Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AZ Products The marketing department of AZ Products has submitted the following sales forecast for the upcoming fiscal year: table [ [ , 1

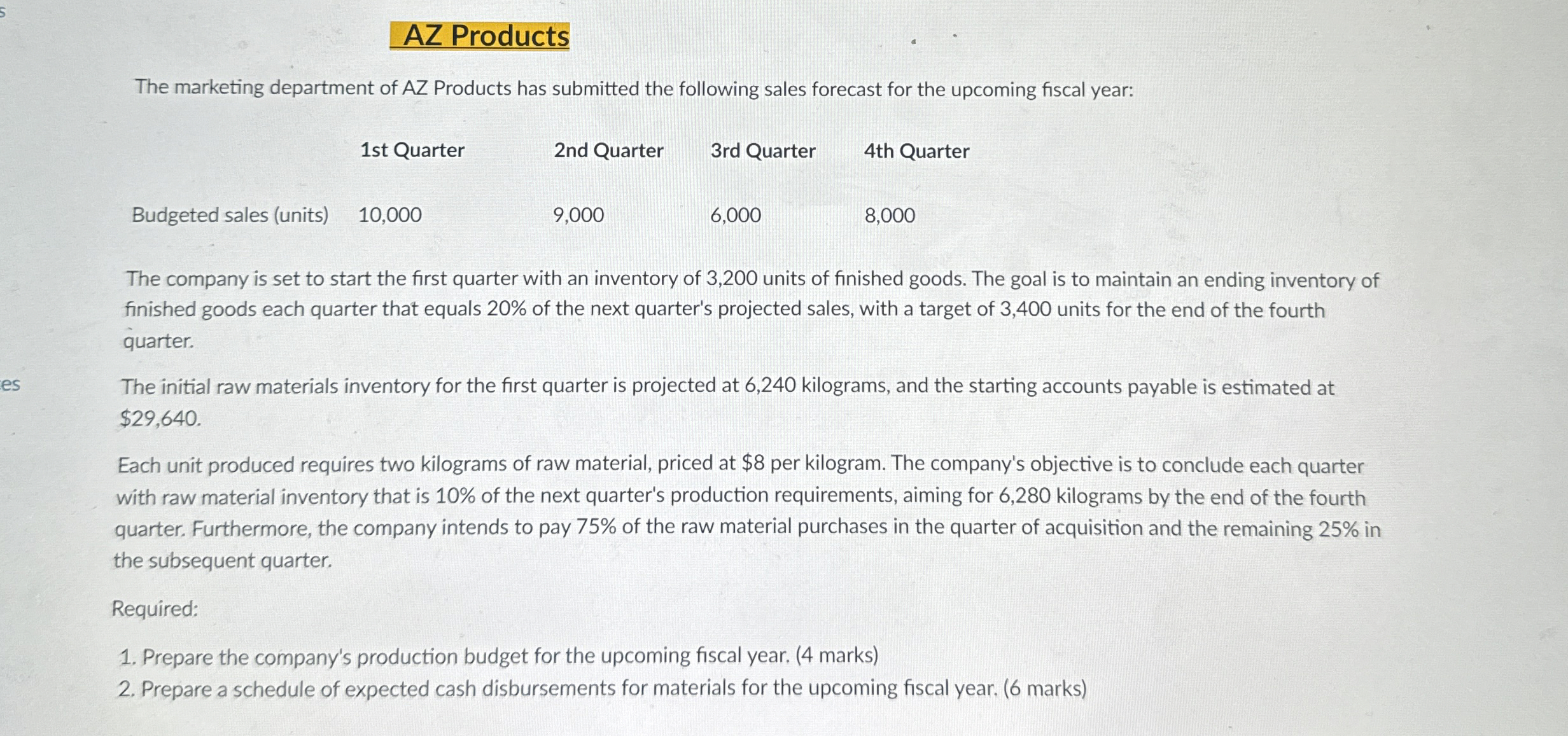

AZ Products

The marketing department of AZ Products has submitted the following sales forecast for the upcoming fiscal year:

tablest Quarter,nd Quarter,rd Quarter,th QuarterBudgeted sales units

The company is set to start the first quarter with an inventory of units of finished goods. The goal is to maintain an ending inventory of finished goods each quarter that equals of the next quarter's projected sales, with a target of units for the end of the fourth quarter.

The initial raw materials inventory for the first quarter is projected at kilograms, and the starting accounts payable is estimated at $

Each unit produced requires two kilograms of raw material, priced at $ per kilogram. The company's objective is to conclude each quarter with raw material inventory that is of the next quarter's production requirements, aiming for kilograms by the end of the fourth quarter. Furthermore, the company intends to pay of the raw material purchases in the quarter of acquisition and the remaining in the subsequent quarter.

Required:

Please explain this point simply

Prepare a schedule of expected cash disbursements for materials for the upcoming fiscal year. marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started