Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AutoSave Ott Data Review View Help Formulas File Home Insert Page Layout General Out Calibri 10 He Copy JA AE23 Wrap Text 3 Merge &

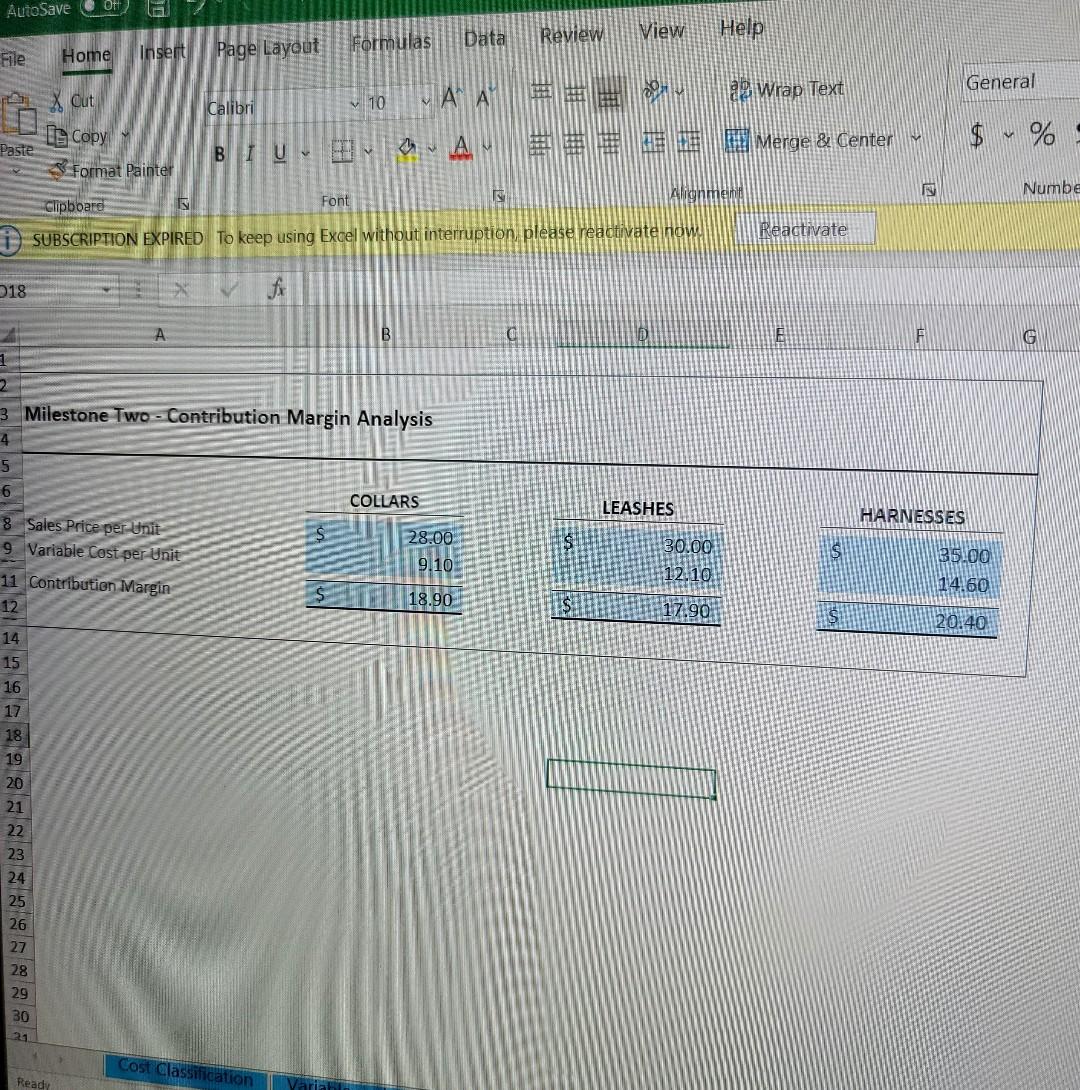

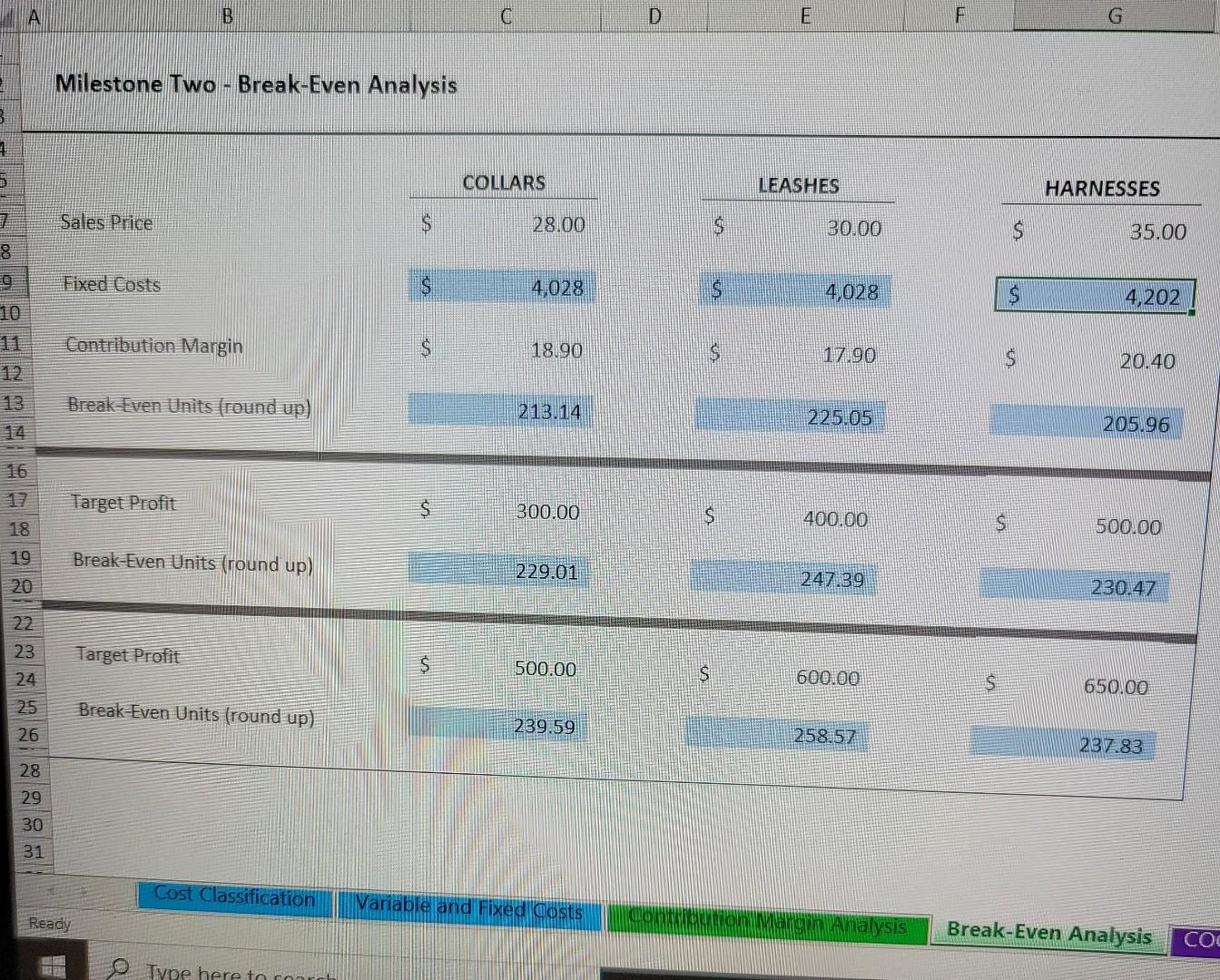

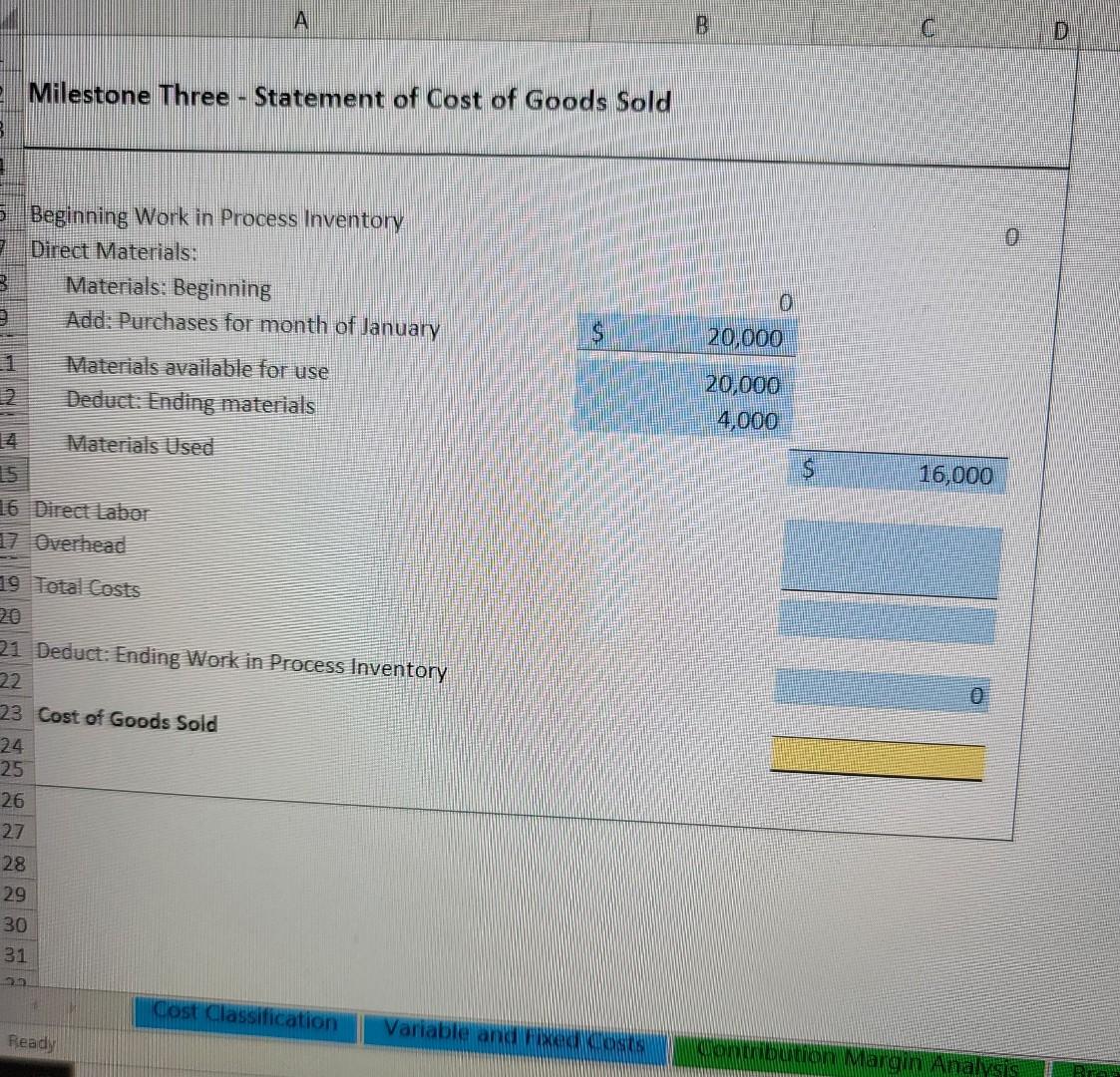

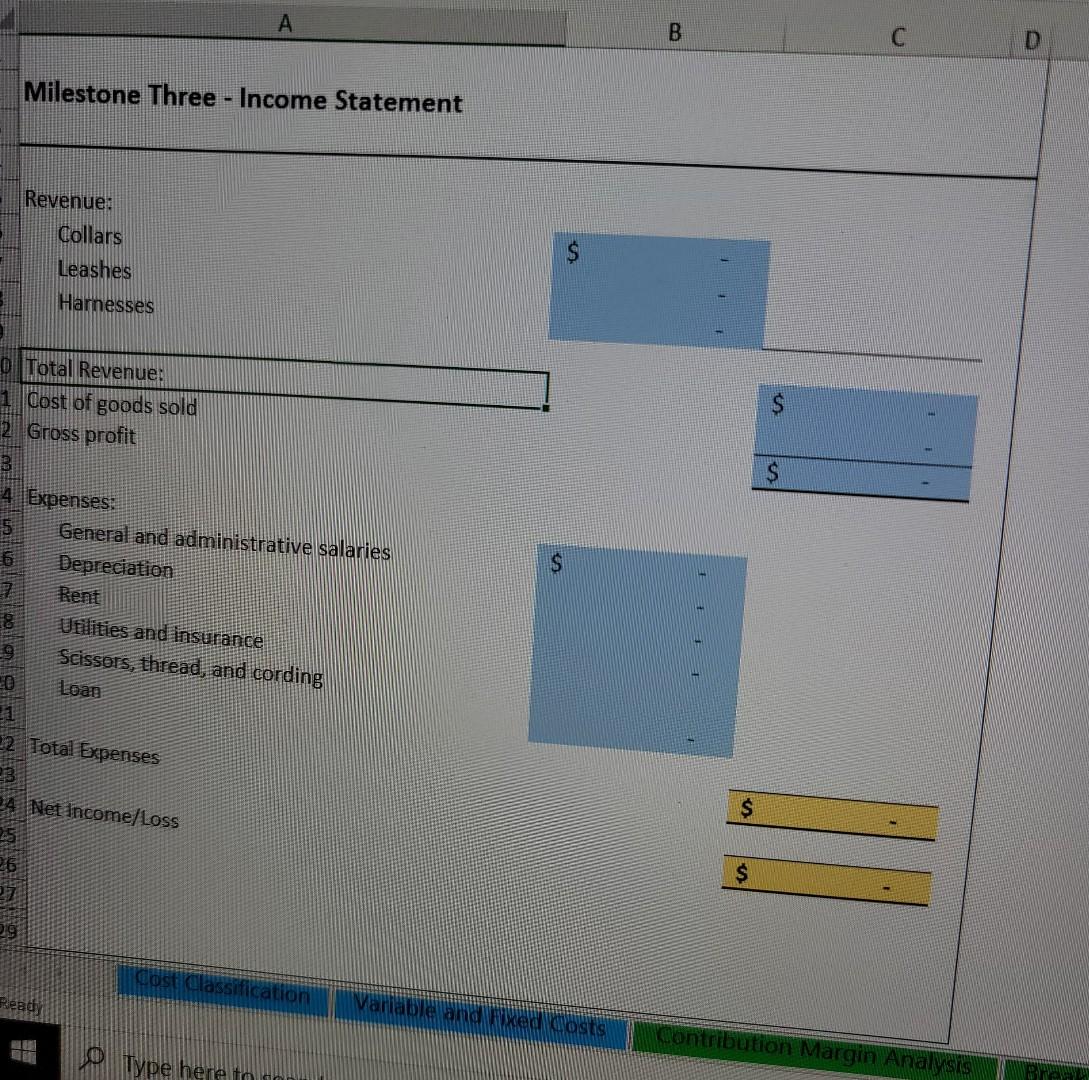

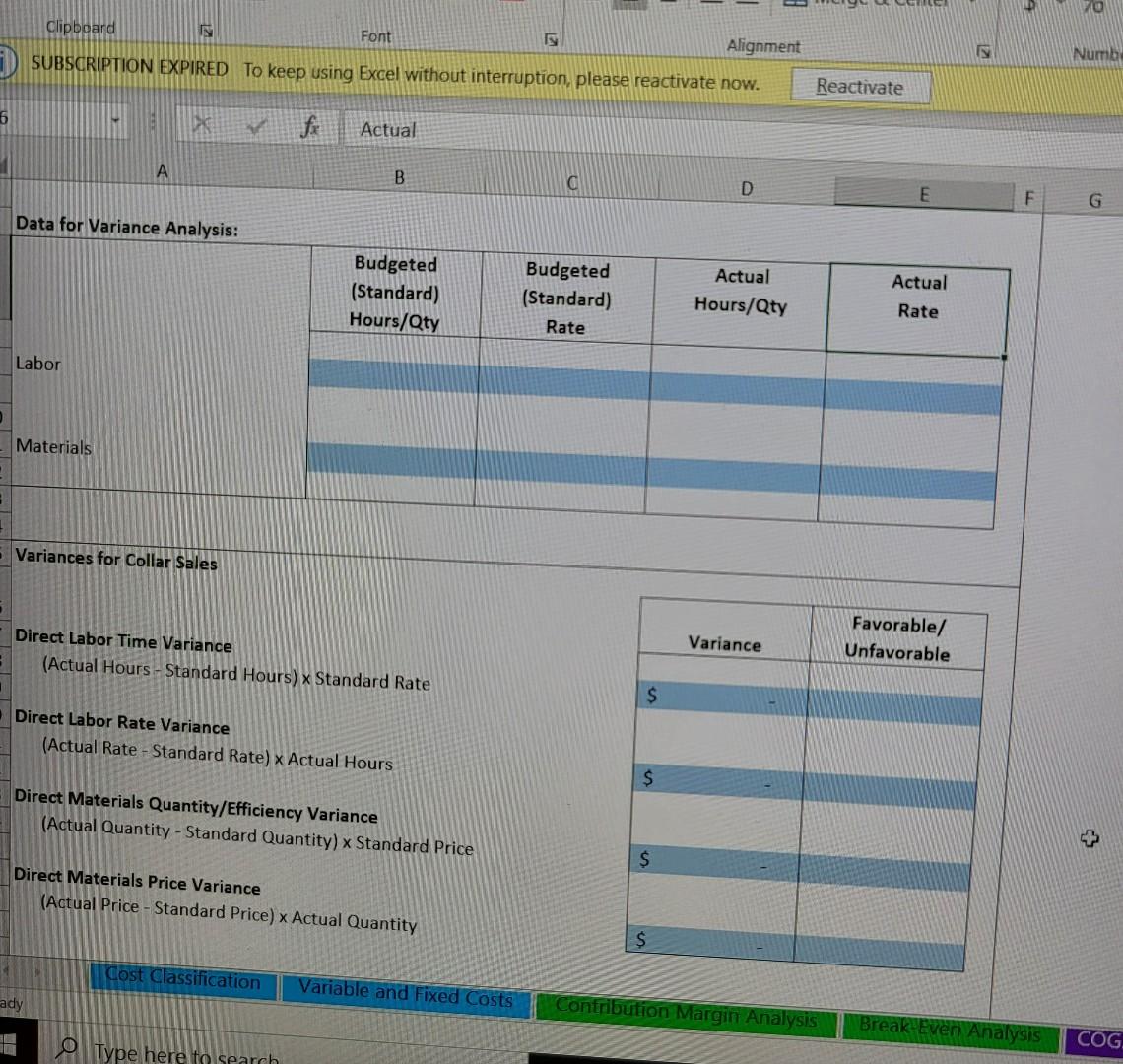

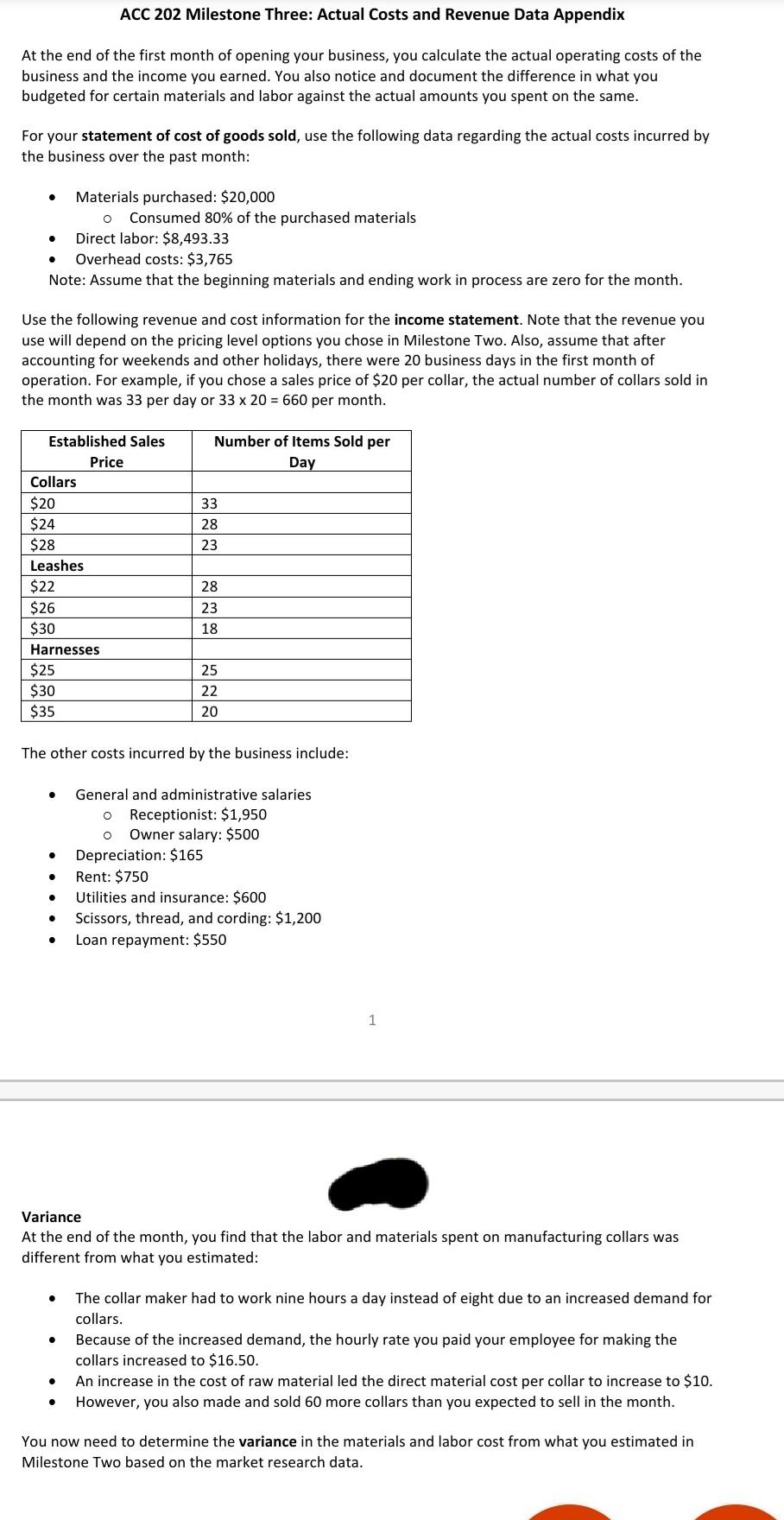

AutoSave Ott Data Review View Help Formulas File Home Insert Page Layout General Out Calibri 10 He Copy JA AE23 Wrap Text 3 Merge & Center $ - % Paste BIU & Format Painter Numbe Font IN Alignment clipboard Reactivate SUBSCRIPTION EXPIRED To keep using Excel without interruption please readtivate nown 18 fx . B F G 1 2 3 Milestone Two - Contribution Margin Analysis 4 5 6 COLLARS LEASHES HARNESSES 8 Sales Price per Unit 9 Variable Cost per Unit 28.00 9.10 30.00 12.10. 