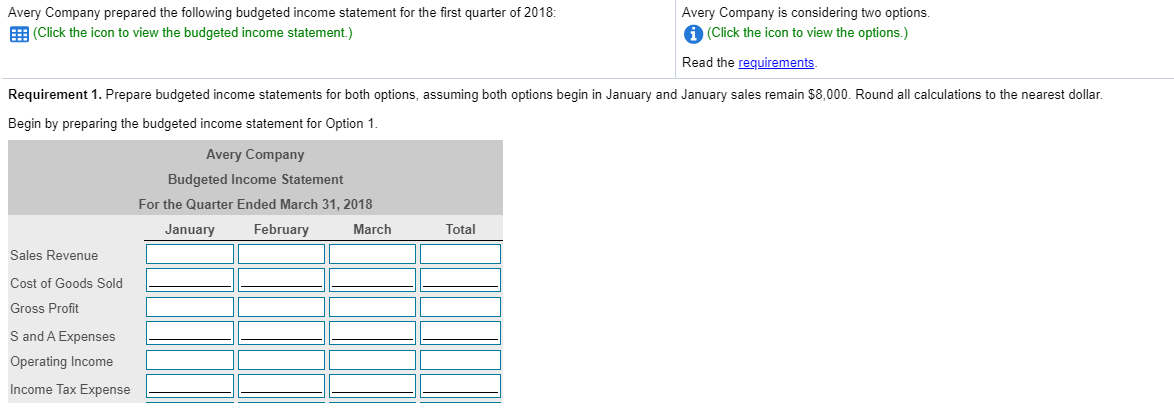

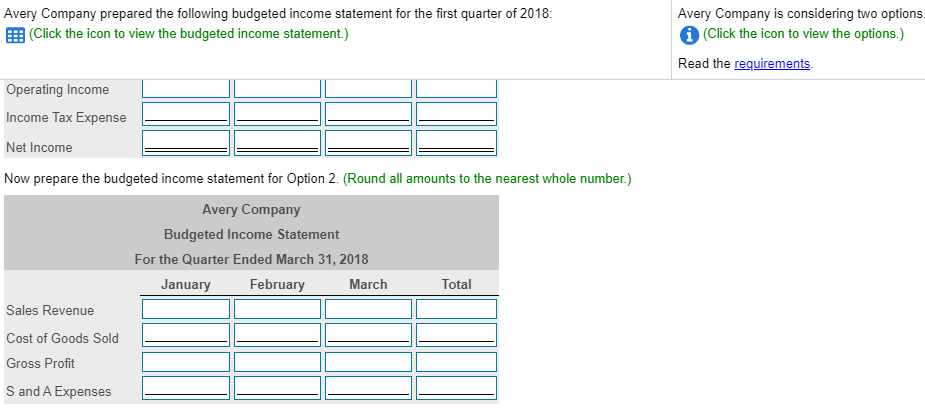

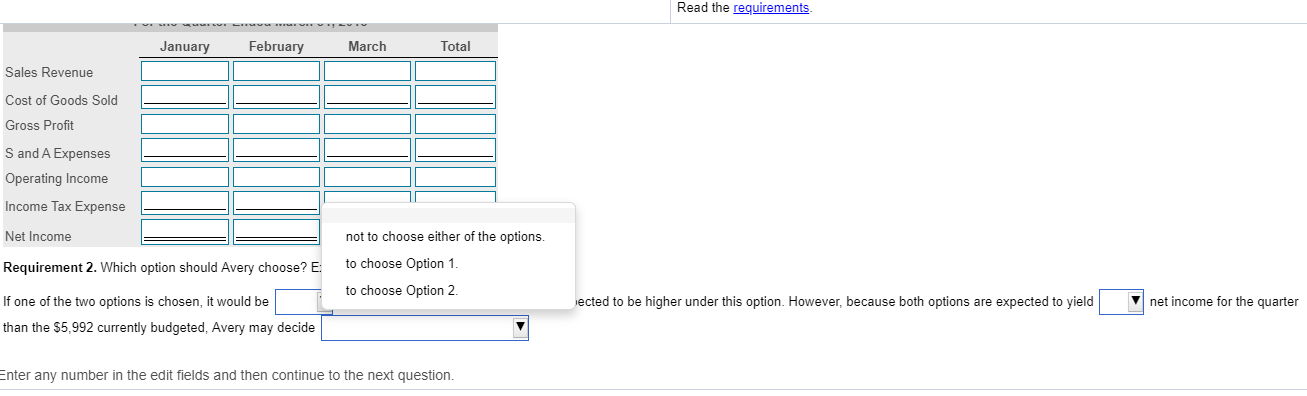

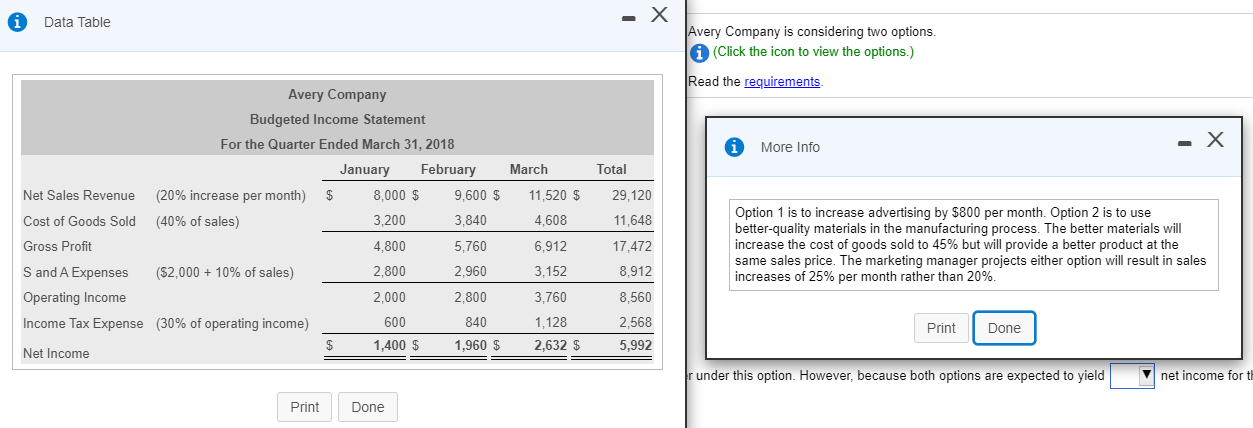

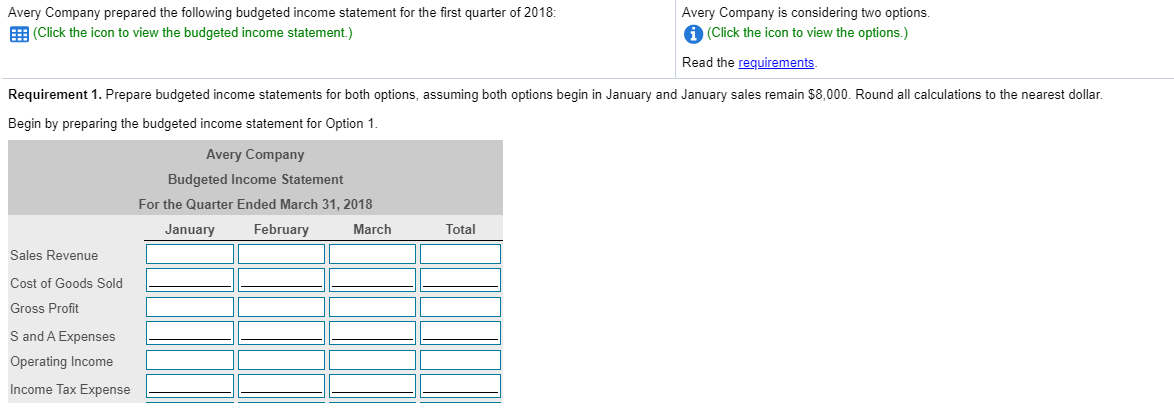

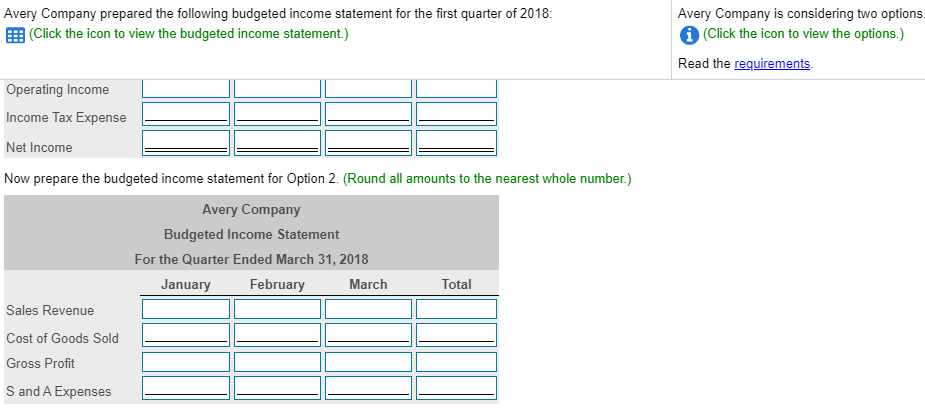

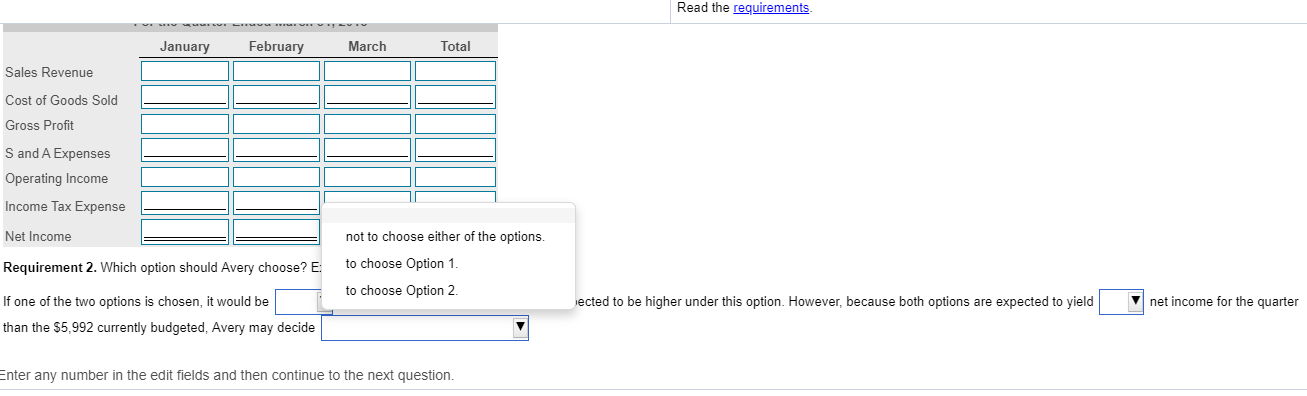

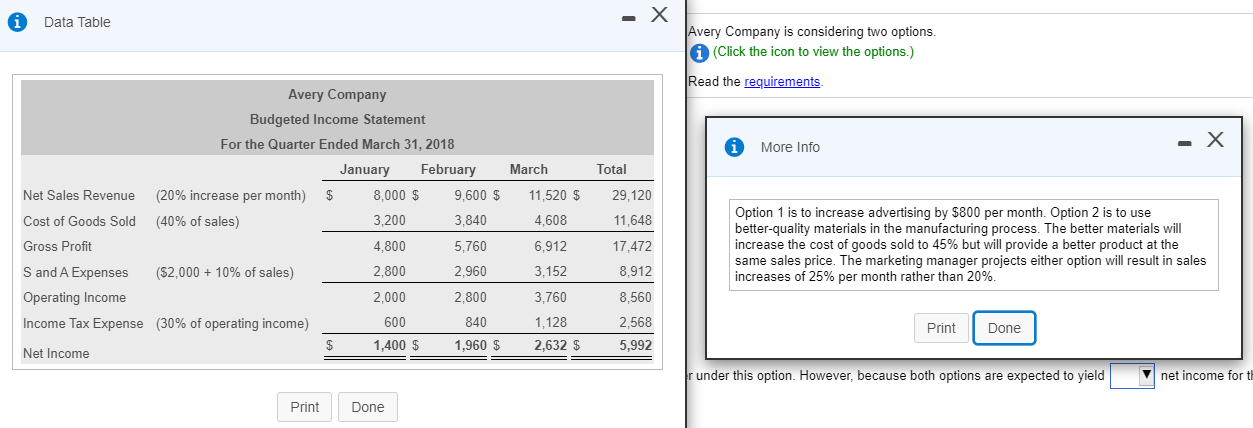

Avery Company prepared the following budgeted income statement for the first quarter of 2018: (Click the icon to view the budgeted income statement.) Avery Company is considering two options. (Click the icon to view the options.) Read the requirements Requirement 1. Prepare budgeted income statements for both options, assuming both options begin in January and January sales remain $8,000. Round all calculations to the nearest dollar. Begin by preparing the budgeted income statement