Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) Betty's accounting records show the following: Trade receivables at 31 July 2021 were 50,000 and trade receivables at 31 July 2022 were 45,000. For

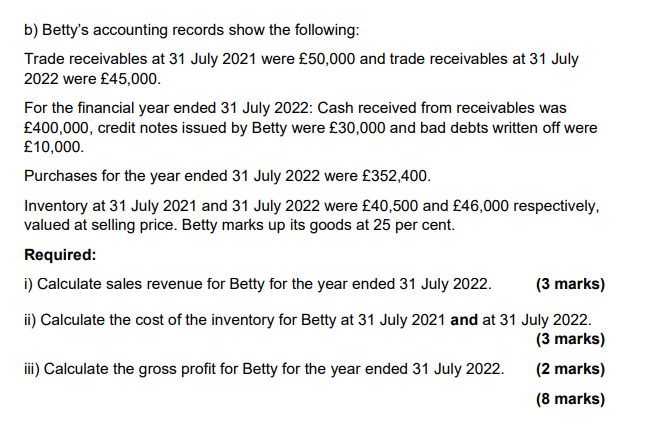

b) Betty's accounting records show the following: Trade receivables at 31 July 2021 were 50,000 and trade receivables at 31 July 2022 were 45,000. For the financial year ended 31 July 2022: Cash received from receivables was 400,000, credit notes issued by Betty were 30,000 and bad debts written off were 10,000. Purchases for the year ended 31 July 2022 were 352,400. Inventory at 31 July 2021 and 31 July 2022 were 40,500 and 46,000 respectively, valued at selling price. Betty marks up its goods at 25 per cent. Required: i) Calculate sales revenue for Betty for the year ended 31 July 2022. (3 marks) ii) Calculate the cost of the inventory for Betty at 31 July 2021 and at 31 July 2022. (3 marks) iii) Calculate the gross profit for Betty for the year ended 31 July 2022. (2 marks) (8 marks) b) Betty's accounting records show the following: Trade receivables at 31 July 2021 were 50,000 and trade receivables at 31 July 2022 were 45,000. For the financial year ended 31 July 2022: Cash received from receivables was 400,000, credit notes issued by Betty were 30,000 and bad debts written off were 10,000. Purchases for the year ended 31 July 2022 were 352,400. Inventory at 31 July 2021 and 31 July 2022 were 40,500 and 46,000 respectively, valued at selling price. Betty marks up its goods at 25 per cent. Required: i) Calculate sales revenue for Betty for the year ended 31 July 2022. (3 marks) ii) Calculate the cost of the inventory for Betty at 31 July 2021 and at 31 July 2022. (3 marks) iii) Calculate the gross profit for Betty for the year ended 31 July 2022. (2 marks) (8 marks)

b) Betty's accounting records show the following: Trade receivables at 31 July 2021 were 50,000 and trade receivables at 31 July 2022 were 45,000. For the financial year ended 31 July 2022: Cash received from receivables was 400,000, credit notes issued by Betty were 30,000 and bad debts written off were 10,000. Purchases for the year ended 31 July 2022 were 352,400. Inventory at 31 July 2021 and 31 July 2022 were 40,500 and 46,000 respectively, valued at selling price. Betty marks up its goods at 25 per cent. Required: i) Calculate sales revenue for Betty for the year ended 31 July 2022. (3 marks) ii) Calculate the cost of the inventory for Betty at 31 July 2021 and at 31 July 2022. (3 marks) iii) Calculate the gross profit for Betty for the year ended 31 July 2022. (2 marks) (8 marks) b) Betty's accounting records show the following: Trade receivables at 31 July 2021 were 50,000 and trade receivables at 31 July 2022 were 45,000. For the financial year ended 31 July 2022: Cash received from receivables was 400,000, credit notes issued by Betty were 30,000 and bad debts written off were 10,000. Purchases for the year ended 31 July 2022 were 352,400. Inventory at 31 July 2021 and 31 July 2022 were 40,500 and 46,000 respectively, valued at selling price. Betty marks up its goods at 25 per cent. Required: i) Calculate sales revenue for Betty for the year ended 31 July 2022. (3 marks) ii) Calculate the cost of the inventory for Betty at 31 July 2021 and at 31 July 2022. (3 marks) iii) Calculate the gross profit for Betty for the year ended 31 July 2022. (2 marks) (8 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started