35.00 114.60 11 Contribution Margin 18.90 12 SI 17.90 $ 20.40 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 21 Cost Classification Ready B D F G Milestone Two - Break-Even Analysis 5 COLLARS LEASHES HARNESSES 7 Sales Price S 28.00 $ 30.00 35.00 8 Fixed Costs 4,028 4,028 S 4,202 10 Contribution Margin 18.90 17.90 20.40 Break Even Units (round up) 213.14 225.05. 205196 Target Profit 300.00 $ 400.00 18 500.00 Break-Even Units (round up) 19 20 229.01 247.39 230.47 23 Target Profit 500.00 24 S 600.00 s 650.00 25 Break-Even Units (round up) 239.59 26 258.57 237.83 28 29 30 31 Cost Classification Variable and Fixed Costs Ready antolon mangin Analysis Break-Even Analysis COI Type here to coarch A B D Milestone Three - Statement of Cost of Goods Sold 5 Beginning Work in Process Inventory 7 Direct Materials: 3 Materials: Beginning 3 Add: Purchases for month of January Materials available for use Deduct: Ending materials O S 20,000 20,000 4,000 S 16,000 Materials Used 15 16 Direct Labor 17 Overhead 19 Total Costs 21 Deduct: Ending Work in Process Inventory 22 23 Cost of Goods Sold 24 25 26 27 28 29 30 31 29 Cost Classification Variable and SSS Ready bution Margir Analysis B C Milestone Three - Income Statement Revenue: Collars Leashes Harnesses $ 5 0 Total Revenue: 1 Cost of goods sold 2 Gross profit B 4 Expenses General and administrative salaries Depreciation 7 Rent 8 Ufilities and insurance Scissors, thread, and cording Loan S 2 22 Total Expenses 24 Net Income/Loss $ $ costklassification Ready Variable and mixed costs Kontribution Margin Analysis o Type here to Bp N Font Clipboard Alignment SUBSCRIPTION EXPIRED To keep using Excel without interruption, please reactivate now. Numb Reactivate 6 fe Actual A B D E F Data for Variance Analysis: Budgeted (Standard) Hours/Qty Budgeted (Standard) Rate Actual Hours/Qty Actual Rate Labor Materials Variances for Collar Sales Direct Labor Time Variance (Actual Hours - Standard Hours) Standard Rate Variance Favorable/ Unfavorable S Direct Labor Rate Variance (Actual Rate - Standard Rate) Actual Hours $ Direct Materials Quantity/Efficiency Variance (Actual Quantity - Standard Quantity) Standard Price 52 S Direct Materials Price Variance (Actual Price - Standard Price) Actual Quantity Cost Classification Variable and Fixed Costs ady Contribution Margin Analysis Break Even Analysis COG. o Type here to search ACC 202 Milestone Three: Actual Costs and Revenue Data Appendix At the end of the first month of opening your business, you calculate the actual operating costs of the business and the income you earned. You also notice and document the difference in what you budgeted for certain materials and labor against the actual amounts you spent on the same. For your statement of cost of goods sold, use the following data regarding the actual costs incurred by the business over the past month: O Materials purchased: $20,000 Consumed 80% of the purchased materials Direct labor: $8,493.33 Overhead costs: $3,765 Note: Assume that the beginning materials and ending work in process are zero for the month. Use the following revenue and cost information for the income statement. Note that the revenue you use will depend on the pricing level options you chose in Milestone Two. Also, assume that after accounting for weekends and other holidays, there were 20 business days in the first month of operation. For example, if you chose a sales price of $20 per collar, the actual number of collars sold in the month was 33 per day or 33 x 20 = 660 per month. Number of Items Sold per Day 33 28 23 Established Sales Price Collars $20 $24 $28 Leashes $22 $26 $30 Harnesses $25 $30 $35 28 23 18 25 22 20 The other costs incurred by the business include: O . General and administrative salaries o Receptionist: $1,950 Owner salary: $500 Depreciation: $165 Rent: $750 Utilities and insurance: $600 Scissors, thread, and cording: $1,200 Loan repayment: $550 . . . . 1 Variance At the end of the month, you find that the labor and materials spent on manufacturing collars was different from what you estimated: . The collar maker had to work nine hours a day instead of eight due to an increased demand for collars. Because of the increased demand, the hourly rate you paid your employee for making the collars increased to $16.50. An increase in the cost of raw material led the direct material cost per collar to increase to $10. However, you also made and sold 60 more collars than you expected to sell in the month. . You now need to determine the variance in the materials and labor cost from what you estimated in Milestone Two based on the market research data

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started