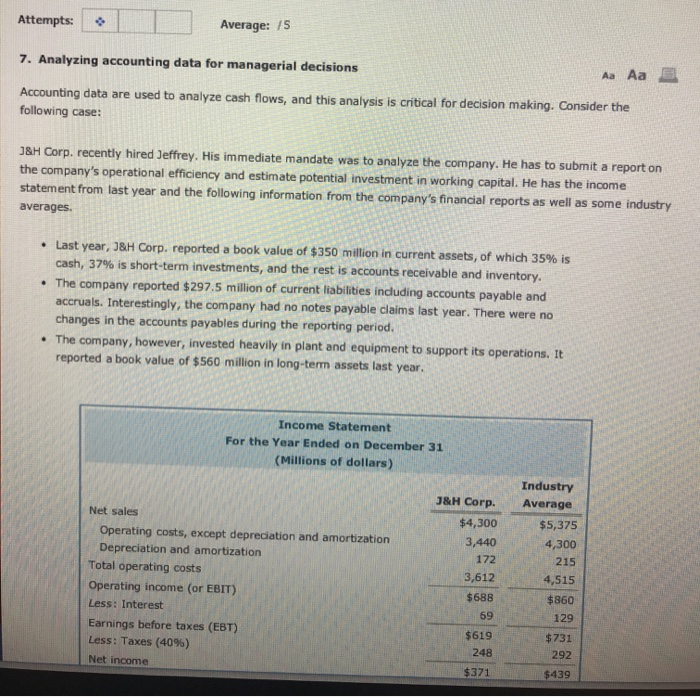

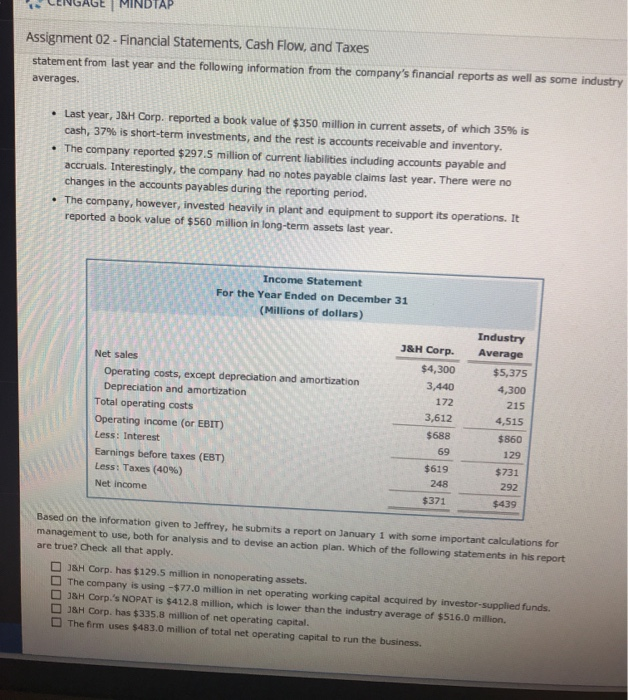

Average: /5 Attempts: 7. Analyzing accounting data for managerial decisions Aa Aa Accounting data following case: are used to analyze cash flows, and this analysis is critical for decision making. Consider the 3&H Corp. recently hired Jeffrey. His immediate mandate was to analyze the company. He has to submit a report on the company's operational efficiency and estimate potential investment in working capital. He has the income statement from last year and the following information from the company's financial reports as well as some industry averages Last year, J&H Corp. reported a book value of $350 million in current assets, of which 35% is cash, 37% is short-term investments, and the rest is accounts receivable and inventory. The company reported $297.5 million of current liabilities including accounts payable and accruals. Interestingly, the company had no notes payable claims last year. There were no changes in the accounts payables during the reporting period. The company, however, invested heavily in plant and equipment to support its operations. It reported a book value of $560 million in long-term assets last year. Income Statement For the Year Ended on December 31 (Millions of dollars) Industry J&H Corp. Average Net sales $4,300 $5,375 Operating costs, except depreciation and amortization 3,440 4,300 Depreciation and amortization 172 215 Total operating costs 3,612 4,515 Operating income (or EBIT) $860 $688 Less: Interest 69 129 Earnings before taxes (EBT) Less: Taxes (40%) $619 $731 248 292 Net income $371 $439 Assignment 02-Financial Statements, Cash Flow, and Taxes statement from last year and the following information from the company's financial reports as well as some industry averages. Last year, J&H Corp. reported a book value of $350 million in current assets, of which 35% is cash, 37% is short-term investments, and the rest is accounts receivable and inventory. The company reported $297.5 million of current liabilities induding accounts payable and accruals. Interestingly, the company had no notes payable claims last year. There were no changes in the accounts payables during the reporting period. The company, however, invested heavily in plant and equipment to support its operations. It reported a book value of $560 million in long-term assets last year. Income Statement For the Year Ended on December 31 (Millions of dollars) Industry 3&H Corp. Average Net sales $4,300 $5,375 Operating costs, except depreciation and amortization Depreciation and amortization Total operating costs 3,440 4,300 172 215 3,612 4,515 Operating income (or EBIT) $688 $860 Less: Interest 69 129 Earnings before taxes (EBT) Less: Taxes (40% ) $619 $731 248 292 Net income $371 $439 Based on the information given to Jeffrey, he submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Which of the following statements in his report are true? Check all that apply. J&H Corp. has $129.5 million in nonoperating assets. The company is using -$77.0 million in net operating working capital acquired by investor-supplied funds. 1&H Corp.'s NOPAT is $412.8 million, which is lower than the industry average of $516.0 million. 18H Corp. has $335.8 million of net operating capital. The firm uses $483.0 million of total net operating capital to run the business