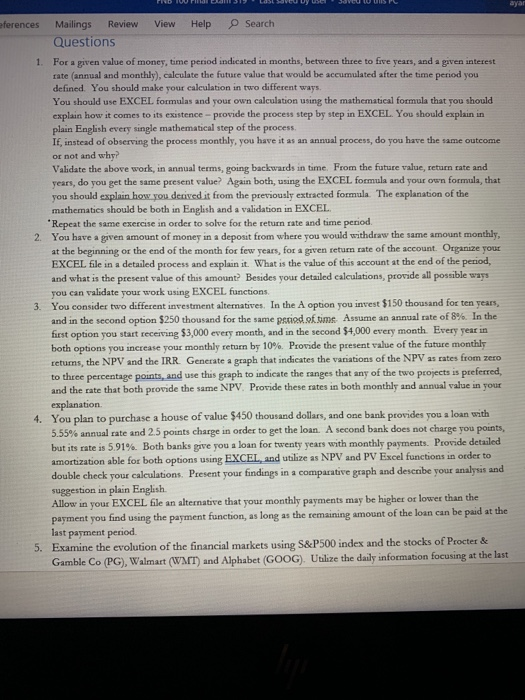

ayar 1 eferences Mailings Review View Help O Search Questions For a given value of money, time period indicated in months, between three to five years, and a given interest rate (annual and monthly), calculate the future value that would be accumulated after the time period you defined. You should make your calculation in two different ways. You should use EXCEL formulas and your own calculation using the mathematical formula that you should explain how it comes to its existence - provide the process step by step in EXCEL. You should explain in plain English every single mathematical step of the process, If, instead of observing the process monthly, you have it as an annual process, do you have the same outcome or not and why? Validate the above work, in annual terms, going backwards in time. From the future value, return rate and years, do you get the same present value? Again both, using the EXCEL formula and your own formula that you should explain how you derived it from the previously extracted formula. The explanation of the mathematics should be both in English and a validation in EXCEL * Repeat the same exercise in order to solve for the return rate and time period 2. You have a given amount of money in a deposit from where you would withdraw the same amount monthly at the beginning or the end of the month for few years, for a given return rate of the account. Organize your EXCEL file in a detailed process and explain it. What is the value of this account at the end of the period, and what is the present value of this amount? Besides your detailed calculations, provide all possible ways you can validate your work using EXCEL functions. 3. You consider two different investment alternatives. In the A option you invest $150 thousand for ten years, and in the second option $250 thousand for the same period of time. Assume an annual rate of 8%. In the first option you start receiving $3,000 every month, and in the second $4,000 every month. Every year in both options you increase your monthly return by 10%. Provide the present value of the future monthly returns, the NPV and the IRR. Generate a graph that indicates the variations of the NPV as rates from zero to three percentage points, and use this graph to indicate the ranges that any of the two projects is preferred, and the rate that both provide the same NPV. Provide these rates in both monthly and annual value in your explanation 4. You plan to purchase a house of value $450 thousand dollars, and one bank provides you a loan with 5.55% annual rate and 2.5 points charge in order to get the loan. A second bank does not charge you points, but its rate is 5.91%. Both banks give you a loan for twenty years with monthly payments. Provide detailed amortization able for both options using EXCEL and utilize as NPV and PV Excel functions in order to double check your calculations. Present your findings in a comparative graph and describe your analysis and suggestion in plain English Allow in your EXCEL file an alternative that your monthly payments may be higher or lower than the payment you find using the payment function, as long as the remaining amount of the loan can be paid at the last payment period 5. Examine the evolution of the financial markets using S&P500 index and the stocks of Procter & Gamble Co (PG), Walmart (WNT) and Alphabet (GOOG). Utilize the daily information focusing at the last ayar 1 eferences Mailings Review View Help O Search Questions For a given value of money, time period indicated in months, between three to five years, and a given interest rate (annual and monthly), calculate the future value that would be accumulated after the time period you defined. You should make your calculation in two different ways. You should use EXCEL formulas and your own calculation using the mathematical formula that you should explain how it comes to its existence - provide the process step by step in EXCEL. You should explain in plain English every single mathematical step of the process, If, instead of observing the process monthly, you have it as an annual process, do you have the same outcome or not and why? Validate the above work, in annual terms, going backwards in time. From the future value, return rate and years, do you get the same present value? Again both, using the EXCEL formula and your own formula that you should explain how you derived it from the previously extracted formula. The explanation of the mathematics should be both in English and a validation in EXCEL * Repeat the same exercise in order to solve for the return rate and time period 2. You have a given amount of money in a deposit from where you would withdraw the same amount monthly at the beginning or the end of the month for few years, for a given return rate of the account. Organize your EXCEL file in a detailed process and explain it. What is the value of this account at the end of the period, and what is the present value of this amount? Besides your detailed calculations, provide all possible ways you can validate your work using EXCEL functions. 3. You consider two different investment alternatives. In the A option you invest $150 thousand for ten years, and in the second option $250 thousand for the same period of time. Assume an annual rate of 8%. In the first option you start receiving $3,000 every month, and in the second $4,000 every month. Every year in both options you increase your monthly return by 10%. Provide the present value of the future monthly returns, the NPV and the IRR. Generate a graph that indicates the variations of the NPV as rates from zero to three percentage points, and use this graph to indicate the ranges that any of the two projects is preferred, and the rate that both provide the same NPV. Provide these rates in both monthly and annual value in your explanation 4. You plan to purchase a house of value $450 thousand dollars, and one bank provides you a loan with 5.55% annual rate and 2.5 points charge in order to get the loan. A second bank does not charge you points, but its rate is 5.91%. Both banks give you a loan for twenty years with monthly payments. Provide detailed amortization able for both options using EXCEL and utilize as NPV and PV Excel functions in order to double check your calculations. Present your findings in a comparative graph and describe your analysis and suggestion in plain English Allow in your EXCEL file an alternative that your monthly payments may be higher or lower than the payment you find using the payment function, as long as the remaining amount of the loan can be paid at the last payment period 5. Examine the evolution of the financial markets using S&P500 index and the stocks of Procter & Gamble Co (PG), Walmart (WNT) and Alphabet (GOOG). Utilize the daily information focusing at the last