Answered step by step

Verified Expert Solution

Question

1 Approved Answer

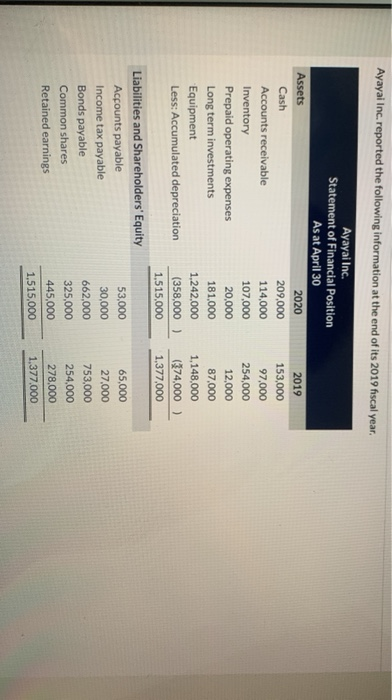

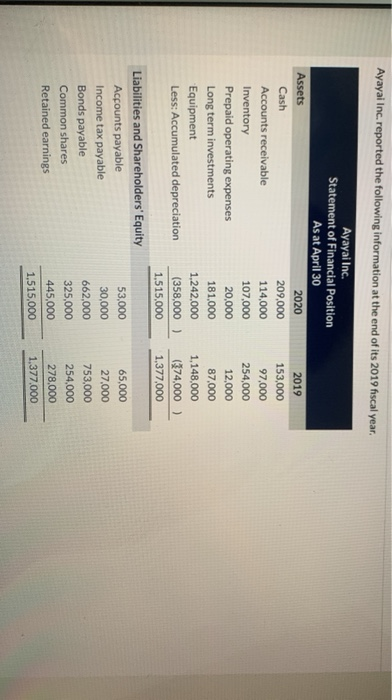

Ayayal Inc. reported the following information at the end of its 2019 fiscal year. Ayayai Inc. Statement of Financial Position As at April 30 Assets

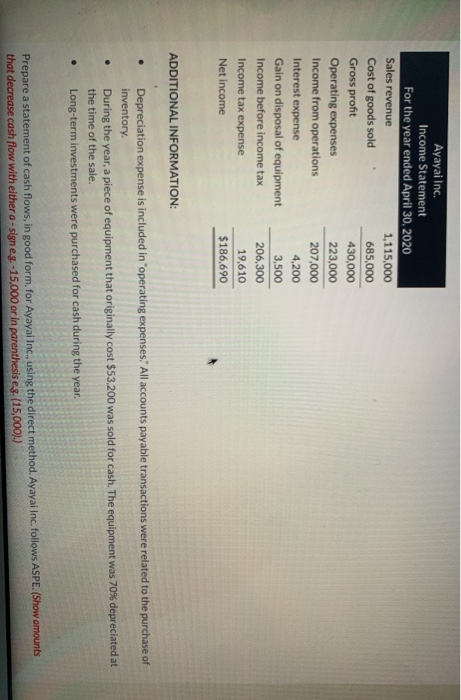

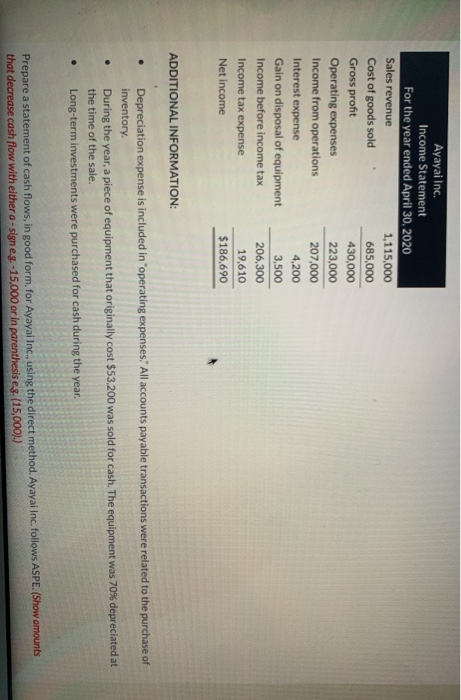

Ayayal Inc. reported the following information at the end of its 2019 fiscal year. Ayayai Inc. Statement of Financial Position As at April 30 Assets 2020 Cash 209,000 Accounts receivable 114,000 Inventory 107.000 Prepaid operating expenses 20,000 Long term investments 181,000 Equipment 1,242,000 Less: Accumulated depreciation (358,000) 1,515,000 Liabilities and Shareholders' Equity Accounts payable 53,000 Income tax payable 30,000 Bonds payable 662,000 Common shares 325,000 Retained earnings 445,000 1,515,000 2019 153,000 97,000 254,000 12,000 87.000 1,148,000 (374,000) 1.377,000 65,000 27,000 753,000 254,000 278,000 1,377.000 Ayayai Inc. Income Statement For the year ended April 30, 2020 Sales revenue 1,115,000 Cost of goods sold 685,000 Gross profit 430,000 Operating expenses 223,000 Income from operations 207.000 Interest expense 4,200 Gain on disposal of equipment 3,500 Income before income tax 206,300 Income tax expense 19,610 Net income $186,690 ADDITIONAL INFORMATION: Depreciation expense is included in "operating expenses." All accounts payable transactions were related to the purchase of inventory During the year, a piece of equipment that originally cost $53,200 was sold for cash. The equipment was 70% depreciated at the time of the sale. Long-term investments were purchased for cash during the year. . Prepare a statement of cash flows, in good form for Ayayai Inc., using the direct method. Ayayal Inc. follows ASPE. (Show amounts that decrease cash flow with either a-sign e.g. - 15,000 or in parenthesis e.s. (15,000).) Ayayal Inc. Statement of Cash Flows April 30, 2020

Ayayal Inc. reported the following information at the end of its 2019 fiscal year. Ayayai Inc. Statement of Financial Position As at April 30 Assets 2020 Cash 209,000 Accounts receivable 114,000 Inventory 107.000 Prepaid operating expenses 20,000 Long term investments 181,000 Equipment 1,242,000 Less: Accumulated depreciation (358,000) 1,515,000 Liabilities and Shareholders' Equity Accounts payable 53,000 Income tax payable 30,000 Bonds payable 662,000 Common shares 325,000 Retained earnings 445,000 1,515,000 2019 153,000 97,000 254,000 12,000 87.000 1,148,000 (374,000) 1.377,000 65,000 27,000 753,000 254,000 278,000 1,377.000 Ayayai Inc. Income Statement For the year ended April 30, 2020 Sales revenue 1,115,000 Cost of goods sold 685,000 Gross profit 430,000 Operating expenses 223,000 Income from operations 207.000 Interest expense 4,200 Gain on disposal of equipment 3,500 Income before income tax 206,300 Income tax expense 19,610 Net income $186,690 ADDITIONAL INFORMATION: Depreciation expense is included in "operating expenses." All accounts payable transactions were related to the purchase of inventory During the year, a piece of equipment that originally cost $53,200 was sold for cash. The equipment was 70% depreciated at the time of the sale. Long-term investments were purchased for cash during the year. . Prepare a statement of cash flows, in good form for Ayayai Inc., using the direct method. Ayayal Inc. follows ASPE. (Show amounts that decrease cash flow with either a-sign e.g. - 15,000 or in parenthesis e.s. (15,000).) Ayayal Inc. Statement of Cash Flows April 30, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started