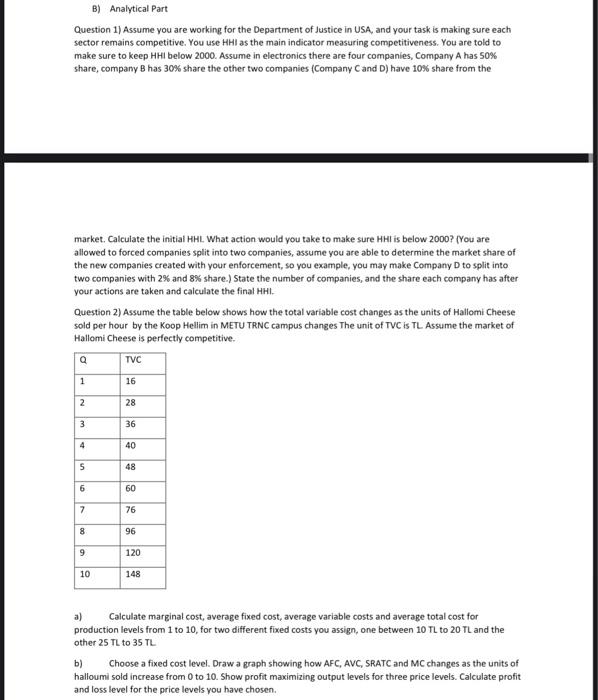

B) Analytical Part Question 1) Assume you are working for the Department of Justice in USA, and your task is making sure each sector remains competitive. You use HHI as the main indicator measuring competitiveness. You are told to make sure to keep HHI below 2000. Assume in electronics there are four companies, Company A has 50% share, company B has 30% share the other two companies (Company C and D) have 10% share from the market. Calculate the initial HHL. What action would you take to make sure HHI is below 2000? (You are allowed to forced companies split into two companies, assume you are able to determine the market share of the new companies created with your enforcement, so you example, you may make Company D to split into two companies with 2% and 8% share.) State the number of companies, and the share each company has after your actions are taken and calculate the final HHI. Question 2) Assume the table below shows how the total variable cost changes as the units of Hallomi Cheese sold per hour by the Koop Hellim in METU TRNC campus changes The unit of TVC is TL Assume the market of Hallomi Cheese is perfectly competitive. Q 1 2 3 4 5 6 7 00 8 9 10 TVC 16 28 36 40 48 60 76 96 120 148 a) Calculate marginal cost, average fixed cost, average variable costs and average total cost for production levels from 1 to 10, for two different fixed costs you assign, one between 10 TL to 20 TL and the other 25 TL to 35 TL b) Choose a fixed cost level. Draw a graph showing how AFC, AVC, SRATC and MC changes as the units of halloumi sold increase from 0 to 10. Show profit maximizing output levels for three price levels. Calculate profit and loss level for the price levels you have chosen. B) Analytical Part Question 1) Assume you are working for the Department of Justice in USA, and your task is making sure each sector remains competitive. You use HHI as the main indicator measuring competitiveness. You are told to make sure to keep HHI below 2000. Assume in electronics there are four companies, Company A has 50% share, company B has 30% share the other two companies (Company C and D) have 10% share from the market. Calculate the initial HHL. What action would you take to make sure HHI is below 2000? (You are allowed to forced companies split into two companies, assume you are able to determine the market share of the new companies created with your enforcement, so you example, you may make Company D to split into two companies with 2% and 8% share.) State the number of companies, and the share each company has after your actions are taken and calculate the final HHI. Question 2) Assume the table below shows how the total variable cost changes as the units of Hallomi Cheese sold per hour by the Koop Hellim in METU TRNC campus changes The unit of TVC is TL Assume the market of Hallomi Cheese is perfectly competitive. Q 1 2 3 4 5 6 7 00 8 9 10 TVC 16 28 36 40 48 60 76 96 120 148 a) Calculate marginal cost, average fixed cost, average variable costs and average total cost for production levels from 1 to 10, for two different fixed costs you assign, one between 10 TL to 20 TL and the other 25 TL to 35 TL b) Choose a fixed cost level. Draw a graph showing how AFC, AVC, SRATC and MC changes as the units of halloumi sold increase from 0 to 10. Show profit maximizing output levels for three price levels. Calculate profit and loss level for the price levels you have chosen