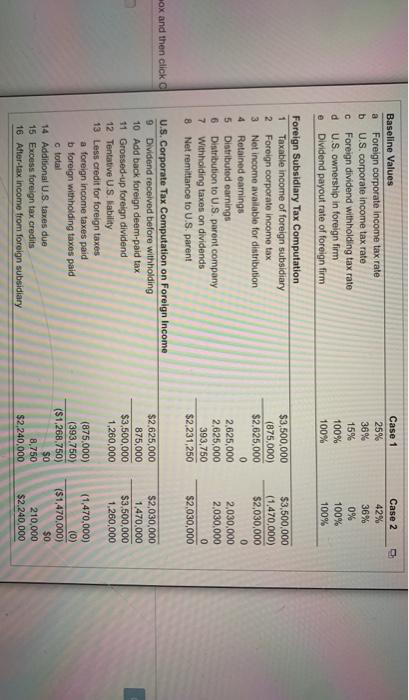

Avon Forsign-Source income. Aron Stoned direct sier at a wide any of producto Avon markets ating bany, union, and home products in more than to countries. As part of me maning in terra och inte barat analysis of the following hypothetical subsidiary earning ways to me tax analysis printed in the popuo window for your basic What is the total tax paymus, toreign and domestic combined for this income? What is the effective tax rate pad on this income by the US-based parent company? c. What would be the total tax payment and effective tax rate the foreign corporate tax rate was 42 and there were no withholding taxes on dividende? d. What would be the total tax payment and actively rate if the income was earned by a branch of the US corporation? Avon's Foreign-Source Income Avon US-based crector of a wide array of product Avon more beauty tashion and home products in more than 100 countries. As part of the training in its corporate on has its am worden of flowing bary coming in analysis. Use the analysis presented in the popup window for your basic cum, Water med to the Whitecte teped on won the US based parent company Where to see and offer the foreign corporate in rows 42 and there were no withholding hos en dividende What would be the total tax payment and dive acrate the income was earned by a branch of the US corporation? Baseline Values a Foreign corporate income tax rate b U.S. corporate income tax rate Foreign dividend withholding tax rate d U.S. ownership in foreign firm e Dividend payout rate of foreign firm Case 1 25% 36% 15% 100% 100% Case 2 42% 36% 0% 100% 100% Foreign Subsidiary Tax Computation 1 Taxable income of foreign subsidiary 2 Foreign corporate income tax 3 Net income available for distribution 4 Retained earnings 5 Distributed earnings 6 Distribution to U.S. parent company 7 Withholding taxes on dividends 8 Net remittance to U.S. parent $3,500,000 (875,000) $2.625,000 0 2,625,000 2,625,000 393,750 $2.231,250 $3,500,000 (1,470,000) $2,030,000 0 2,030,000 2,030,000 0 $2.030,000 ox and then click C $2,625,000 875,000 $3,500,000 1,260,000 52,030,000 1.470.000 $3,500,000 1,260,000 U.S. Corporate Tax Computation on Foreign Income 9 Dividend received before withholding 10 Add back foreign deem-paid tax 11 Grossed-up foreign dividend 12 Tentative U.S. Bability 13 Less credit for foreign taxes a foreign income taxes paid b foreign withholding taxes paid o total 14 Additional U.S. taxes due 15 Excess foreign tax credits 16 After-tax income from foreign subsidiary (875,000) (393.750) ($1268.750) $0 8,750 $2,240,000 (1,470,000) (0) ($1,470,000) $0 210,000 $2.240,000 Avon Forsign-Source income. Aron Stoned direct sier at a wide any of producto Avon markets ating bany, union, and home products in more than to countries. As part of me maning in terra och inte barat analysis of the following hypothetical subsidiary earning ways to me tax analysis printed in the popuo window for your basic What is the total tax paymus, toreign and domestic combined for this income? What is the effective tax rate pad on this income by the US-based parent company? c. What would be the total tax payment and effective tax rate the foreign corporate tax rate was 42 and there were no withholding taxes on dividende? d. What would be the total tax payment and actively rate if the income was earned by a branch of the US corporation? Avon's Foreign-Source Income Avon US-based crector of a wide array of product Avon more beauty tashion and home products in more than 100 countries. As part of the training in its corporate on has its am worden of flowing bary coming in analysis. Use the analysis presented in the popup window for your basic cum, Water med to the Whitecte teped on won the US based parent company Where to see and offer the foreign corporate in rows 42 and there were no withholding hos en dividende What would be the total tax payment and dive acrate the income was earned by a branch of the US corporation? Baseline Values a Foreign corporate income tax rate b U.S. corporate income tax rate Foreign dividend withholding tax rate d U.S. ownership in foreign firm e Dividend payout rate of foreign firm Case 1 25% 36% 15% 100% 100% Case 2 42% 36% 0% 100% 100% Foreign Subsidiary Tax Computation 1 Taxable income of foreign subsidiary 2 Foreign corporate income tax 3 Net income available for distribution 4 Retained earnings 5 Distributed earnings 6 Distribution to U.S. parent company 7 Withholding taxes on dividends 8 Net remittance to U.S. parent $3,500,000 (875,000) $2.625,000 0 2,625,000 2,625,000 393,750 $2.231,250 $3,500,000 (1,470,000) $2,030,000 0 2,030,000 2,030,000 0 $2.030,000 ox and then click C $2,625,000 875,000 $3,500,000 1,260,000 52,030,000 1.470.000 $3,500,000 1,260,000 U.S. Corporate Tax Computation on Foreign Income 9 Dividend received before withholding 10 Add back foreign deem-paid tax 11 Grossed-up foreign dividend 12 Tentative U.S. Bability 13 Less credit for foreign taxes a foreign income taxes paid b foreign withholding taxes paid o total 14 Additional U.S. taxes due 15 Excess foreign tax credits 16 After-tax income from foreign subsidiary (875,000) (393.750) ($1268.750) $0 8,750 $2,240,000 (1,470,000) (0) ($1,470,000) $0 210,000 $2.240,000