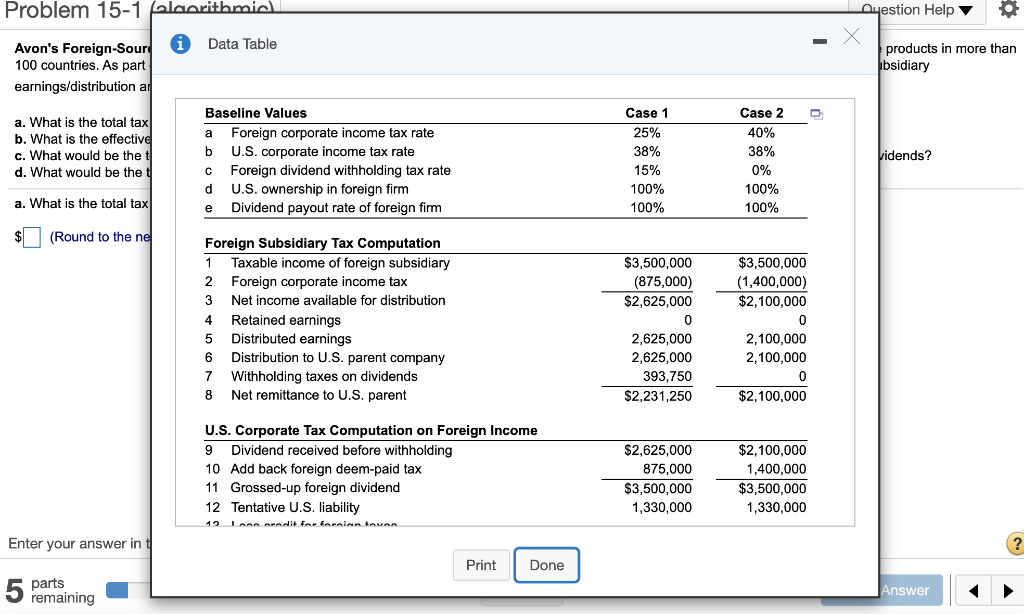

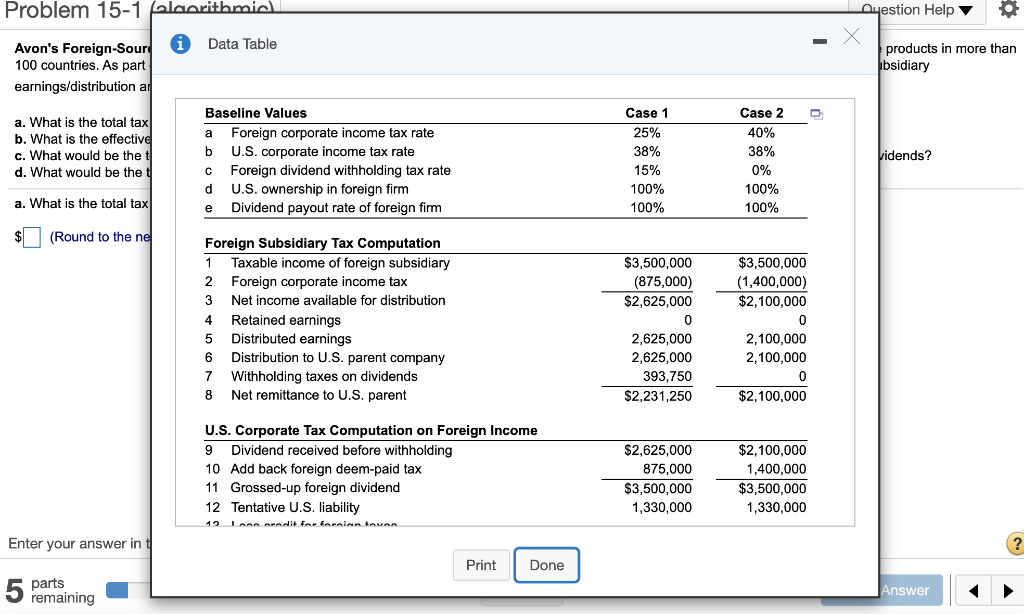

Avon's Foreign-Source Income. Avon is a U.S.-based direct seller of a wide array of products. Avon markets leading beauty, fashion, and home products in more than 100 countries. As part of the training in its corporate treasury offices, it has its interns build a spreadsheet analysis of the following hypothetical subsidiary earnings/distribution analysis. Use the tax analysis presented in the popup window for your basic structure, a. What is the total tax payment, foreign and domestic combined, for this income? b. What is the effective tax rate paid on this income by the U.S.-based parent company? c. What would be the total tax payment and effective tax rate if the foreign corporate tax rate was 40% and there were no withholding taxes on dividends? d. What would be the total tax payment and effective tax rate if the income was earned by a branch of the U.S. corporation? a. What is the total tax payment, foreign and domestic combined, for this income? (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer. ? Problem 15-1 blaarithmic Ayestion Help Data Table - Avon's Foreign-Sour 100 countries. As part earnings/distribution ar products in more than ubsidiary a. What is the total tax b. What is the effective c. What would be the t d. What would be the Baseline Values a Foreign corporate income tax rate b U.S. corporate income tax rate Foreign dividend withholding tax rate d U.S. ownership in foreign firm Dividend payout rate of foreign firm Case 1 25% 38% 15% 100% 100% Case 2 40% 38% 0% 100% 100% Vidends? a. What is the total tax e $ (Round to the ne Foreign Subsidiary Tax Computation 1 Taxable income of foreign subsidiary 2 Foreign corporate income tax 3 Net income available for distribution 4 Retained earnings 5 Distributed earnings 6 Distribution to U.S. parent company 7 Withholding taxes on dividends 8 Net remittance to U.S. parent $3,500,000 (875,000) $2,625,000 0 2,625,000 2,625,000 393,750 $2,231,250 $3,500,000 (1,400,000) $2,100,000 0 2,100,000 2,100,000 0 $2,100,000 U.S. Corporate Tax Computation on Foreign Income 9 Dividend received before withholding 10 Add back foreign deem-paid tax 11 Grossed-up foreign dividend 12 Tentative U.S. liability 12 LARA APANIA far FARRAR HAMAR $2,625,000 875,000 $3,500,000 1,330,000 $2,100,000 1,400,000 $3,500,000 1,330,000 Enter your answer int ? Print Done 5 parts remaining