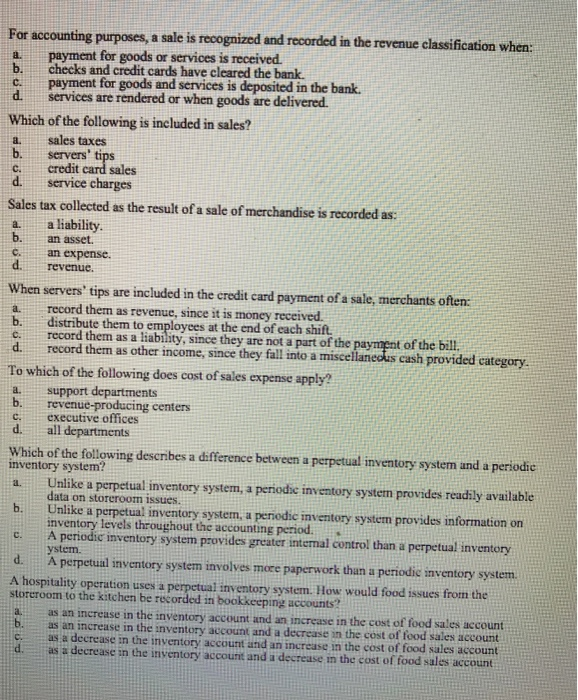

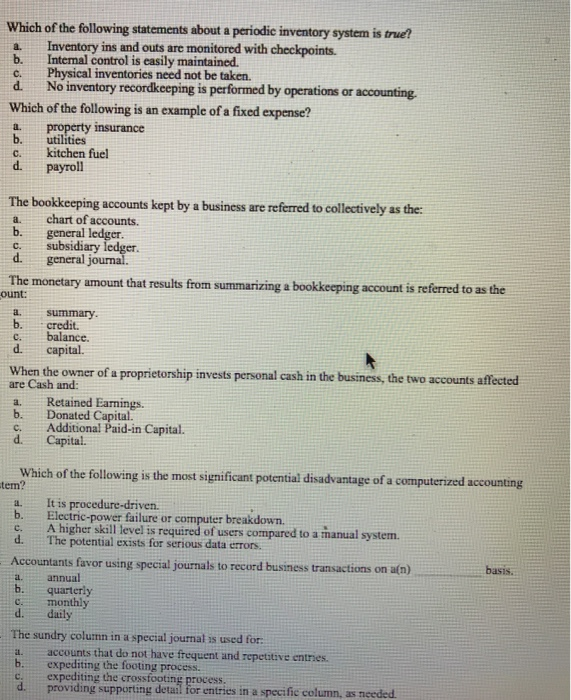

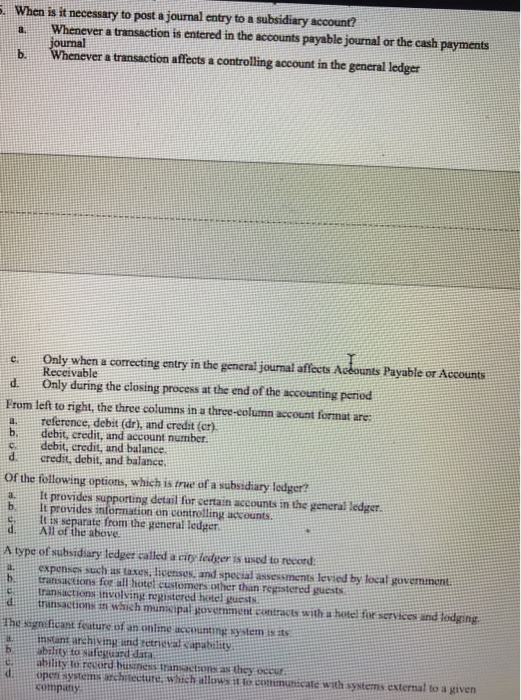

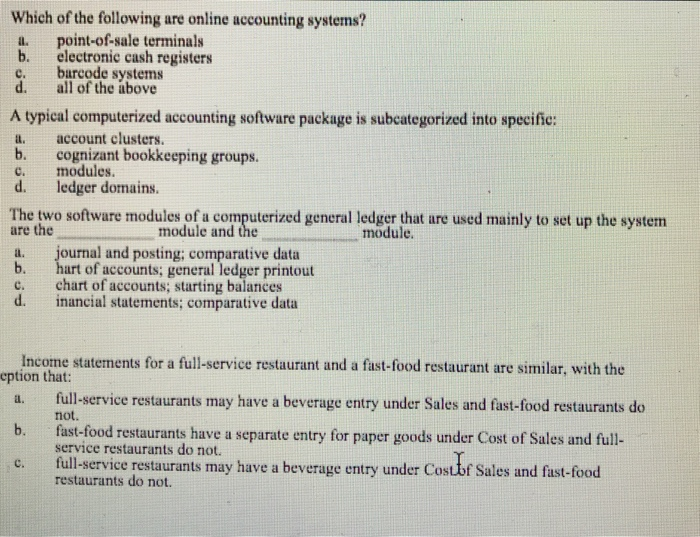

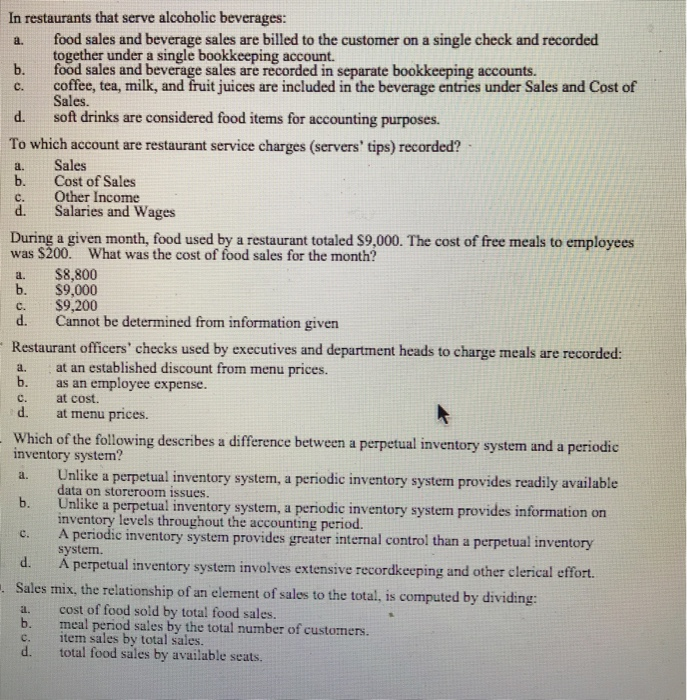

b. c. ASO For accounting purposes, a sale is recognized and recorded in the revenue classification when: payment for goods or services is received. checks and credit cards have cleared the bank payment for goods and services is deposited in the bank. services are rendered or when goods are delivered. Which of the following is included in sales? sales taxes servers' tips credit card sales service charges Sales tax collected as the result of a sale of merchandise is recot a liability. b. an asset. an expense. revenue. When servers' tips are included in the credit card payment of a sale, merchants often: a. record them as revenue, since it is money received. b. distribute them to employees at the end of each shift. c. record them as a liability, since they are not a part of the payment of the bill. record them as other income, since they fall into a miscellaneous cash provided category. To which of the following does cost of sales expense apply? support departments revenue-producing centers executive offices all departments Which of the following describes a difference between a perpetual inventory system and a periodie inventory system? Unlike a perpetual inventory system, a periodic inventory system provides readily available data on storeroom issues. b. Unlike a perpetual inventory system, a periodic inventory system provides information on inventory levels throughout the accounting period. A periodic inventory system provides greater internal control than a perpetual inventory ystem A perpetual inventory system involves more paperwork than a periodic inventory system. A hospitality operation uses a perpetual inventory system. How would food issues from the storeroom to the kitchen he recorded in bookkeeping accounts as an increase in the inventory account and an increase in the cost of food sales account 6. as an increase in the inventory account and a decrease in the cost of food sales account as a decrease in the inventory account and an increase in the cost of food sales account d a s a decrease in the inventory account and a decrease in the cost of food sales account d. c. Which of the following statements about a periodic inventory system is true? a Inventory ins and outs are monitored with checkpoints. b. Internal control is easily maintained. Physical inventories need not be taken. No inventory recordkeeping is performed by operations or accounting. Which of the following is an example of a fixed expense? . property insurance b. utilities C. kitchen fuel payroll