for Option 1. Avery Company Budgeted Income Statement For the Quarter Ended March 31, 2018 January February March Total Sales Revenue Cost of Goods Sold Gross Profit S and A Expenses Operating Income Income Tax Expense Avery Company prepared the following budgeted income statement for the first quarter of 2018: (Click the icon to view the budgeted income statement.) Avery Company is considering two options (Click the icon to view the options.) Read the requirements Operating Income Income Tax Expense Net Income Now prepare the budgeted income statement for Option 2. (Round all amounts to the nearest whole number.) Avery Company Budgeted Income Statement For the Quarter Ended March 31, 2018 January February March Total Sales Revenue Cost of Goods Sold Gross Profit S and A Expenses Read the requirements January February March Total Sales Revenue Cost of Goods Sold Gross Profit S and A Expenses Operating Income Income Tax Expense Net Income Requirement 2. Which option should Avery choose? E: not to choose either of the options. to choose Option 1. to choose Option 2 lected to be higher under this option. However, because both options are expected to yield net income for the quarter If one of the two options is chosen, it would be than the $5,992 currently budgeted, Avery may decide Enter any number in the edit fields and then continue to the next question. x Data Table Avery Company is considering two options. (Click the icon to view the options.) Read the requirements. - X More Info March Total 11,520 $ 29,120 Avery Company Budgeted Income Statement For the Quarter Ended March 31, 2018 January February Net Sales Revenue (20% increase per month) $ 8.000 $ 9,600 $ Cost of Goods Sold (40% of sales) 3,200 3,840 Gross Profit 4.800 5,760 S and A Expenses ($2,000 + 10% of sales) 2.800 2,960 Operating Income 2.000 Income Tax Expense (30% of operating income) 600 840 Net Income $ 1,400 $ 1,960 $ 4,608 11,648 6,912 17,472 Option 1 is to increase advertising by $800 per month. Option 2 is to use better-quality materials in the manufacturing process. The better materials will increase the cost of goods sold to 45% but will provide a better product at the same sales price. The marketing manager projects either option will result in sales increases of 25% per month rather than 20% 3,152 8,912 2,800 3,760 1,128 2,632 $ 8,560 2,568 5,992 Print Done under this option. However, because both options are expected to yield net income for t Print Done