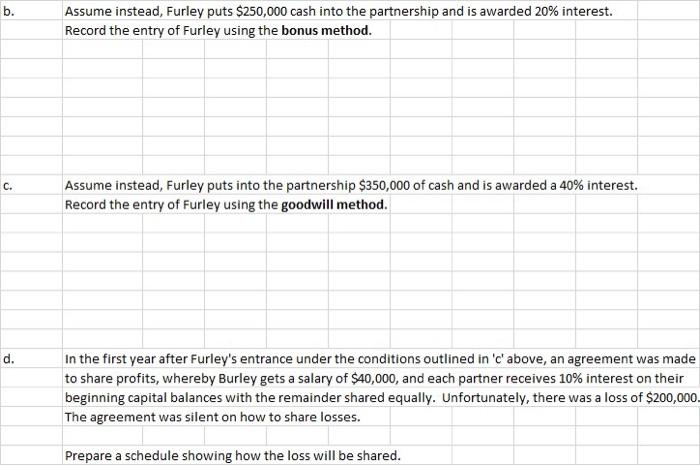

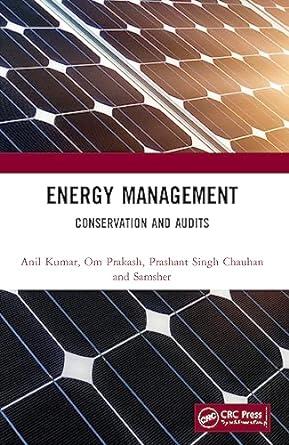

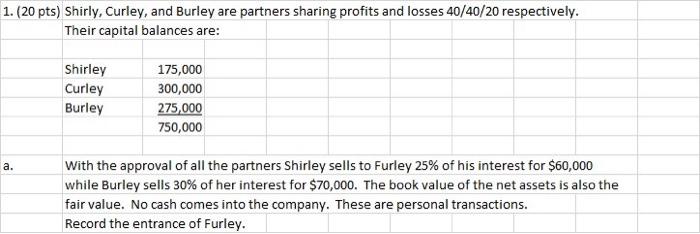

b. Assume instead, Furley puts $250,000 cash into the partnership and is awarded 20% interest. Record the entry of Furley using the bonus method. C. Assume instead, Furley puts into the partnership $350,000 of cash and is awarded a 40% interest. Record the entry of Furley using the goodwill method. d. In the first year after Furley's entrance under the conditions outlined in 'c' above, an agreement was made to share profits, whereby Burley gets a salary of $40,000, and each partner receives 10% interest on their beginning capital balances with the remainder shared equally. Unfortunately, there was a loss of $200,000 The agreement was silent on how to share losses. Prepare a schedule showing how the loss will be shared. 1. (20 pts) Shirly, Curley, and Burley are partners sharing profits and losses 40/40/20 respectively. Their capital balances are: Shirley Curley Burley 175,000 300,000 275,000 750,000 a. With the approval of all the partners Shirley sells to Furley 25% of his interest for $60,000 while Burley sells 30% of her interest for $70,000. The book value of the net assets is also the fair value. No cash comes into the company. These are personal transactions. Record the entrance of Furley. b. Assume instead, Furley puts $250,000 cash into the partnership and is awarded 20% interest. Record the entry of Furley using the bonus method. C. Assume instead, Furley puts into the partnership $350,000 of cash and is awarded a 40% interest. Record the entry of Furley using the goodwill method. d. In the first year after Furley's entrance under the conditions outlined in 'c' above, an agreement was made to share profits, whereby Burley gets a salary of $40,000, and each partner receives 10% interest on their beginning capital balances with the remainder shared equally. Unfortunately, there was a loss of $200,000 The agreement was silent on how to share losses. Prepare a schedule showing how the loss will be shared. 1. (20 pts) Shirly, Curley, and Burley are partners sharing profits and losses 40/40/20 respectively. Their capital balances are: Shirley Curley Burley 175,000 300,000 275,000 750,000 a. With the approval of all the partners Shirley sells to Furley 25% of his interest for $60,000 while Burley sells 30% of her interest for $70,000. The book value of the net assets is also the fair value. No cash comes into the company. These are personal transactions. Record the entrance of Furley