a. b. The bookkeeping accounts kept by a business are referred to collectively as the chart of accounts. general ledger. C. subsidiary ledger general journal. The monetary amount that results from summarizing a bookkeeping account is referred to as the ount: summary credit. balance. C. capital. When the owner of a proprietorship invests personal cash in the business, the two accounts affected are Cash and: Retained Earnings. b. Donated Capital. Additional Paid-in Capital. d. Capital Which of the following is the most significant potential disadvantage of a computerized accounting tem? It is procedure-driven. b. Electric power failure or computer breakdown A higher skill level is required of users compared to a manual system. The potential exists for serious data errors. Accountants favor using special journals to record business transactions on a(n) annual quarterly monthly d. daily The sundry column in a special journal is used for accounts that do not have frequent and repetitive entries. b. expediting the footing process expediting the crossfooting process. providing supporting detail for entries in a specific column, as needed. When is it necessary to post a journal entry to a subsidiary account? Whenever a transaction is entered in the accounts payable journal or the cash payments journal Whenever a transaction affects a controlling account in the general ledger Only when a correcting entry in the general journal affects Accounts Payable or Accounts Receivable Only during the closing process at the end of the accounting period From left to right, the three columns in a three-column account format are reference, debit (dr), and credit (er). debit, credit, and account number. debit, credit, and balance credit, debit, and balance of the following options, which is true of a subsidiary ledger? It provides supporting detail for certain accounts in the general ledger It provides information on Controlling accounts It is separate from the general ledger All of the above A type of subsidiary ledger called acin fedger is used to record expenses such as taxes, license and special assessments levied by local government transaction for all hotel customers ther than registered guests transactions involving registered hotel guest transaction in which muncipal government contract with a hotel Vic and lodging The signalicant feature of an online counting system is its instant archiving in tetrieval apability ability to safeguard data ability to record business Transactions as they opensystems architecture, which allows to communicate with systems external to a viven company b. Which of the following are online accounting systems? point-of-sale terminals electronic cash registers barcode