Answered step by step

Verified Expert Solution

Question

1 Approved Answer

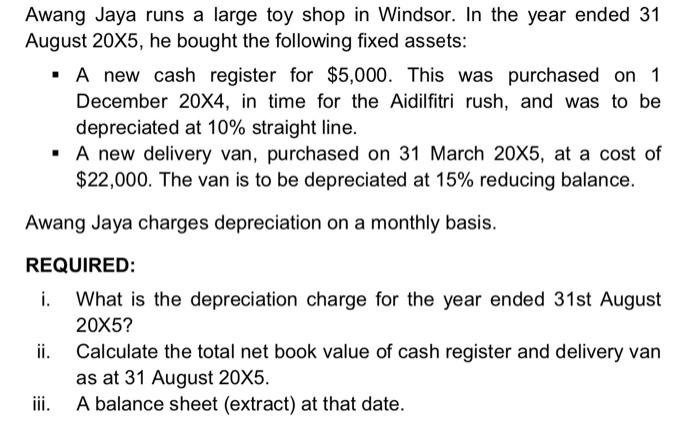

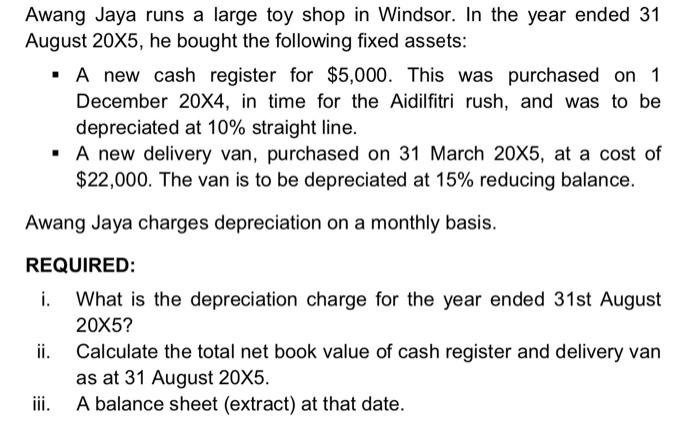

Awang Jaya runs a large toy shop in Windsor. In the year ended 31 August 20X5, he bought the following fixed assets: - A new

Awang Jaya runs a large toy shop in Windsor. In the year ended 31 August 20X5, he bought the following fixed assets: - A new cash register for $5,000. This was purchased on 1 December 20X4, in time for the Aidilfitri rush, and was to be depreciated at 10% straight line. - A new delivery van, purchased on 31 March 205, at a cost of $22,000. The van is to be depreciated at 15% reducing balance. Awang Jaya charges depreciation on a monthly basis. REQUIRED: i. What is the depreciation charge for the year ended 31st August 205? ii. Calculate the total net book value of cash register and delivery van as at 31 August 205. iii. A balance sheet (extract) at that date

Awang Jaya runs a large toy shop in Windsor. In the year ended 31 August 20X5, he bought the following fixed assets: - A new cash register for $5,000. This was purchased on 1 December 20X4, in time for the Aidilfitri rush, and was to be depreciated at 10% straight line. - A new delivery van, purchased on 31 March 205, at a cost of $22,000. The van is to be depreciated at 15% reducing balance. Awang Jaya charges depreciation on a monthly basis. REQUIRED: i. What is the depreciation charge for the year ended 31st August 205? ii. Calculate the total net book value of cash register and delivery van as at 31 August 205. iii. A balance sheet (extract) at that date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started