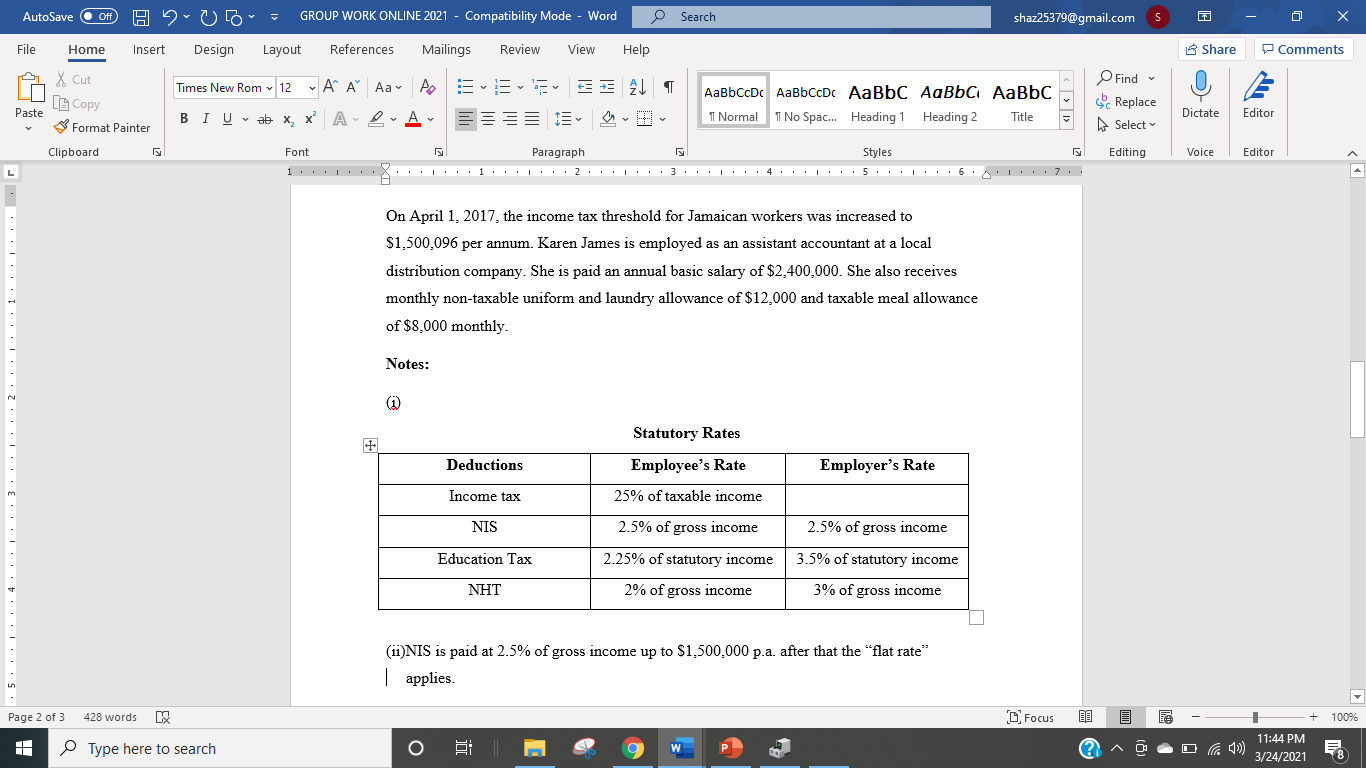

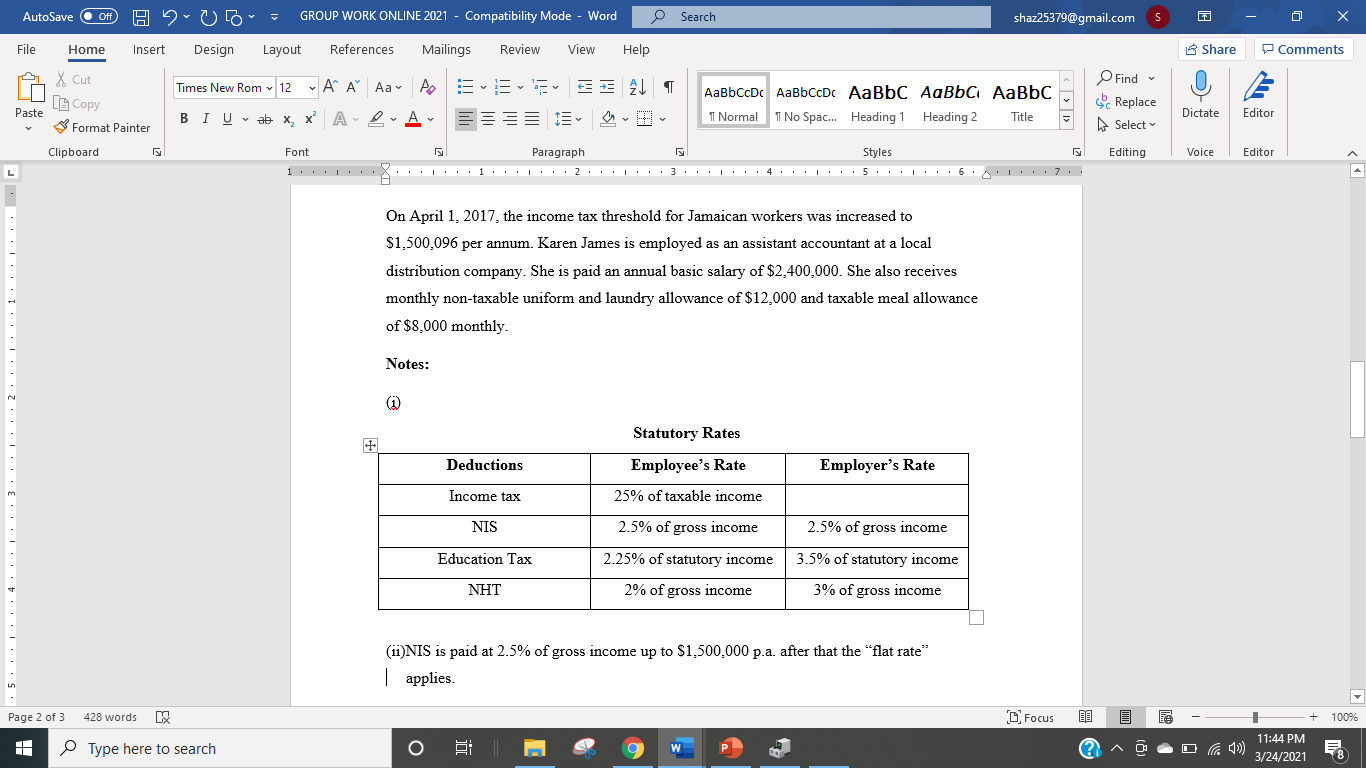

AutoSave Off GROUP WORK ONLINE 2021 - Compatibility Mode - Word Search shaz25379@gmail.com S 7 File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut Times New Rom 12 AA Aa to E = +91 AaBbCcDc AaBbCcDc AaBbc AaBbc AaBbc 1 Normal 1 No Spac... Heading 1 Heading 2 Title La Copy * Format Painter Find c Replace Select Paste BIU ab X, X A LA Dictate Editor Clipboard Font Editing Voice Editor Paragraph Styles iii...1....2............4......5....6: III.7., 1. On April 1, 2017, the income tax threshold for Jamaican workers was increased to $1,500,096 per annum. Karen James is employed as an assistant accountant at a local distribution company. She is paid an annual basic salary of $2,400,000. She also receives monthly non-taxable uniform and laundry allowance of $12,000 and taxable meal allowance of $8,000 monthly Notes: (1) 5iiiiiii4iiiiiii3iiiiiii2.irl.i.li..l... .r Statutory Rates Deductions Employee's Rate Employer's Rate Income tax 25% of taxable income NIS 2.5% of gross income 2.5% of gross income Education Tax 2.25% of statutory income 3.5% of statutory income NHT 2% of gross income 3% of gross income (11)NIS is paid at 2.5% of gross income up to $1,500,000 p.a. after that the "flat rate" | applies. Page 2 of 3 428 words C Focus 100% Type here to search 11:44 PM 3/24/2021 AutoSave Off GROUP WORK ONLINE 2021 - Compatibility Mode - Word Search shaz25379@gmail.com S 7 File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut Times New Rom 12 AA Aa to == = UT AaBbCcDc AaBbCcDc AaBbc AaBbc AaBbc 1 Normal 1 No Spac... Heading 1 Heading 2 Title La Copy & Format Painter Find c Replace Select Paste BI U ab X, X A LA T=y Dictate Editor Clipboard