systems all of the above A typical computerized accounting software package is subcategorized into specific: account clusters. b. cognizant bookkeeping groups. modules. d. ledger domains. The two software modules of a computerized general ledger that are used mainly to set up the system are the module and the module. journal and posting: comparative data hurt of accounts, general ledger printout chart of accounts, starting balances inancial statements, comparative data C. Income statements for a full-service restaurant and a fast-food restaurant are similar, with the eption that: b. full-service restaurants may have a beverage entry under Sales and fast-food restaurants do not. fast-food restaurants have a separate entry for paper goods under Cost of Sales and full- service restaurants do not full-service restaurants may have a beverage entry under Costbf Sales and fast-food restaurants do not c. In restaurants that serve alcoholic beverages: food sales and beverage sales are billed to the customer on a single check and recorded together under a single bookkeeping account. b. food sales and beverage sales are recorded in separate bookkeeping accounts. coffee, tea, milk, and fruit juices are included in the beverage entries under Sales and Cost of Sales. soft drinks are considered food items for accounting purposes. To which account are restaurant service charges (servers' tips) recorded? Sales b. Cost of Sales c. Other Income d. Salaries and Wages During a given month, food used by a restaurant totaled $9,000. The cost of free meals to employees was $200. What was the cost of food sales for the month? a. $8,800 $9,000 c. 9,200 d. Cannot be determined from information given Restaurant officers' checks used by executives and department heads to charge meals are recorded: a. at an established discount from menu prices. b. as an employee expense. at cost. d. at menu prices. Which of the following describes a difference between a perpetual inventory system and a periodic inventory system? Unlike a perpetual inventory system, a periodic inventory system provides readily available data on storeroom issues. b. Unlike a perpetual inventory system, a periodic inventory system provides information on inventory levels throughout the accounting period. c. A periodic inventory system provides greater internal control than a perpetual inventory system. d. A perpetual inventory system involves extensive recordkeeping and other clerical effort. A Sales mix, the relationship of an element of sales to the total, is computed by dividing: cost of food sold by total food sales. b. meal period sales by the total number of customers. item sales by total sales. total food sales by available seats. c