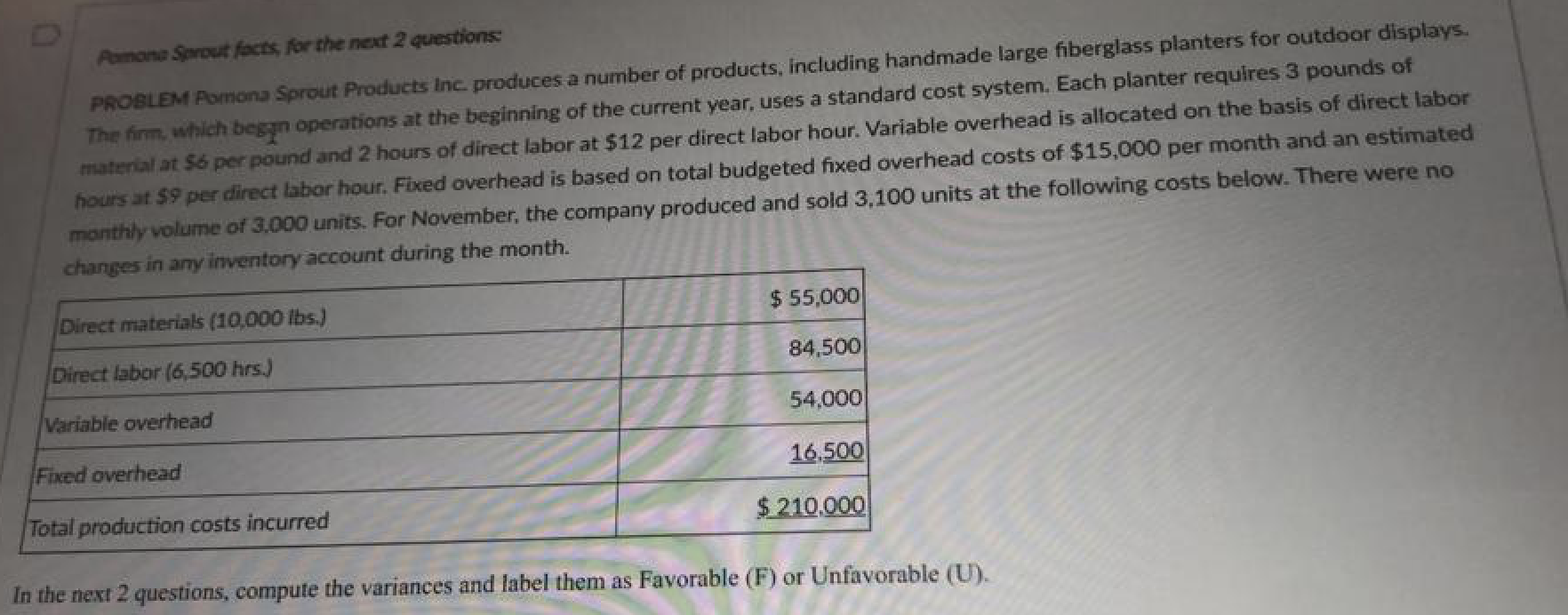

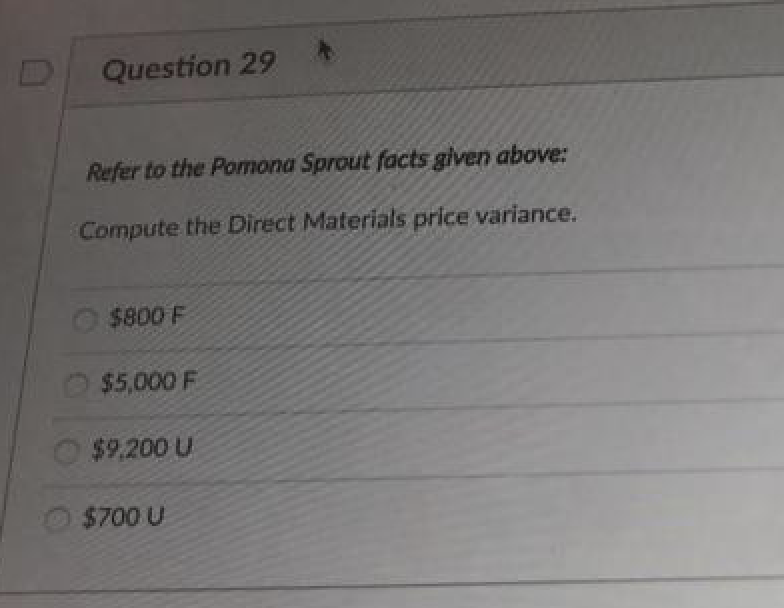

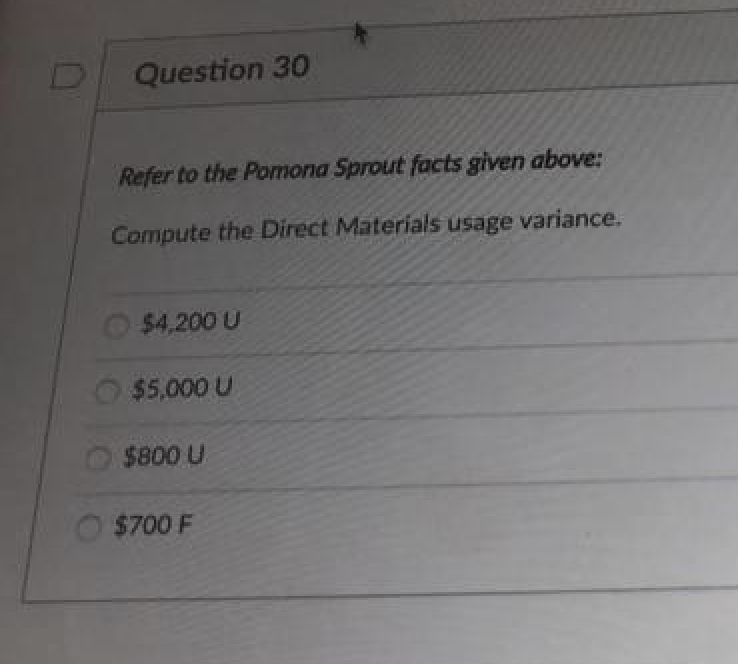

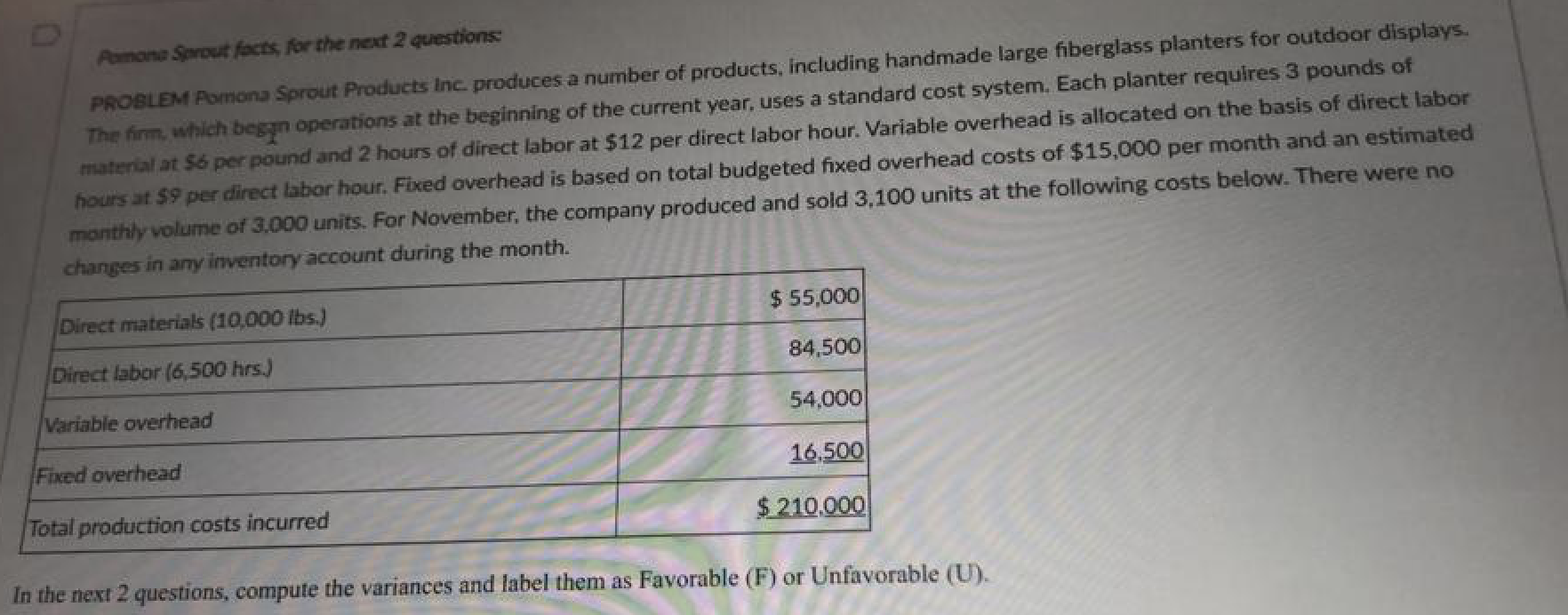

Axone Seout facts, for the next 2 questions: PROBLEM Pomona Sprout Products Inc. produces a number of products, including handmade large fiberglass planters for outdoor displays. The firm, which began operations at the beginning of the current year, uses a standard cost system. Each planter requires 3 pounds of material at 36 per pound and 2 hours of direct labor at $12 per direct labor hour. Variable overhead is allocated on the basis of direct labor hours at $ per direct labor hour. Fixed overhead is based on total budgeted fixed overhead costs of $15,000 per month and an estimated monthly volume of 3.000 units. For November, the company produced and sold 3,100 units at the following costs below. There were no changes in any inventory account