Editing Voice Editor Font Paragraph Styles l'''''''''''''lllllll'2'''''''''.4''''''''''''6',''''''.. (11)NIS is paid at 2.5% of gross income up to $1,500,000 p.a. after that the "flat rate" applies. (111) The following personal deductions are made from Karen James' salary: Credit union $5,400 weekly: insurance $96.000 annually; and car loan of $20,000 monthly. (iv)The company operates a pension scheme to which Karen James makes a contribution of 5% of her basic salary. ...9...1...3...1...7.,11...6...1...5...1.. (v) For the month of April 2017. it is expected that Karen will earn overtime pay amounting to $24,000 Required: (a) Karen James net pay for the month of April 2017 (b) Prepare a summary that shows Karen's statutory deductions for April 2017. (c) Prepare a summary that shows the employer's statutory contributions for April 2017. Page 2 of 3 428 words C Focus 100% Type here to search 11:44 PM 3/24/2021 AutoSave Off GROUP WORK ONLINE 2021 - Compatibility Mode - Word Search shaz25379@gmail.com S 7 File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut Times New Rom 12 AA Aa to E = +91 AaBbCcDc AaBbCcDc AaBbc AaBbc AaBbc 1 Normal 1 No Spac... Heading 1 Heading 2 Title La Copy * Format Painter Find c Replace Select Paste BIU ab X, X A LA Dictate Editor Clipboard Font Editing Voice Editor Paragraph Styles iii...1....2............4......5....6: III.7., 1. On April 1, 2017, the income tax threshold for Jamaican workers was increased to $1,500,096 per annum. Karen James is employed as an assistant accountant at a local distribution company. She is paid an annual basic salary of $2,400,000. She also receives monthly non-taxable uniform and laundry allowance of $12,000 and taxable meal allowance of $8,000 monthly Notes: (1) 