Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) ABC Limited is considering whether it would be financially advisable to retire to existing long term debt with a cheaper loan. The current loan

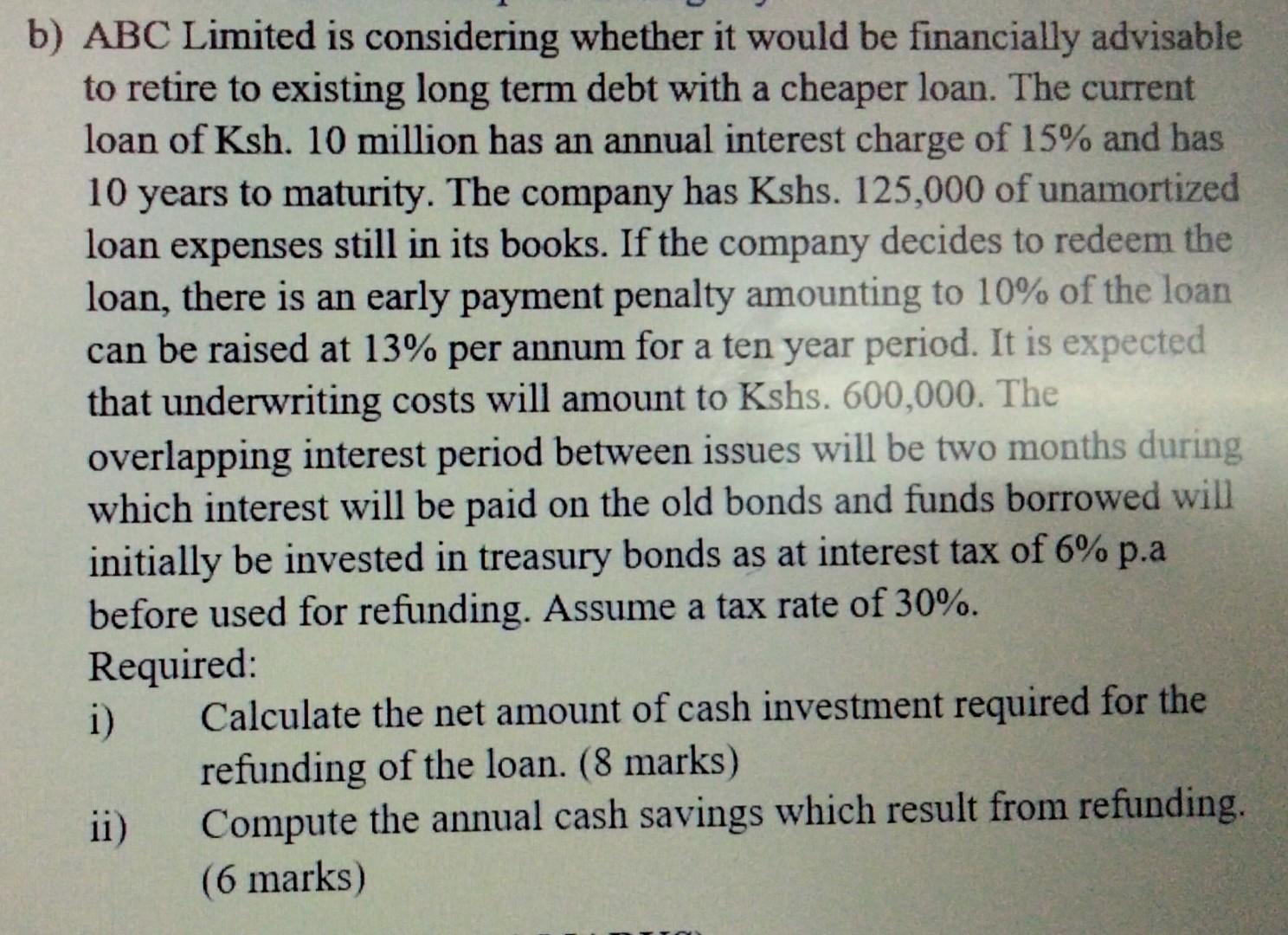

b) ABC Limited is considering whether it would be financially advisable to retire to existing long term debt with a cheaper loan. The current loan of Ksh. 10 million has an annual interest charge of 15% and has 10 years to maturity. The company has Kshs. 125,000 of unamortized loan expenses still in its books. If the company decides to redeem the loan, there is an early payment penalty amounting to 10% of the loan can be raised at 13% per annum for a ten year period. It is expected that underwriting costs will amount to Kshs. 600,000 . The overlapping interest period between issues will be two months during which interest will be paid on the old bonds and funds borrowed will initially be invested in treasury bonds as at interest tax of 6% p.a before used for refunding. Assume a tax rate of 30%. Required: i) Calculate the net amount of cash investment required for the refunding of the loan. (8 marks) ii) Compute the annual cash savings which result from refunding. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started