Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b. 25.0%, 12.5%, 6.1% c. 20.0%, 12.7%, 6.1% d. 20.0%, 12.5%, 5.1% e. 20.0%, 13.3%, 5.1% Eleanor's Computers, Inc. has the following balance sheets and

b.

b.

25.0%, 12.5%, 6.1%

c.

20.0%, 12.7%, 6.1%

d.

20.0%, 12.5%, 5.1%

e.

20.0%, 13.3%, 5.1%

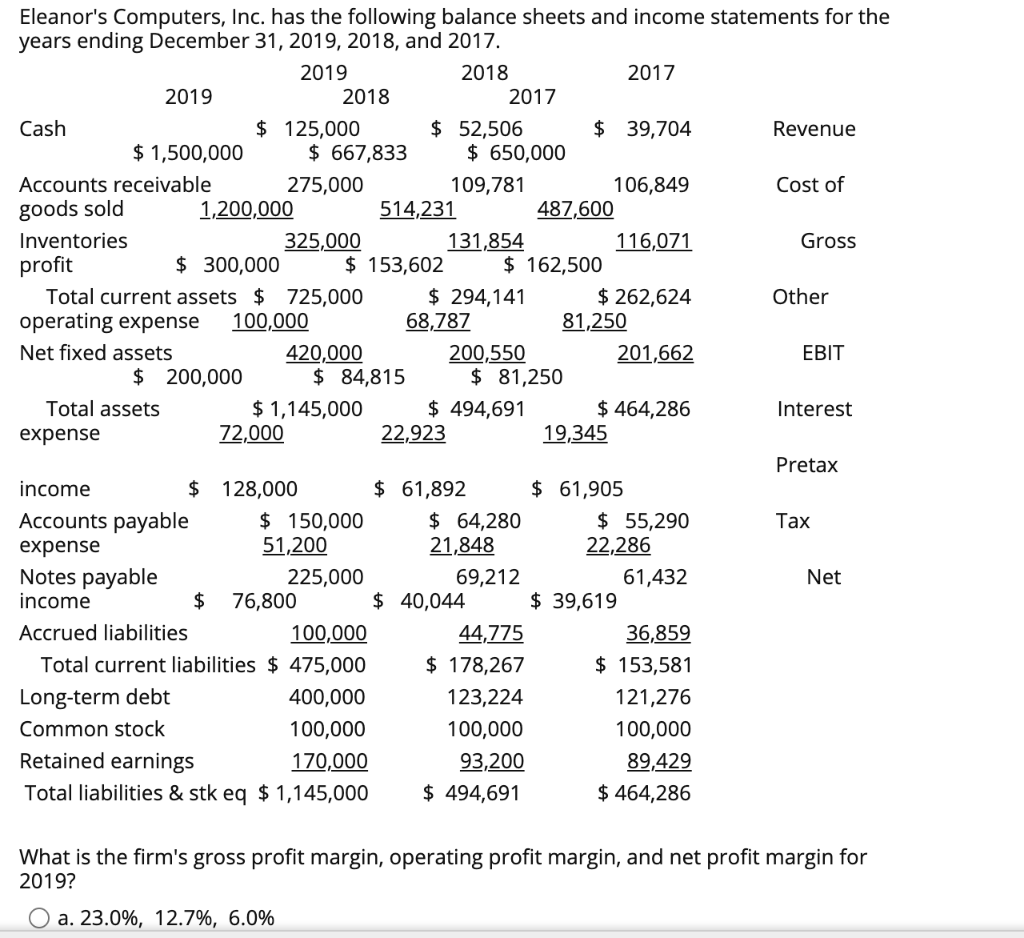

Eleanor's Computers, Inc. has the following balance sheets and income statements for the years ending December 31, 2019, 2018, and 2017. 2019 2018 2017 2019 2018 2017 Cash $ 125,000 $ 52,506 $ 39,704 Revenue $ 1,500,000 $ 667,833 $ 650,000 Accounts receivable 275,000 109,781 106,849 Cost of goods sold 1,200,000 514,231 487,600 Inventories 325,000 131,854 116,071 Gross profit $ 300,000 $ 153,602 $ 162,500 Total current assets $ 725,000 $ 294,141 $ 262,624 Other operating expense 100,000 68,787 81,250 Net fixed assets 420,000 200,550 201,662 EBIT $ 200,000 $ 84,815 $ 81,250 Total assets $ 1,145,000 $ 494,691 $ 464,286 Interest expense 72,000 22,923 19,345 Pretax income $ 128,000 $ 61,892 $ 61,905 Accounts payable $ 150,000 $ 64,280 $ 55,290 Tax expense 51,200 21,848 22,286 Notes payable 225,000 69,212 61,432 Net income $ 76,800 $ 40,044 $ 39,619 Accrued liabilities 100,000 44,775 36,859 Total current liabilities $ 475,000 $ 178,267 $ 153,581 Long-term debt 400,000 123,224 121,276 Common stock 100,000 100,000 100,000 Retained earnings 170,000 93,200 89,429 Total liabilities & stk eq $ 1,145,000 $ 494,691 $ 464,286 What is the firm's gross profit margin, operating profit margin, and net profit margin for 2019? O a. 23.0%, 12.7%, 6.0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started