Question

b) AppleZar Berhad and TimeXX Berhad enter into an interest rate swap trading as the fixed payer and floating rate payer, respectively. The notional

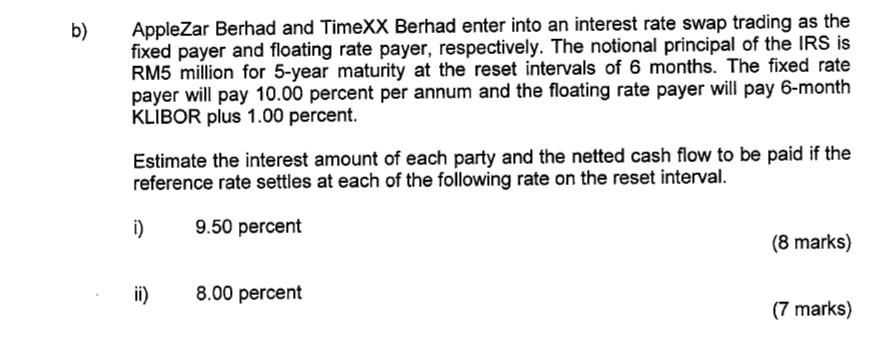

b) AppleZar Berhad and TimeXX Berhad enter into an interest rate swap trading as the fixed payer and floating rate payer, respectively. The notional principal of the IRS is RM5 million for 5-year maturity at the reset intervals of 6 months. The fixed rate payer will pay 10.00 percent per annum and the floating rate payer will pay 6-month KLIBOR plus 1.00 percent. Estimate the interest amount of each party and the netted cash flow to be paid if the reference rate settles at each of the following rate on the reset interval. 9.50 percent i) ii) 8.00 percent (8 marks) (7 marks)

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the interest amounts and netted cash flow for the interest rate swap we need to consider the following information Fixed Rate 1000 per an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investments

Authors: Zvi Bodie, Alex Kane, Alan Marcus, Stylianos Perrakis, Peter

8th Canadian Edition

007133887X, 978-0071338875

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App