during the month. $ 55,000 Direct materials (10,000 lbs.) 84,500 Direct labor (6,500 hrs.) 54,000 Variable overhead 16.500 Fixed overhead $ 210,000 Total production costs incurred In the next 2 questions, compute the variances and label them as Favorable (F) or Unfavorable (U). Question 29 Refer to the Pomona Sprout facts given above: Compute the Direct Materials price variance. $800 F $5,000 F $9,200 U $700 U Question 30 Refer to the Pomona Sprout facts given above: Compute the Direct Materials usage variance. $4,200 U $5,000 U $800 U $700 F Axone Seout facts, for the next 2 questions: PROBLEM Pomona Sprout Products Inc. produces a number of products, including handmade large fiberglass planters for outdoor displays. The firm, which began operations at the beginning of the current year, uses a standard cost system. Each planter requires 3 pounds of material at 36 per pound and 2 hours of direct labor at $12 per direct labor hour. Variable overhead is allocated on the basis of direct labor hours at $ per direct labor hour. Fixed overhead is based on total budgeted fixed overhead costs of $15,000 per month and an estimated monthly volume of 3.000 units. For November, the company produced and sold 3,100 units at the following costs below. There were no changes in any inventory account during the month. $ 55,000 Direct materials (10,000 lbs.) 84,500 Direct labor (6,500 hrs.) 54,000 Variable overhead 16.500 Fixed overhead $ 210,000 Total production costs incurred In the next 2 questions, compute the variances and label them as Favorable (F) or Unfavorable (U). Question 29 Refer to the Pomona Sprout facts given above: Compute the Direct Materials price variance. $800 F $5,000 F $9,200 U $700 U Question 30 Refer to the Pomona Sprout facts given above: Compute the Direct Materials usage variance. $4,200 U $5,000 U $800 U $700 F