Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(5.4) This exercise deals with a transaction-based motivation for money demand. The model considered here is also referred to as Baumol-Tobin model. Consider an

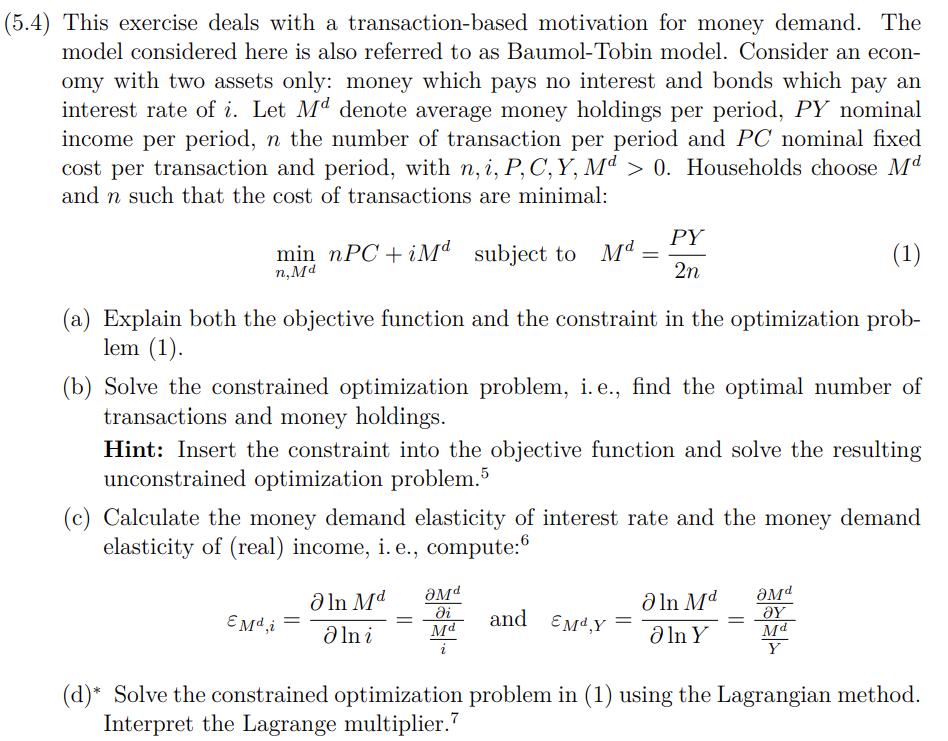

(5.4) This exercise deals with a transaction-based motivation for money demand. The model considered here is also referred to as Baumol-Tobin model. Consider an econ- omy with two assets only: money which pays no interest and bonds which pay an interest rate of i. Let Md denote average money holdings per period, PY nominal income per period, n the number of transaction per period and PC nominal fixed cost per transaction and period, with n, i, P, C, Y, Md > 0. Households choose M and n such that the cost of transactions are minimal: (1) (a) Explain both the objective function and the constraint in the optimization prob- lem (1). min nPC + iMd subject to M namd EMd.i (b) Solve the constrained optimization problem, i. e., find the optimal number of transactions and money holdings. Hint: Insert the constraint into the objective function and solve the resulting unconstrained optimization problem.5 (c) Calculate the money demand elasticity of interest rate and the money demand elasticity of (real) income, i. e., compute:6 = ln Md ln i Md di Md PY 2n = and EMY = ln Md ln Y = Md Y Md Y (d)* Solve the constrained optimization problem in (1) using the Lagrangian method. Interpret the Lagrange multiplier.7

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started