Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b A budget is a plan for spending money based on income, expenses and A. liabilities B.net worth C.assets D.financial goals Which of the following

b

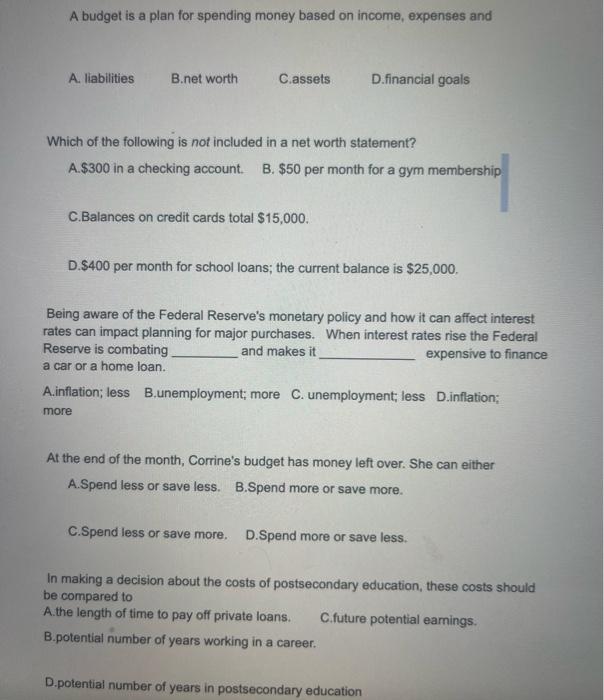

A budget is a plan for spending money based on income, expenses and A. liabilities B.net worth C.assets D.financial goals Which of the following is not included in a net worth statement? A.$300 in a checking account. B. $50 per month for a gym membership C.Balances on credit cards total $15,000. D.$400 per month for school loans; the current balance is $25,000. Being aware of the Federal Reserve's monetary policy and how it can affect interest rates can impact planning for major purchases. When interest rates rise the Federal Reserve is combating and makes it expensive to finance a car or a home loan. A.inflation; less B.unemployment; more C. unemployment; less D.inflation; more At the end of the month, Corrine's budget has money left over. She can either A.Spend less or save less. B.Spend more or save more. C.Spend less or save more. D.Spend more or save less. In making a decision about the costs of postsecondary education, these costs should be compared to A.the length of time to pay off private loans. C.future potential earings B.potential number of years working in a career. D.potential number of years in postsecondary education

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started