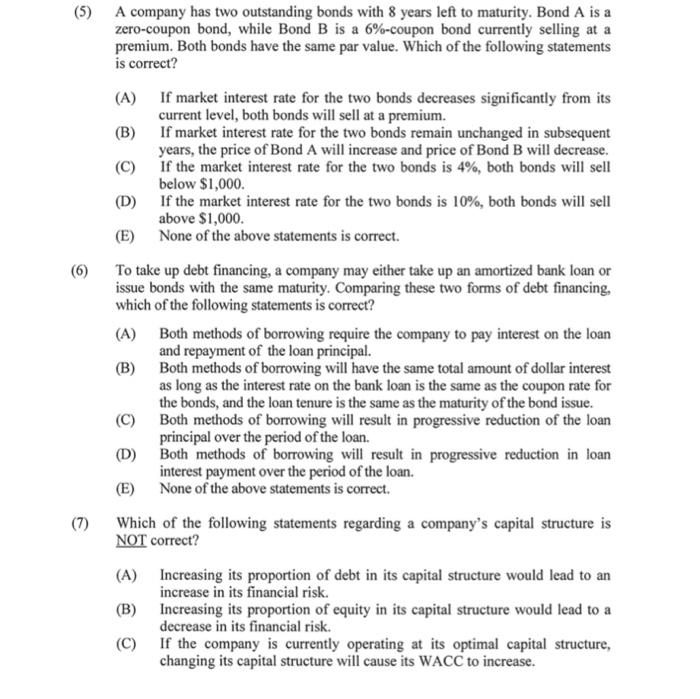

(B) (5) A company has two outstanding bonds with 8 years left to maturity. Bond A is a zero-coupon bond, while Bond B is a 6%-coupon bond currently selling at a premium. Both bonds have the same par value. Which of the following statements is correct? (A) If market interest rate for the two bonds decreases significantly from its current level, both bonds will sell at a premium. If market interest rate for the two bonds remain unchanged in subsequent years, the price of Bond A will increase and price of Bond B will decrease. (C) If the market interest rate for the two bonds is 4%, both bonds will sell below $1,000. (D) If the market interest rate for the two bonds is 10%, both bonds will sell above $1,000. (E) None of the above statements is correct. To take up debt financing, a company may either take up an amortized bank loan or issue bonds with the same maturity. Comparing these two forms of debt financing, which of the following statements is correct? (A) Both methods of borrowing require the company to pay interest on the loan and repayment of the loan principal. (B) Both methods of borrowing will have the same total amount of dollar interest as long as the interest rate on the bank loan is the same as the coupon rate for the bonds, and the loan tenure is the same as the maturity of the bond issue. (C) Both methods of borrowing will result in progressive reduction of the loan principal over the period of the loan. (D) Both methods of borrowing will result in progressive reduction in loan interest payment over the period of the loan. (E) None of the above statements is correct. Which of the following statements regarding a company's capital structure is NOT correct? (A) Increasing its proportion of debt in its capital structure would lead to an increase in its financial risk. (B) Increasing its proportion of equity in its capital structure would lead to a decrease in its financial risk. (C) If the company is currently operating at its optimal capital structure, changing its capital structure will cause its WACC to increase