPRAISED VALUE OF TOTAL APPORTIONED COST Land Building 1 Building 2 Land improvements 1 LAND BUILDING 1 BUILDING 2 BUILDING) LAND LAND IMPROVEMENTS 1 IMPROVEMENTS 2 10 Purchase Price (") 11 Demolition 12 Land Grading Construction - Building 3 Construction - Land Imp 2 - DATE - - AutoSaver BEJ Chapter 10 Lab- Students (1) Home Insert Draw Page Layout Formulas Data Review View out Copy Calibr (Body 11 A A = = 23 Wrap Text General $ % 9 Merge & Center 2 3 c11X fx CHAPTER 10 - LAB QUESTION 2 A machine costing $600,000 with a four year life and an estimated salvage value of $40,000 is installed in Porter Company's factory on January 1. The factory manager estimates the machine will produce 500,000 units of product during its life. It actually produces the following units: Year 1.240,000 units Year 2.125,000 units Year 3-120,000 units and Year 4 - 25,000 units. The total number of units produced by the end of Year 4 exceeds the original estimate the difference was not predicted the machine cannot be deprecated below its salvage value. Populate the depreciation tables (Lab 2 Solution Tab) based on (A) Straight Line Method; () Units of Production Method; (C) Double Declining Balance Method AutoSave BESH = Home View Data A U Paste Formulas 14 A A Insert Draw Page Layout X Cut Calibri (Body) Format BTU x v fx Review = E ( Copy 29 Wrap Merge E F29 BEGINNING BOOK VALUE STRAIGHT LINE ACCUMULATED DEPRECIATION DEPRECIATION YEAR ENDING BOOK VALUE UNITS OF PRODUCTION ACCUMULATED DEPRECIATION DEPRECIATION BEGINNING BOOK VALUE ENDING ENDING BOOK VALUE YEAR BEGINNING YEARBOOK VALUE DOUBLE DECLINING BALANCE ACCUMULATED DEPRECIATION DEPRECIATION ENDING BOOK VALUE