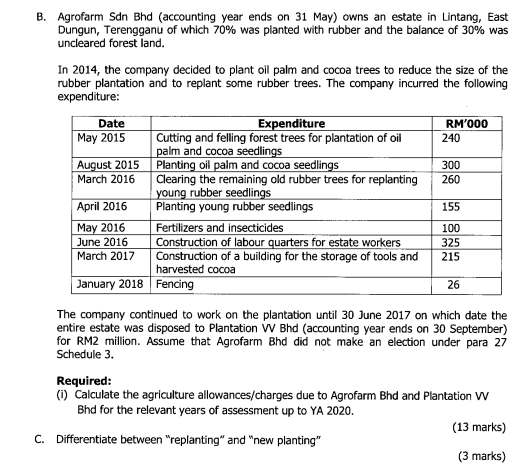

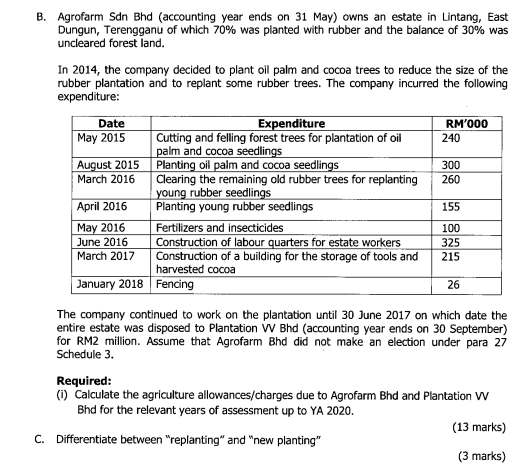

B. Agrofarm Sdn Bhd (accounting year ends on 31 May) owns an estate in Lintang, East Dungun, Terengganu of which 70% was planted with rubber and the balance of 30% was uncleared forest land. In 2014, the company decided to plant oil palm and cocoa trees to reduce the size of the rubber plantation and to replant some rubber trees. The company incurred the following expenditure: Date Expenditure RM'000 May 2015 Cutting and felling forest trees for plantation of oil 240 palm and cocoa seedlings August 2015 Planting oil palm and cocoa seedlings 300 March 2016 Clearing the remaining old rubber trees for replanting 260 young rubber seedlings April 2016 Planting young rubber seedlings 155 May 2016 Fertilizers and insecticides June 2016 Construction of labour quarters for estate workers 325 March 2017 Construction of a building for the storage of tools and 215 harvested cocoa January 2018 Fencing 26 100 The company continued to work on the plantation until 30 June 2017 on which date the entire estate was disposed to Plantation W Bhd (accounting year ends on 30 September) for RM2 million. Assume that Agrofarm Bhd did not make an election under para 27 Schedule 3. Required: (0) Calculate the agriculture allowances/charges due to Agrofarm Bhd and Plantation W Bhd for the relevant years of assessment up to YA 2020. (13 marks) C. Differentiate between "replanting" and "new planting" (3 marks) B. Agrofarm Sdn Bhd (accounting year ends on 31 May) owns an estate in Lintang, East Dungun, Terengganu of which 70% was planted with rubber and the balance of 30% was uncleared forest land. In 2014, the company decided to plant oil palm and cocoa trees to reduce the size of the rubber plantation and to replant some rubber trees. The company incurred the following expenditure: Date Expenditure RM'000 May 2015 Cutting and felling forest trees for plantation of oil 240 palm and cocoa seedlings August 2015 Planting oil palm and cocoa seedlings 300 March 2016 Clearing the remaining old rubber trees for replanting 260 young rubber seedlings April 2016 Planting young rubber seedlings 155 May 2016 Fertilizers and insecticides June 2016 Construction of labour quarters for estate workers 325 March 2017 Construction of a building for the storage of tools and 215 harvested cocoa January 2018 Fencing 26 100 The company continued to work on the plantation until 30 June 2017 on which date the entire estate was disposed to Plantation W Bhd (accounting year ends on 30 September) for RM2 million. Assume that Agrofarm Bhd did not make an election under para 27 Schedule 3. Required: (0) Calculate the agriculture allowances/charges due to Agrofarm Bhd and Plantation W Bhd for the relevant years of assessment up to YA 2020. (13 marks) C. Differentiate between "replanting" and "new planting