Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E c Wrap lext General Calibri BIU-B - 12 AAL .A Merge & Center. $ % 8 % Conditional Format as Cell Formatting Table Styles

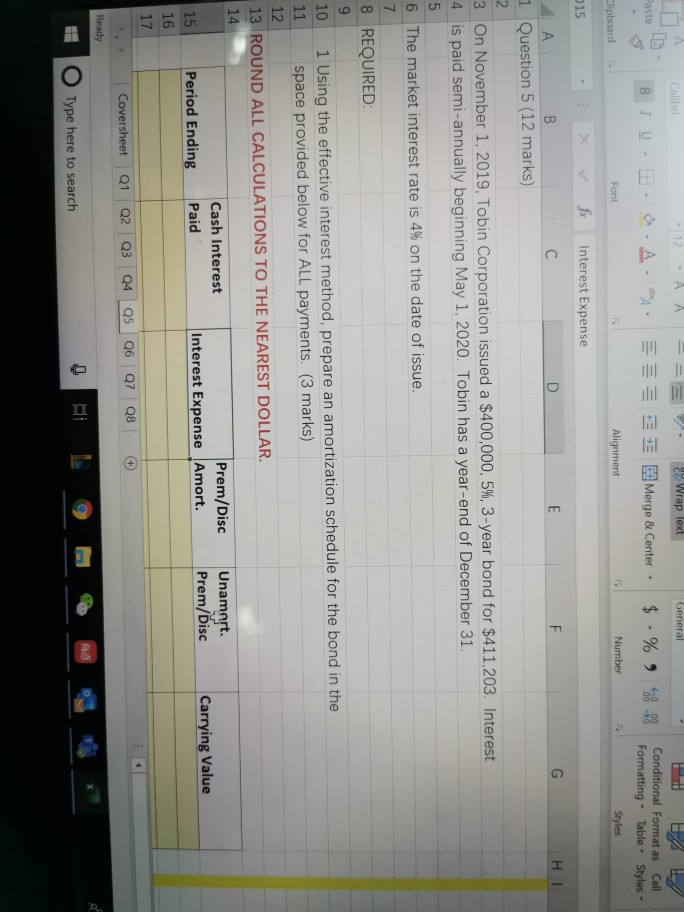

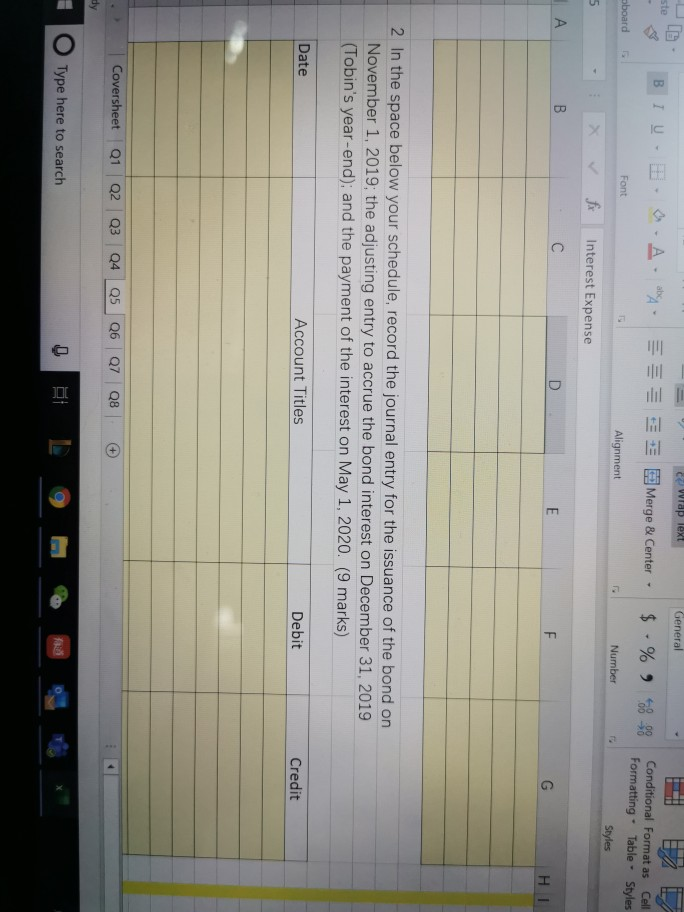

E c Wrap lext General Calibri BIU-B - 12 AAL .A Merge & Center. $ % 8 % Conditional Format as Cell Formatting Table Styles Styles Alignment Font Number Clipboard f Interest Expense 15 - X V A B 1 Question 5 (12 marks) 3 On November 1, 2019, Tobin Corporation issued a $400,000, 5%, 3-year bond for $411.203. Interest 4 is paid semi-annually beginning May 1, 2020. Tobin has a year-end of December 31. 6 The market interest rate is 4% on the date of issue. 8 REQUIRED 9 10 1 Using the effective interest method, prepare an amortization schedule for the bond in the 11 space provided below for ALL payments. (3 marks) 12 13 ROUND ALL CALCULATIONS TO THE NEAREST DOLLAR. 14 Unamart. Cash Interest Paid Prem/Disc Interest Expense Amort. Prem/Disc Carrying Value Period Ending 16 17 Coversheet 01 02 03 04 05 06 07 08 Ready + Type here to search Lo n don ** = cWiap lext General o . A atra lili Merge & Center - $ - % ) 88-98 8 BI U B board X Font Conditional Format as Cell Formatting Table - Styles Styles Alignment Number for Interest Expense HI 2 In the space below your schedule, record the journal entry for the issuance of the bond on November 1, 2019; the adjusting entry to accrue the bond interest on December 31, 2019 (Tobin's year-end); and the payment of the interest on May 1, 2020. (9 marks) Date Account Titles Debit Credit Coversheet 01 02 03 04 05 06 07 08 O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started