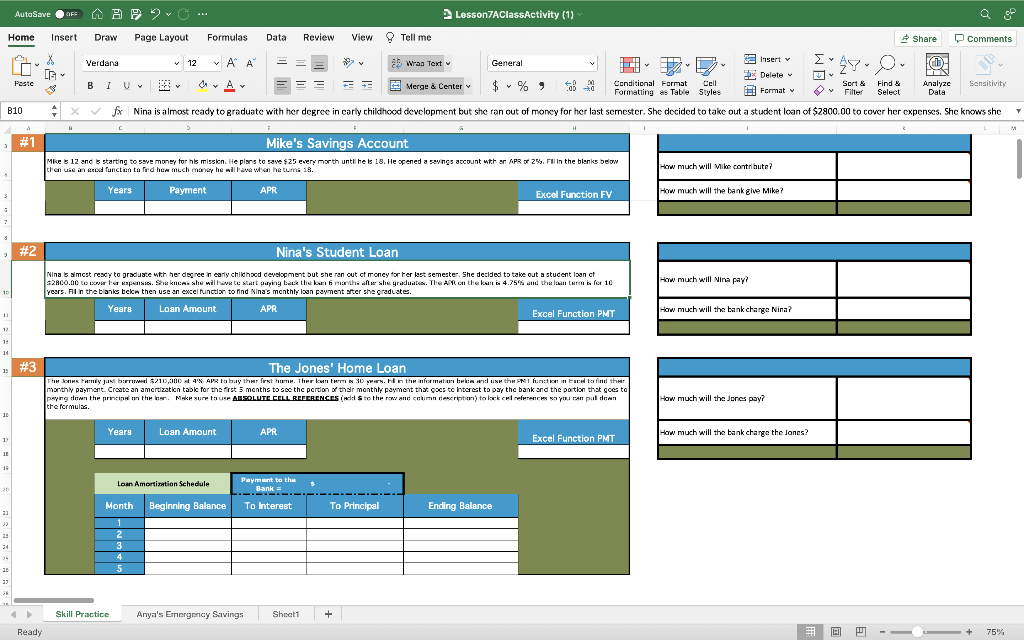

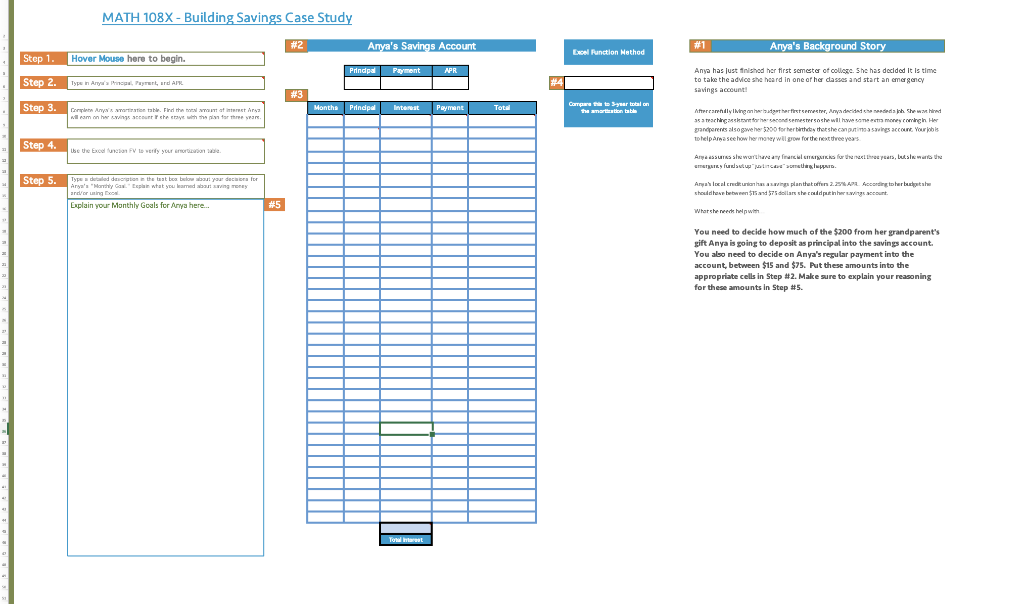

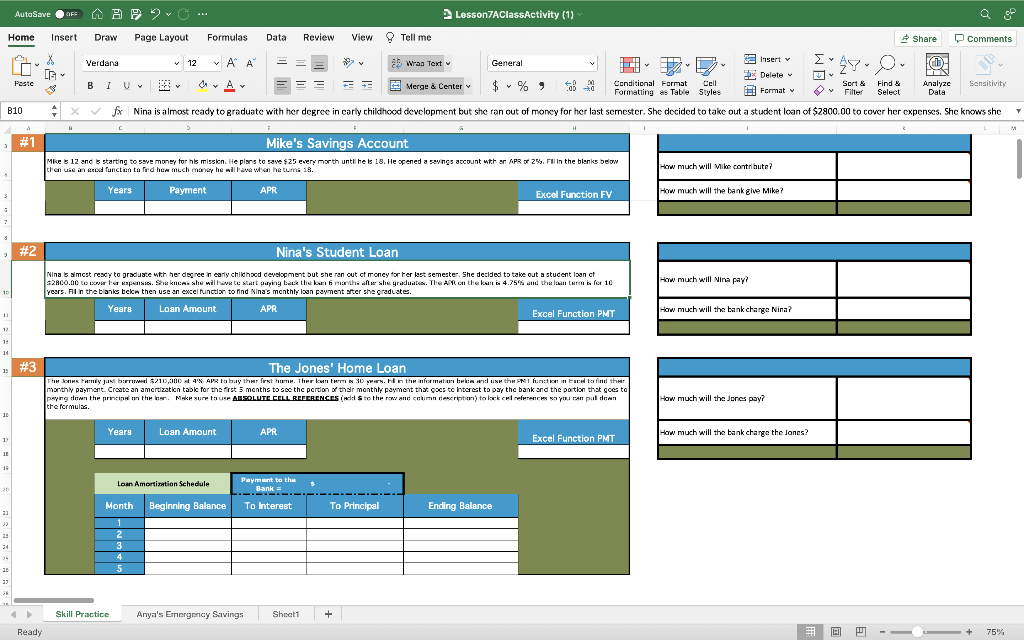

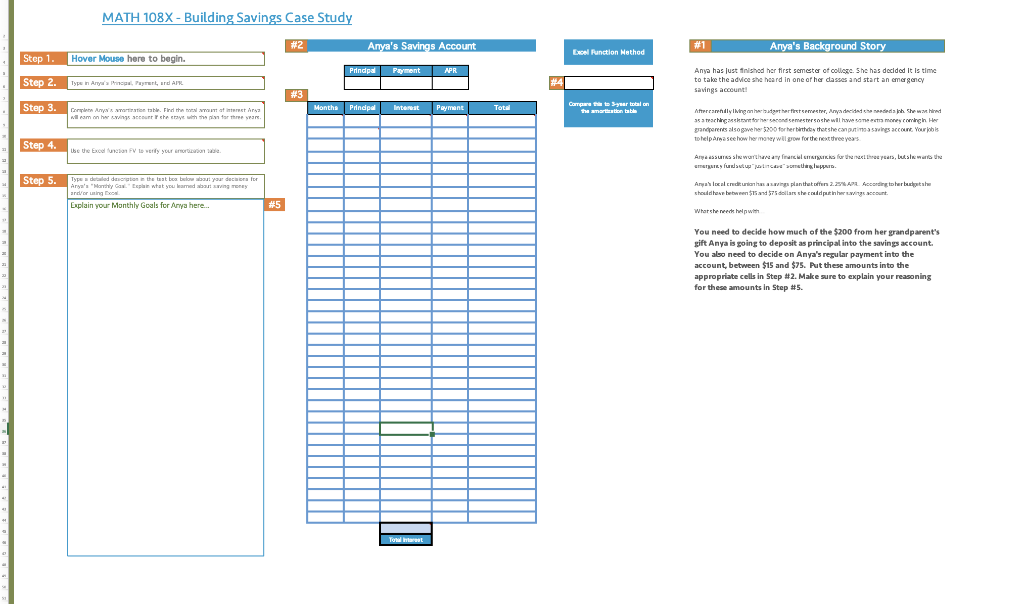

AutoSave Pvc ... OF Lesson/AClassActivity (1) Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X [G Y Paste Verdana v 12 ~ A ab Wran Text Insert v General v x Delete BIU A : - Merge & Center $ - %, SB Conditional Format Cell Sort & Find & Analyzc Sensitivity Formatting as Table Styles Format Filter Select Data fx Nina is almost ready to graduate with her degree in carly childhood development but she ran out of money for her last semester. She decided to take out a student loan of $2800.00 to cover her expenses. She knows she B10 A M #1 3 Mike's Savings Account Mke s 12 and starting to save money for his mission. He plans to save $25 every morth until he is 18. He opened a swings account with an APR or 29. Fill in the blanks below then use an and function to fed how much mand he will l'avewa hatua 18. How much will Mike contribute? Years Payment APR 5 How much will the bank ale Mike? Excel Function FV G 7 3 #2 Nina's Student Loan 2 How much will Nina pay 15 Ninas almost recy to graduate with her degree in early childhocd cevelopment but she ran out of money for her last semester. She decided to take out a student loan ct S2800.00 to response. She kneeshe will have to start paying