5iiiiiii4iiiiiii3iiiiiii2.irl.i.li..l... .r Statutory Rates Deductions Employee's Rate Employer's Rate Income tax 25% of taxable income NIS 2.5% of gross income 2.5% of gross income Education Tax 2.25% of statutory income 3.5% of statutory income NHT 2% of gross income 3% of gross income (11)NIS is paid at 2.5% of gross income up to $1,500,000 p.a. after that the "flat rate" | applies. Page 2 of 3 428 words C Focus 100% Type here to search 11:44 PM 3/24/2021 AutoSave Off GROUP WORK ONLINE 2021 - Compatibility Mode - Word Search shaz25379@gmail.com S 7 File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut Times New Rom 12 AA Aa to == = UT AaBbCcDc AaBbCcDc AaBbc AaBbc AaBbc 1 Normal 1 No Spac... Heading 1 Heading 2 Title La Copy & Format Painter Find c Replace Select Paste BI U ab X, X A LA T=y Dictate Editor Clipboard Editing Voice Editor Font Paragraph Styles l'''''''''''''lllllll'2'''''''''.4''''''''''''6',''''''.. (11)NIS is paid at 2.5% of gross income up to $1,500,000 p.a. after that the "flat rate" applies. (111) The following personal deductions are made from Karen James' salary: Credit union $5,400 weekly: insurance $96.000 annually; and car loan of $20,000 monthly. (iv)The company operates a pension scheme to which Karen James makes a contribution of 5% of her basic salary. ...9...1...3...1...7.,11...6...1...5...1.. (v) For the month of April 2017. it is expected that Karen will earn overtime pay amounting to $24,000 Required: (a) Karen James net pay for the month of April 2017 (b) Prepare a summary that shows Karen's statutory deductions for April 2017. (c) Prepare a summary that shows the employer's statutory contributions for April 2017. Page 2 of 3 428 words C Focus 100% Type here to search 11:44 PM 3/24/2021