Answered step by step

Verified Expert Solution

Question

1 Approved Answer

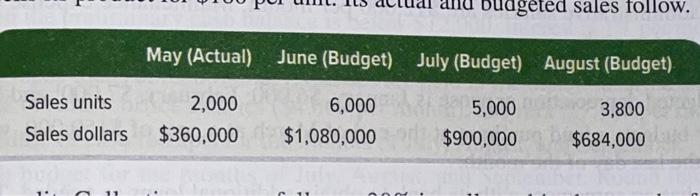

aztec company sells its products for $180 per unit. its actual budgeted sales follow. all sales are on credit. collections are as follows:30% is collected

aztec company sells its products for $180 per unit. its actual budgeted sales follow. all sales are on credit. collections are as follows:30% is collected in the month of the sale, and the remaining 70% is collected in the month following the sale. merchandise purchases cost $110 per unit. for those purchases 60% is paid in the month of purchase and the other 40% is paid in the month following purchase. The company has a policy to maintain an ending monthly inventory of 20% of the next months unit sales. the may 31 actual inventory level of 1,200 units is consistent with this policy. Selling administrative expenses of 110,000 per month are paid in cash. The companies minimum cash balance at month end is $100,000. Loans are obtained at the end of any month when the preliminary cash balance is below $100,000. Any preliminary cash balance above $100,000 is used to repay loans at month end. This loan has a 1% monthly interest rate. on may 31 The loan balance is $25,000 in the companies cash balance is $100,000. round to the nearest dollar.

1. Prepare a schedule of cash receipts from sales for each of the month June and July.

2. Prepare the merchandise purchases budget for June and July.

3. Prepare a schedule of cash payments for merchandise purchases for June and July. Assume May's budgeted merchandise purchases is $308,000.

4. Prepare a cash budget for June and July, including any loan activity and interest expense. Compute the load balance at the end of each month.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started