Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aya Olsen would like to start her own beauty clinic July 1, 2024. Aya Olsen works to day as an assistant in another and

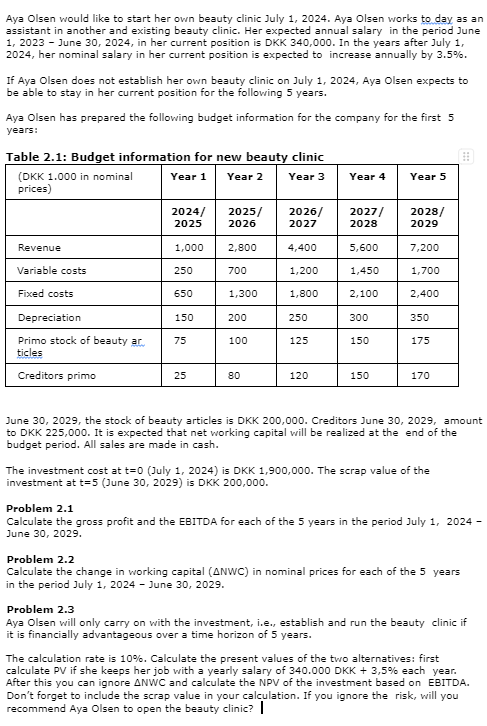

Aya Olsen would like to start her own beauty clinic July 1, 2024. Aya Olsen works to day as an assistant in another and existing beauty clinic. Her expected annual salary in the period June 1, 2023 - June 30, 2024, in her current position is DKK 340,000. In the years after July 1, 2024, her nominal salary in her current position is expected to increase annually by 3.5%. If Aya Olsen does not establish her own beauty clinic on July 1, 2024, Aya Olsen expects to be able to stay in her current position for the following 5 years. Aya Olsen has prepared the following budget information for the company for the first 5 years: Table 2.1: Budget information for new beauty clinic (DKK 1.000 in nominal prices) Year 1 Year 2 Year 3 Year 4 Year 5 2024/ 2025/ 2026/ 2027/ 2028/ 2025 2026 2027 2028 2029 Revenue 1,000 2,800 4,400 5,600 7,200 Variable costs 250 700 1,200 1,450 1,700 Fixed costs 650 1,300 1,800 2,100 2,400 Depreciation 150 200 250 300 350 Primo stock of beauty ar ticles 75 100 125 150 175 Creditors primo 25 80 120 150 170 June 30, 2029, the stock of beauty articles is DKK 200,000. Creditors June 30, 2029, amount to DKK 225,000. It is expected that net working capital will be realized at the end of the budget period. All sales are made in cash. The investment cost at t=0 (July 1, 2024) is DKK 1,900,000. The scrap value of the investment at t=5 (June 30, 2029) is DKK 200,000. Problem 2.1 Calculate the gross profit and the EBITDA for each of the 5 years in the period July 1, 2024 - June 30, 2029. Problem 2.2 Calculate the change in working capital (ANWC) in nominal prices for each of the 5 years in the period July 1, 2024 - June 30, 2029. Problem 2.3 Aya Olsen will only carry on with the investment, i.e., establish and run the beauty clinic if it is financially advantageous over a time horizon of 5 years. The calculation rate is 10%. Calculate the present values of the two alternatives: first calculate PV if she keeps her job with a yearly salary of 340.000 DKK + 3,5% each year. After this you can ignore ANWC and calculate the NPV of the investment based on EBITDA. Don't forget to include the scrap value in your calculation. If you ignore the risk, will you recommend Aya Olsen to open the beauty clinic? |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started