Question

2. Mr. Handsome is interested in the UGLY stock. He finds that the price should be $3, but the market price is $5 per

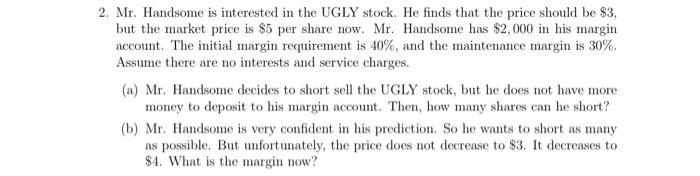

2. Mr. Handsome is interested in the UGLY stock. He finds that the price should be $3, but the market price is $5 per share now. Mr. Handsome has $2,000 in his margin account. The initial margin requirement is 40%, and the maintenance margin is 30%. Assume there are no interests and service charges. (a) Mr. Handsome decides to short sell the UGLY stock, but he does not have more money to deposit to his margin account. Then, how many shares can he short? (b) Mr. Handsome is very confident in his prediction. So he wants to short as many as possible. But unfortunately, the price does not decrease to $3. It decreases to $4. What is the margin now?

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A Mr Handsome has 2000 in his margin account so he can short ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay

6th edition

013703038X, 978-0137030385

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App