Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Miss Good wants to buy BAD stock, which is selling for $5 per share. She can buy on margin. The initial margin requirement

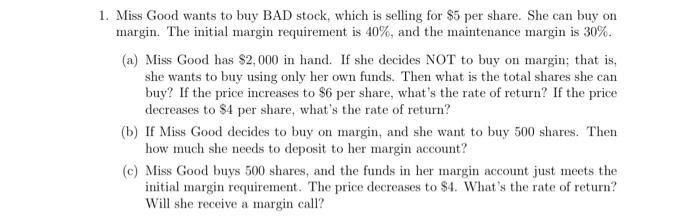

1. Miss Good wants to buy BAD stock, which is selling for $5 per share. She can buy on margin. The initial margin requirement is 40%, and the maintenance margin is 30%. (a) Miss Good has $2,000 in hand. If she decides NOT to buy on margin; that is, she wants to buy using only her own funds. Then what is the total shares she can buy? If the price increases to $6 per share, what's the rate of return? If the price decreases to $4 per share, what's the rate of return? (b) If Miss Good decides to buy on margin, and she want to buy 500 shares. Then how much she needs to deposit to her margin account? (c) Miss Good buys 500 shares, and the funds in her margin account just meets the initial margin requirement. The price decreases to $4. What's the rate of return? Will she receive a margin call?

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a If Miss Good decides not to buy on margin and wants to buy using only her own funds she can buy a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started