at the animanthe after she graduates. The Art on the sun 4.75% and the len term for 10 Yours. Fill in the banks below then use an excel function to find Nina's monthly loan payment after she graduates. Years Loan Amount APR Excel Function PMT How much will the bank change Nina? 11 12 19 14 13 #3 The Jones' Home Loan Thones Funny just barried $210,000 4' APR to buy the fret ETIH. Therkum 30. Hin the informationen du th NT functions to find that monthly payment. Create an amortization table for the first 5 months to see the portion of their monthly payment that goes to interest to pay the bank and the portion that goes to paying down the princinthe. Make sure to use ABSOLUTE CELL REFERENCES (dd to the row and column description) to look cel references so you can pul dan the formula How much will the Jones pay? ? 15 Years Loan Amount APR 13 How much will the bank change the danes? Excel Function PMT 11 Loan Amortization Schedule 30 Payment to the -.-. Bank To Interest Month Beginning Balance To Principal Ending Balance 21 23 2 3 4 5 36 20 29 Skill Practice Anya's Emergency Savings Sheet1 + Ready S: 75% MATH 108X - Building Savings Case Study #2 Anya's Savings Account #1 Anya's Background Story Excel Runction Method Step 1. Hover Mouse here to begin. Prindpal Payment APR Step 2. Type in Arananlar #4 Anya has just finished her first semester of college. She has decided It is time to take the advice she heard in one of her dasses and start an emergency savings account #3 Step 3. Months Principal Carlo Anya's nation table. Find that interest illam on her wings account the tray with the plan for three years Interest Payment Total Compare to Byar balon The national Mitterrandy living on hersther testsemester, Anya decided the wind 35 teachers are cond semestershe will wesome extra more coming Her grandparents alsogweher 5200 for her birthday that she can putina savings account your jobs to help anna see how hermosey will grow for the next three years Step 4. Ube the Excel function FV la vily your mobile Assurss worth any new TIKS further three years, bulls my fundat comes Step 5. Type duled descrition in the tattoo below but your decision for Arya's "Harry Gal Esplain what you are a swing money andring Explain your Monthly Goals for Anya here.. Aryal swing plantaten 2.2L According to her betale shoulder between $and 575 dollar shephewing #5 Wharshe reciw You need to decide how much of the $200 from her grandparent's gift Anya is going to deposit as principal into the savings account. You abo need to decide on Anya's regular payment into the account between $15 and $75. Put these amounts into the appropriate cells in Step #2. Make sure to explain your reasoning for these amounts in Step #5. Total est