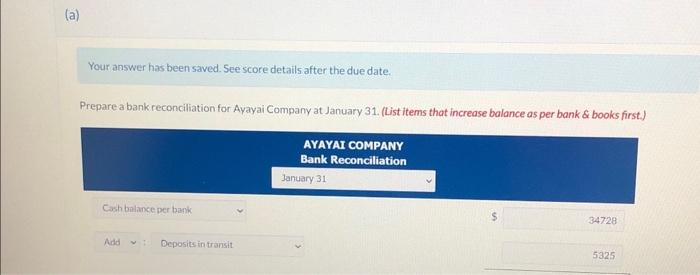

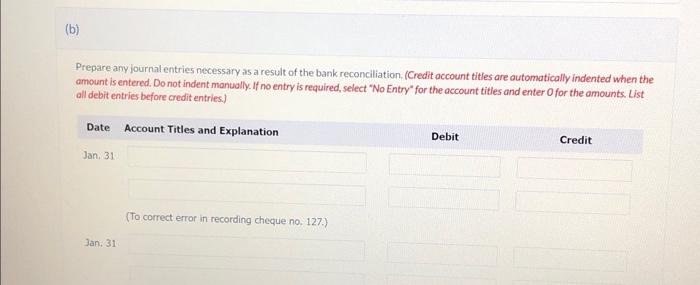

Ayayai Company's bank statement for the month ended January 31 showed a balance per bank of $34,728. The company's Cash balance at January 31 was $16,398. Other information is as follows: 1. Cash receipts for January were $87,679, of which $5.325 was outstanding at January 31 . 2. The bank statement shows a debit memorandum for $165 for cheque printing charges. 3. Cheque no. 119 payable to Cullumber Company was recorded in the general journal and cleared the bank for $373. A review of the Accounts Payable subsidiary ledger shows a $161 credit balance in the account of Cullumber Company and that the payment to it should have been for $534. 4. The total amount of cheques written during January was $75.186, of which $6.039 was cutstanding at January 31 . 5. Cheque No. 127 was correctly written and paid by the bank for $409. The general journal reflects an entry for cheque no. 127 as a debit to Accounts Payable and a credit to Cash for $490. 6. The bank returned an NSF cheque from a customer for $810, 7. The bank included a credit memorandum for $18,510, which represents an EFT collection of a customer's account: Your answer has been saved. See score details after the due date. Prepare a bankreconciliation for Ayayai Company at January 31. (List items that increase balance as per bank \& books first.) Prepare arry journal entries necessary as a result of the bank reconciliation. (Credit occount titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter Ofor the amounts List all debit entries before credit entries) Ayayai Company's bank statement for the month ended January 31 showed a balance per bank of $34,728, The company's Cash balance at January 31 was $16,398. Other information is as follows: 1. Cash receipts for January were $87,679, of which $5,325 was outstanding at January 31 . 2. The bank statement shows a debit memorandum for $165 for cheque printing charges. 3. Cheque no. 119 payable to Cullumber Company was recorded in the general journal and cleared the bank for $373. A review of the Accounts Payable subsidiary ledger shows a $161 credit balance in the account of Cullumber Company and that the payment to it should have been for $534, 4. The total amount of cheques written during January was $75,186, of which $6,039 was outstanding at January 31. 5. Cheque No. 127 was correctly written and paid by the bank for $409. The general journal reflects an entry for cheque no. 127 as a debit to Accounts Payable and a credit to Cash for $490. 6. The bank returned an NSF cheque from a customer for $810 7. The bank included acredit memorandum for $18.510, which represents an EFT collection of a customer's account. Your answer has been saved. See score details after the due date. Prepare a bank reconciliation for Ayayai Company at January 31. (List items that increase balance as per bank \& books first.) Prepare any journal entries necessary as a result of the bank reconciliation. (Credit account titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter ofor the amounts. List. all debit entries before credit entries.)