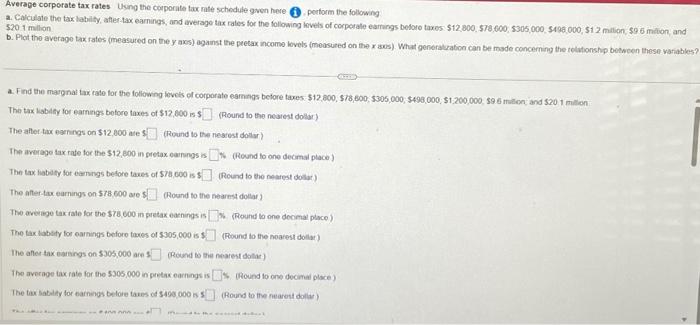

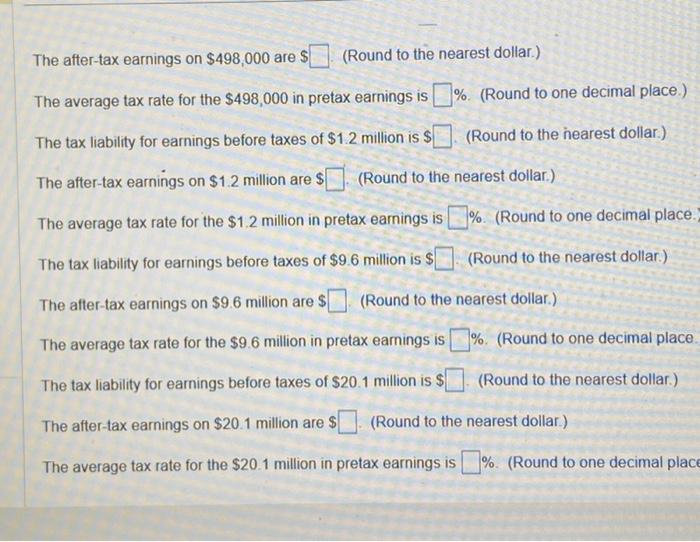

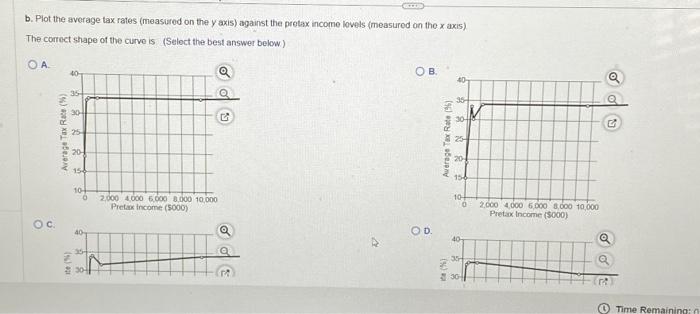

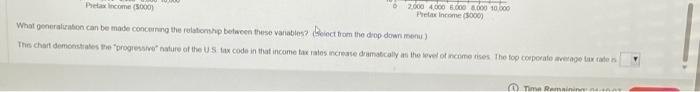

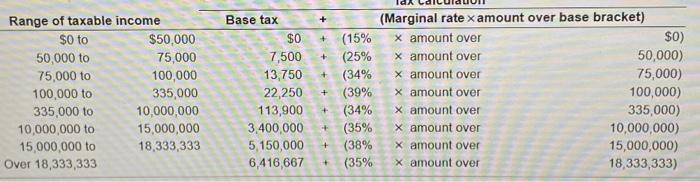

Average corporate tax rates Using the corporate lax rate schedule gven here (i). portorm the following a. Cavculate the tax labilty, ater tax earnings, and average tax rates for the following lovels of corporate eamings besore taxes $12.800,578,600;5305,000,5496,000,512 mallion, $9 is mition, and 5201 million b. Plot the average tax rates (measured on the y axs) aganst the peetax incomo kvels (meosured on the x aes). What generalyation can be made conceming the tolutionshp between these variables? Tha tax labiliy lor earnigs botore laxes of $12,800 is $ (Round to the nourest dollar) The atter tax egenings on $12,000 ate ! (Round is the nearest dollar) The awergge fax rate for the $12,800 in sretax earnngs is (Round to one decmal place) The tax liabity for earnngs belore taues of $7a,000 is 1 (Round to the nearest dollar) The aftertax earnings on 578600 ave (Round to the nearest dolar) The areuge tax rate for the 578,600 in pretax eaenings is 8. (Rround to one decomal place) The tax tabety for earnings before theses of $305,000 is 1 (Riound io the noarest dollar) The afler tax earangs on 5305,000 are: (Round to the nearest dollar) The average taxrate for the 5305000 in pretax earnngs is 15. (Round to one decinal pluce) The tax Sabaliy for farnings beloie tanes if 3498000n ! (Round to the neareti dollac) The after-tax earnings on $498,000 are $ (Round to the nearest dollar.) The average tax rate for the $498,000 in pretax earnings is \%. (Round to one decimal place.) The tax liability for earnings before taxes of $1.2 million is $ (Round to the hearest dollar.) The after-tax earnings on $1.2 million are $ (Round to the nearest dollar.) The average tax rate for the $1.2 million in pretax earnings is \%. (Round to one decimal place. The tax liability for earnings before taxes of $9.6 million is $ (Round to the nearest dollar.) The after-tax earnings on $9.6 million are $ (Round to the nearest dollar.) The average tax rate for the $9.6 million in pretax earnings is \%. (Round to one decimal place The tax liability for earnings before taxes of $20.1 million is $ (Round to the nearest dollar.) The after-tax earnings on $20.1 million are $ (Round to the nearest dollar.) The average tax rate for the $20.1 million in pretax earnings is \%. (Round to one decimal plac b. Plot the average tax rates (measured on the y axis) against the pretax income lovels (measured on the x axis) The correct shape of the curve is (Select the best answer below) A C. What goneratuation can be made concerngng the relatonshp tetween these variables? (Soinct brom the diog down menu )